AUD/USD faces headwinds amid China’s economic woes, mixed Fed signals

- China’s economic indicators signal distress, with weak retail sales, plunging imports/exports, and Evergrande’s bankruptcy filing.

- US Federal Reserve minutes highlight commitment to 2% inflation target but voices caution against overtightening.

- Traders eye upcoming S&P Global PMIs in Australia and a slew of US data, including Powell’s Jackson Hole speech, for directional cues.

AUD/USD registers minuscule losses though it registered weekly losses of 1.41%, as market sentiment remained downbeat amid China’s economic developments, denting investors’ mood. That, alongside global bond yields portraying traders expecting additional tightening, kept the Australian Dollar (AUD) pressured for the eighth consecutive day. The AUD/USD finished the week trading at 0.6401, down 0.02%.

Australian Dollar under pressure for the eighth day as China’s economic turmoil and global bond yields weigh on sentiment

During the last two weeks, China’s economic docket paints a troubled economic outlook, as retail sales were weaker than expected, imports and exports plunged, and business activity stalled. That, alongside news that Evergrande’s filing for bankruptcy in New York, added to the ongoing economic turmoil of the second-largest economy worldwide.

In the meantime, the latest US Federal Reserve monetary policy minutes, revealed on Wednesday, showed policymakers’ commitment to curb inflation towards its 2% target. In fact, most participants noted that further tightening is required, hurting investors’ speculations the central bank would give signs of pausing or ending its tightening cycle.

Nevertheless, it seems traders overreacted, as there have been growing voices among the Fed’s board to not overtightening monetary conditions. Regional Fed Presidents Bostic, Harker, Golsbee, and Barkin, stated that rates are restrictive, and the US central bank could be “patient” regarding future decisions. Consequently, the CME FedWatch Tool shows that market players expect the Fed to hold rates in September, but November’s meeting would be live.

AUD/USD traders’ focus shifts to next week’s data. In Australia, S&P Global PMIs are expected to remain unchanged. On the US front, Fed speakers, housing data, PMIs, durable goods orders, and Fed Chair Jerome Powell’s speech at Jackson Hole could rock the boat after volatility continued to shrink throughout August.

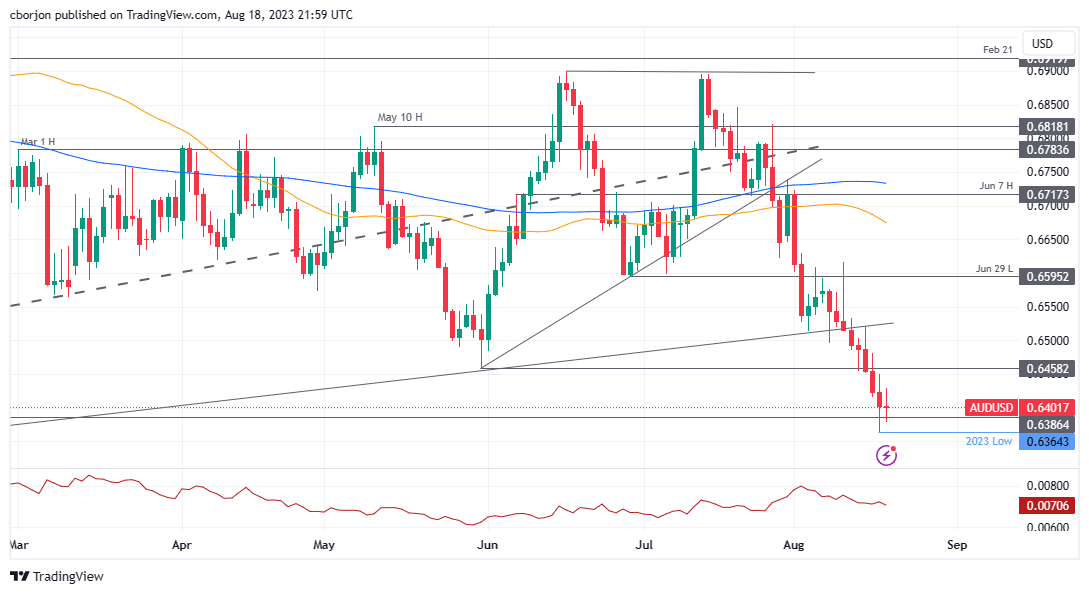

AUD/USD Price Analysis: Technical outlook

The AUD/USD downtrend remains intact, though it failed to achieve a daily close below the November 10 low of 0.6386, keeping buyers hopeful of higher prices. Despite that, AUD/USD could re-test 0.6400, followed by the new year-to-date (YTD) low challenge at 0.6364. A decisive break below the latter, expect the AUD/USD to visit the November 3 swing low of 0.6272, ahead of the 0.6200 figure. Otherwise, the AUD/USD could aim towards the May 31 low of 0.6458 before challenging the 0.6500 mark.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.