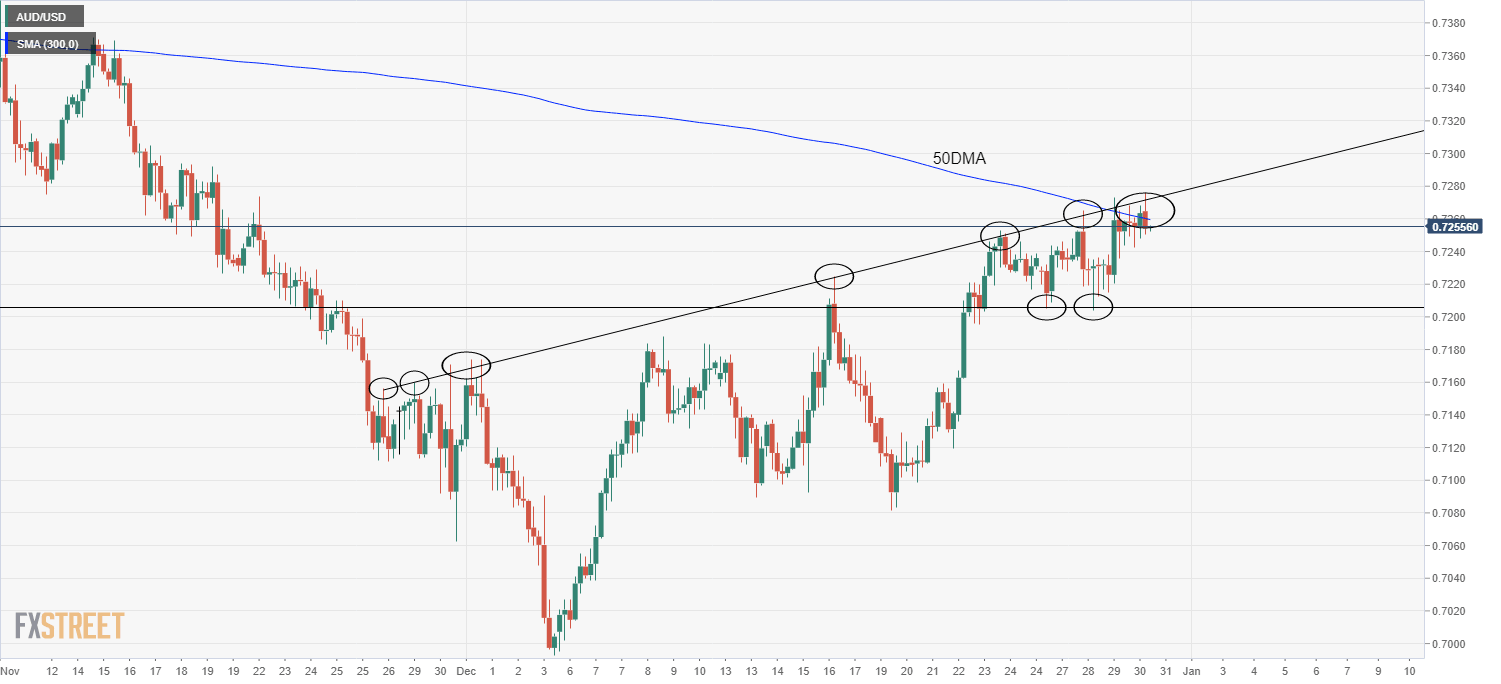

AUD/USD hits technical resistance above 0.7250, still looking to close out month at highs

- AUD/USD is currently probing fresh monthly higher above 0.7250, though is finding some technical resistance.

- The pair has remained resilient this week to surging Covid-19 infection rates in Australia.

AUD/USD is currently probing monthly highs in the 0.7260 area and set for a second consecutive day of gains as the pair continues to derive support from buoyant risk appetite in global equity and commodity markets. For now, the pair seems to be finding resistance in the form of its 50-day moving average at 0.7265 and has been unable to break above an uptrend that has been capping the price action going back to the end of November.

AUD/USD didn’t see much of a reaction to the latest US weekly jobless claims report that was stronger than expected. For reference, initial claims dropped back under 200K, continued claims fall to a fresh post-pandemic low at 1.716M, which puts it broadly back in line with pre-pandemic levels and the insured unemployment rate dropped to 1.3% from 1.4%.

AUD has remained resilient this week to surging Covid-19 infection rates in Australia as the country’s high vaccination rate and new emphasis on living with the virus (as opposed to the previous zero Covid-19 strategy) renders fresh lockdowns unlikely. Indeed, the Australian government is expected to narrow the definition of “close contact” with a Covid-19 positive person in order to reduce the number of people being forced to self-isolate at any given time, in line with new guidelines in the US and elsewhere.

On the eve of New Year’s Eve, the Aussie looks on course to close out what has been a fairly rough year on a positive note. The Australian dollar has shed roughly 5.6% of its value versus the US dollar this year but is up roughly 2.0% this month. Risk appetite has recovered substantially in the latter parts of the month after a shaky start to the month as concerns about the global economic impact of the Omicron variant have subsided. Meanwhile, strong Australian economic data on the back of a phased ending of lockdowns in October, coupled with hawkish shifts in central banks elsewhere, has got market participants betting that the RBA will pivot policy guidance in a hawkish direction in the coming months to put the RBA’s monetary policy tightening timeline more in line with the Fed’s.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset