AUD/USD flirting with 50DMA in 0.7360s as markets digest latest Chinese macro data

- AUD/USD has recovered back to its 50DMA in the 0.7360s, aided by stronger Chinese macro data.

- Some analysts warn that weak Chinese real estate investment data suggests further economic weakness lies ahead, a negative for AUD.

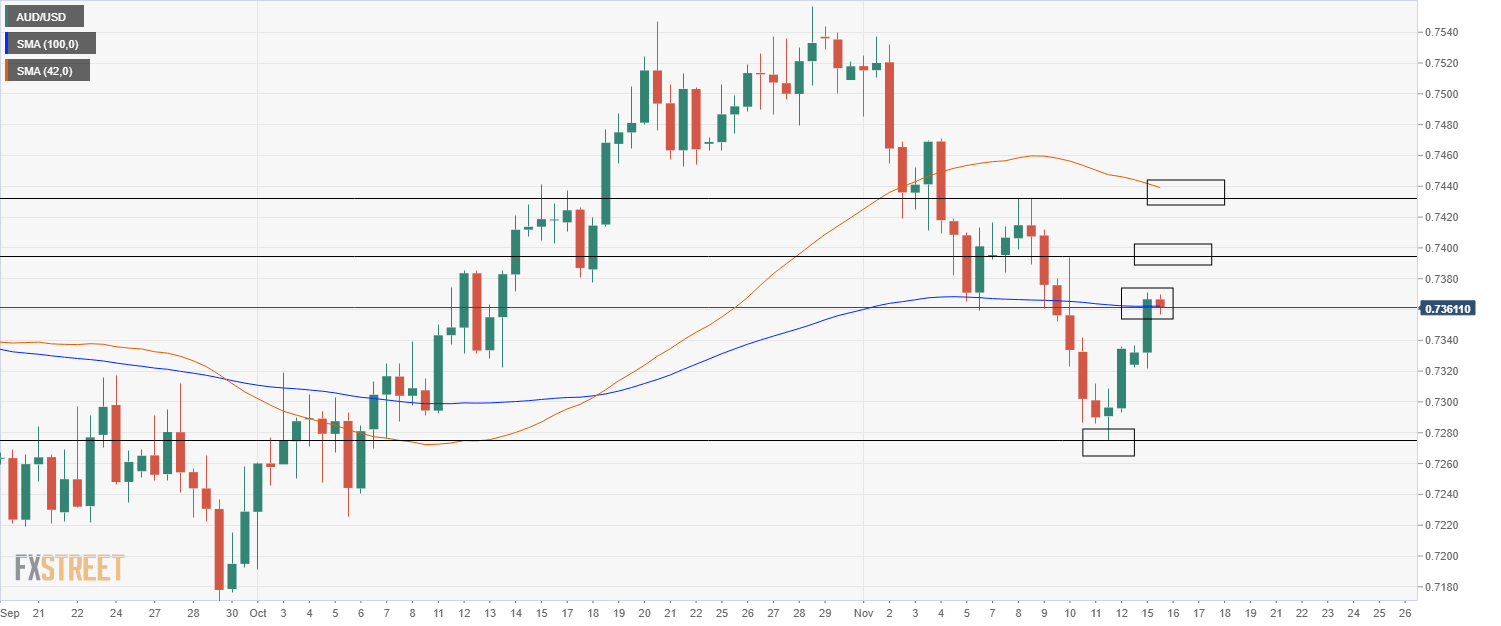

AUD/USD has managed to recover all the way back to its 50-day moving average in the 0.7360s on Monday, having been as low as 0.7270s last week. FX markets didn’t show much of a reaction to the latest NY Fed manufacturing survey released, which pointed to an improvement in business conditions in the US at the start of this month. According to market commentators, Monday’s 30 pip gains from the 0.7330s is as a result of better than expected activity data released out of China, Australia’s most important trade partner, during Monday’s Asia Pacific session. For reference, Chinese Industrial Production rose at a YoY pace of 3.5% in October, above economist forecasts for 3.0%, while Retail Sales rose at a pace of 4.9% YoY, above economist forecasts for 3.7%.

Some analysts raised concerns about the Retail Sales beat, rather than suggesting the beginnings of a sustained pickup in consumer spending, it was a result of higher prices from higher food sales as consumer pre-empt any possible winter lockdowns. Other analysts pointed to the Chinese Real Estate Investment data, which showed investment coming in at 6.1% – a tad under expectations for 6.2%. Societe Generale said that “for our economists, it doesn't change the view that a property-led slowdown (in Chinese growth) will continue over the coming months and more broad-based easing is still warranted”. This is hardly going to be a long-term positive for the Aussie.

Some market participants might thus look at current AUD/USD levels as an attractive short-entry point. According to Westpac, there are “multiple opportunities for the RBA to remind the market this week that they (are dovish)” and “the A$ should be well capped by 0.7350/70… We expect to see further weakness below 0.7300.” Should AUD/USD fail to break above its 50DMA, that might be taken as a bearish sign by some technicians, which could also help to propel the pair lower towards 0.7300 again. Conversely, if recent bullish momentum continues and the 50DMA is broken, the next area of resistance is around 0.7400 and in the 0.7430s.

Ahead, Aussie markets will be focused on Australian Wage Price data out on Wednesday, which is likely to come in subdued and justify the RBA's dovish stance. AUD/USD's focus will otherwise be risk appetite and US-related economic events such as retail sales data (on Tuesday) and this week's smattering of Fedspeak.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset