AUD/USD pinning into the high side, climbing into 0.6500

- The AUD/USD is climbing into higher ground amidst risk-on markets.

- The Aussie is up over 2% from Tuesday's low bids against the Greenback.

- A miss for the US CPI data print is sending market sentiment soaring.

The AUD/USD is on the rise for Tuesday, rallying over 2% as market sentiment goes firmly risk-on following a US Consumer Price Index (CPI) print that suggests inflation in the US economy is receding faster than previously expected.

US CPI inflation softens to 3.2% vs. 3.3% forecast

US CPI inflation missed the mark on Tuesday, printing below forecast, and the miss is giving the market hope that US inflation is receding faster than policymakers have been anticipating. If inflation drops faster, for longer, than initially forecast, it would force open the door for a rate cut cycle from the Federal Reserve (Fed) sooner than expected.

Despite the Tuesday rally, the Aussie could see some difficulties holding onto higher chart ground heading through the rest of the week. Early Tuesday saw Australia's Westpac Consumer Confidence for November print at -2.6%, compared to October's 2.9% rise.

Early Wednesday will see Aussie Wage Price Index figures for the third quarter, which is forecast to increase from 0.8% to 1.3%. Later that same day, US Producer Price Index (PPI) and Retail Sales both land.

Producer inflation for the year into October is expected to hold steady at 2.7%, while month-on-month Retail Sales growth in October is expected to retreat from 0.7% to -0.3%.

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -1.61% | -1.71% | -0.66% | -1.84% | -0.70% | -1.83% | -1.25% | |

| EUR | 1.58% | -0.10% | 0.93% | -0.21% | 0.91% | -0.22% | 0.36% | |

| GBP | 1.68% | 0.10% | 1.05% | -0.11% | 1.00% | -0.12% | 0.47% | |

| CAD | 0.63% | -0.97% | -1.05% | -1.16% | -0.07% | -1.19% | -0.56% | |

| AUD | 1.80% | 0.21% | 0.12% | 1.17% | 1.11% | 0.00% | 0.58% | |

| JPY | 0.68% | -0.91% | -1.00% | 0.02% | -1.11% | -1.10% | -0.55% | |

| NZD | 1.80% | 0.21% | 0.12% | 1.16% | 0.00% | 1.11% | 0.58% | |

| CHF | 1.23% | -0.37% | -0.46% | 0.58% | -0.58% | 0.55% | -0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

AUD/USD Technical Outlook

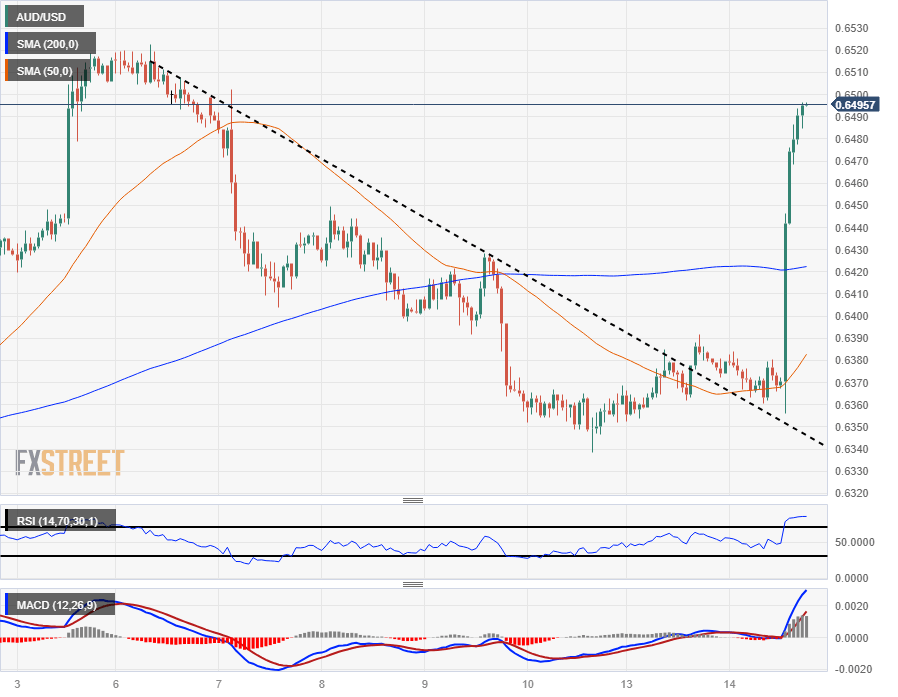

The AUD/USD's intraday rally sees the pair paring back last week's declines, spiking towards the 0.6500 handle following broad-market reaction to the US CPI data print.

The pair has risen over 2% from Tuesday's low bids near 0.6355, caching a firm ride up from the 50-hour Simple Moving Average (SMA) to sail clean through the 200-hour SMA, currently churning just north of 0.6420.

On the daily candlesticks, the Aussie is seeing one of its best trading days against the US Dollar since July, and has clawed back half of the range between the 50- and 200-day SMAs. The two moving averages have spread notably bearish, with the 50-day grinding it out from just below the 0.6400 handle while the 200-day SMA turns down into 0.660.

The AUD/USD, despite Tuesday's gains extending a lift from the consolidation zone near 0.6300, is still down for the year, and is trading at a nearly 6% discount against the Greenback from June's high bids near 0.6900.

AUD/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.