AUD/USD falls amid sour sentiment, PBoC rate decision

- AUD/USD drop influenced by a surprise PBoC rate hold decision amid thin liquidity conditions on the US market holiday.

- Mixed economic data throughout January could prevent the RBA from raising rates in the near term.

- The pair is at the mercy of Aussie’s economic data, along with US NY Empires State Index and Fed’s Waller speech.

The Aussie Dollar (AUD) dropped during the North American session by some 0.42% against the US Dollar (USD) due to sentiment deterioration and low volume conditions, as the financial markets in the United States (US) remained closed on Martin Luther King (MLK) holiday. The AUD/USD trades at 0.6655 after hitting a high of 0.6705.

AUD/USD driven by risk aversion at the beginning of the week

AUD/USD was hurt by risk appetite as well as the People’s Bank of China (PBoC) keeping rates unchanged at 2.50%, coughing traders off guard, even though China’s economy crawls to grow at the levels expected by China’s President Xi Jinping.

Meanwhile, economic conditions in Australia continued to be challenging, as most of its PMIs remained in contractionary territory despite a slight improvement. Further data was positive, with Retail Sales exceeding the forecast of 1.2%, coming at 2% on January 6, adding to inflationary pressures, which were dissipated by the latest report. On January 9, the Australian Bureau of Statistics (ABS) revealed that headline inflation hit 4.3%, diving for the third straight month, which could deter the Reserve Bank of Australia (RBA) from hiking rates.

Ahead of the week, Australia’s economic docket will feature Westpac Consumer Confidence alongside housing data release. On the US front, the calendar would feature the NY Empire State Manufacturing Index on Tuesday, along with the Federal Reserve Governor Christoper Waller's speech.

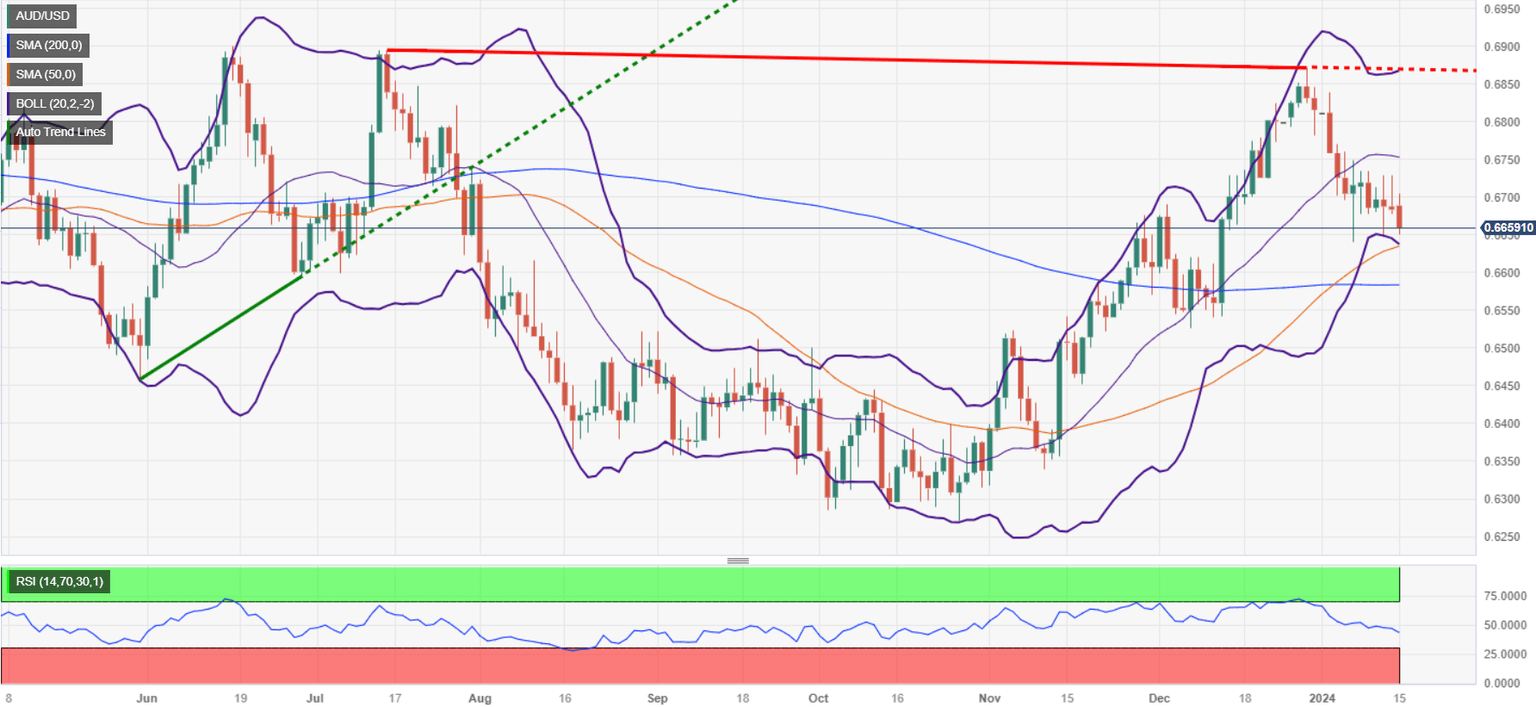

AUD/USD Price Analysis: Technical outlook

The daily chart portrays the pair as neutral to upward biased, but in the last week, it has been trading sideways, unable to gather direction. If buyers lift the AUD/USD past the first resistance seen at 0.6700, they will face the next ceiling at the January 12 high of 0.6727. Once hurdled, the next stop would be the January 5 high of 0.6747, ahead of 0.6800. on the flip side, downside risks remain at the January 5 low of 0.6640, followed by the 0.6600 threshold.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.