AUD/USD is on the defensive meeting weekly resistance

- AUD/USD meets weekly resistance that puts the focus on the downside for the week ahead.

- Central bank divergence remains the driving force, US dollar is firming.

AUD/USD ended the week on the back foot as it ran into a layer of weekly resistance just ahead of 0.73 the figure. Down some 0.8% on the day, the pair finished Friday's session at 0.7223 after travelling between a range of 0.7122 and 0.7184.

The Australian dollar was unable o maximise on the mid-week blockbuster employment data and was capped around 0.7223 the high for the week. The US dollar found a last-minute bid during a risk-off US session and the US Dollar Index finished the week above the 96.00 figure for the third week in a row.

Central banks were the driving force with the Bank of England surprisingly hawkish, the European Central bank more hawkish than expected and the Federal Reserve ramping up rate hike expectations also.

This leaves the Reserve Bank of Australia lagging in this regard and the divergence between the central banks is a weight on the currency. Having said that, the recent string of stronger data supports prospects for an end of QE at the start of the new year.

For instance, a 366k monthly increase in employment was twice as strong as expected, considerably stronger than the bounce in June 2020 and therefore the biggest gain on record. In this regard, the RBA minutes will be a key event for the currency this week and analysts at TD Securities explained that ''markets are likely to focus on QE discussions and their impact on the rate hike timeline.'' ''Governor Lowe's recent speech noted 3 criteria for the Bank's QE decision: 1) other CB actions, 2) bond market functioning, 3) actual and expected progress towards employment and inflation target goals.''

AUD/USD technical analysis

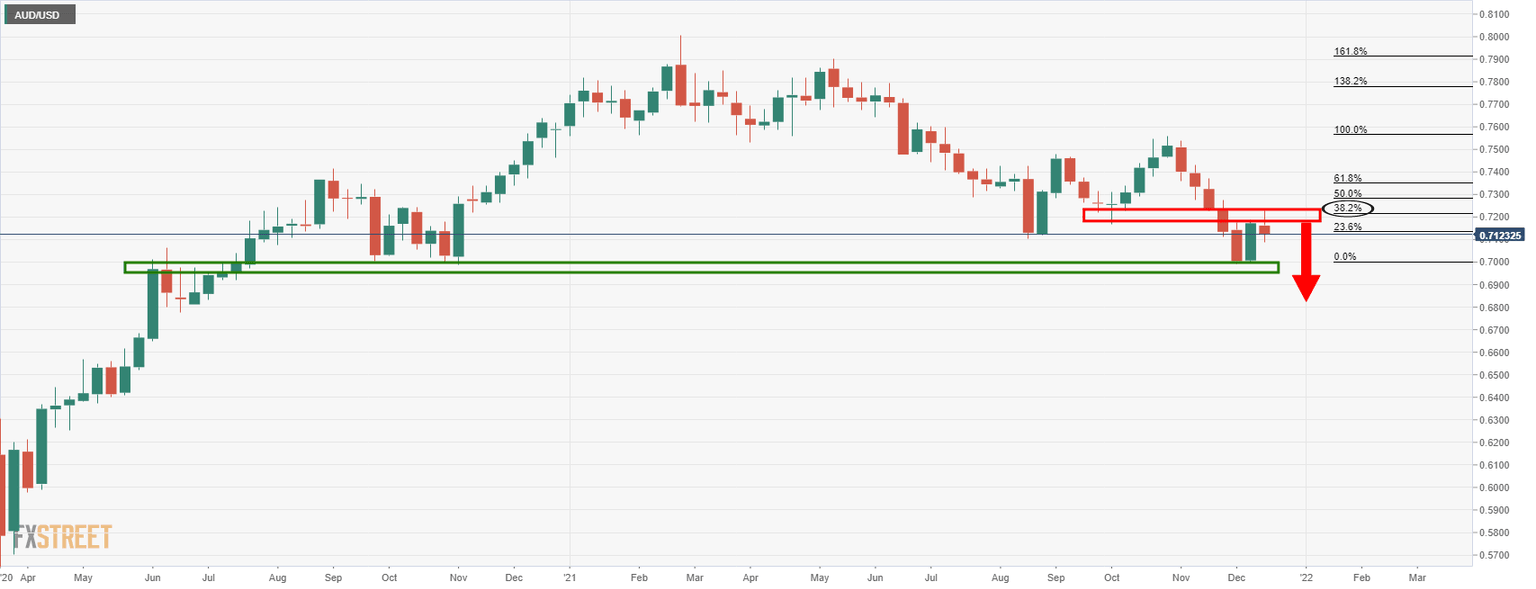

As illustrated, the price reached a 38.2% Fibonacci retracement level on the weekly time frame through 0.72 the figure and would be expected to struggle at this juncture. This could result in a meanwhile downside correction for the week ahead and potentially lead to a downside continuation for the medium term.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.