AUD/USD falls below 0.7200 on risk-off mood, despite positive Aussie/Chinese data

- The AUD/USD trims its gains but stays positive in the week, by 0.17%.

- Positive Australian Q1 GDP and China’s Caixin PMI data boosted sentiment in the Asian session.

- The greenback rallied due to US ISM Manufacturing surprising to the upside, and job openings dropped.

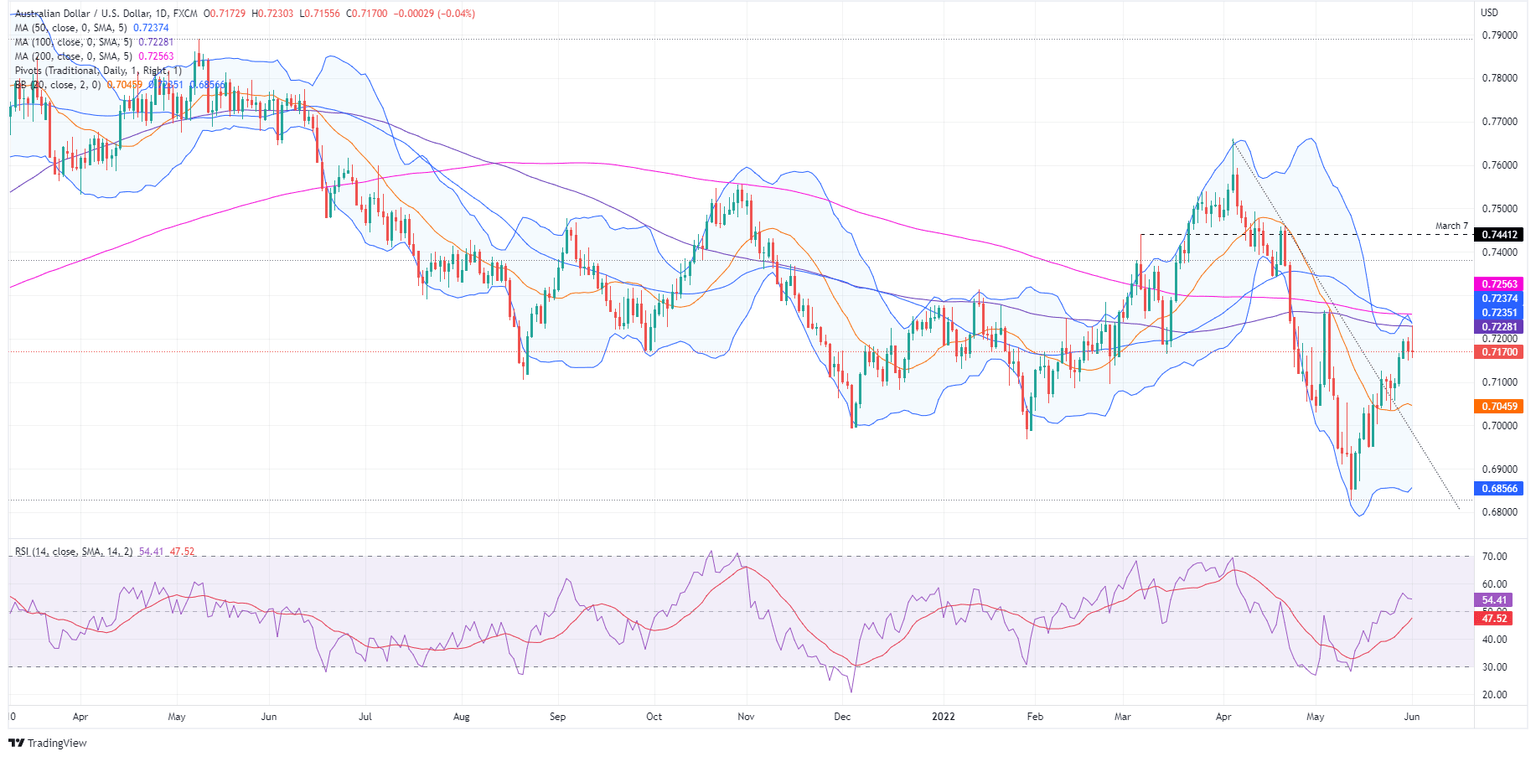

- AUD/USD Price Forecast: Failure to reclaim the 100-DMA opened the door for further losses.

The Australian dollar retreats from weekly highs around 0.7230 and drops 70 pips during Wednesday’s North American session, towards daily lows near 0.7160s. At 0.7170, the AUD/USD is set to extend its losses as sellers prepare to break below the 0.7149 weekly high, aiming to drag the major towards 0.7100.

Negative sentiment and a strong US Dollar weigh on the AUD/USD

A dampened market sentiment, as portrayed by global equities, keeps the AUD/USD extending its losses. Albeit positive data from Australia regarding Q1 GDP, which recovered 0.75% QoQ (3.3% YoY), and China’s Caixin PMI for May aligned with expectations, worries about the US Federal Reserve tightening monetary conditions, could tip the economy into recession.

The market reaction was muted, though, in the middle of the European session, the AUD/USD jumped towards weekly highs around 0.7230s and retreated following the release of upbeat US economic data.

Regarding the US economic docket, the May ISM Manufacturing PMI advanced in May as new orders, and output growth quickened, suggesting that demand remains solid. The reading rose to 56.1 vs. 55.4 in April, while estimations were around 54.5. Meanwhile, the US JOLTs report showed that openings in April fell from 11.9 million in March to 11.4 million, offering some relief for employers who struggle to contract or keep workers.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of six peers, rallies 0.79%, up at 102.584, underpinned by higher US Treasury yields. The 10-year benchmark note rate climbs close to 10 bps and begins June at around 2.944%.

Later in the day, the San Francisco Fed’s President Mary Daly crossed wires and said that she sees a couple of 50 bps hikes and reinforced the need to get rates to neutral expeditiously and would like to be around 2.5% by the end of 2022.

AUD/USD Price Forecast: Technical outlook

The AUD/USD remains downward biased. Failure to reclaim the 100-day moving average (DMA) at 0.7228 spurred a dip below the 0.7200 mark. Also, the Relative Strength Index (RSI), at 54.63, is in bullish territory but begins to aim lower, indicating that some selling pressure could accelerate the fall towards 0.7100.

Therefore, the AUD/USD first support would be the 0.7150 figure. Break below would expose the May 27 low at 0.7089, followed by the 20-DMA at 0.7039. Once cleared, a move towards the 0.7000 psychological figure is on the cards.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.