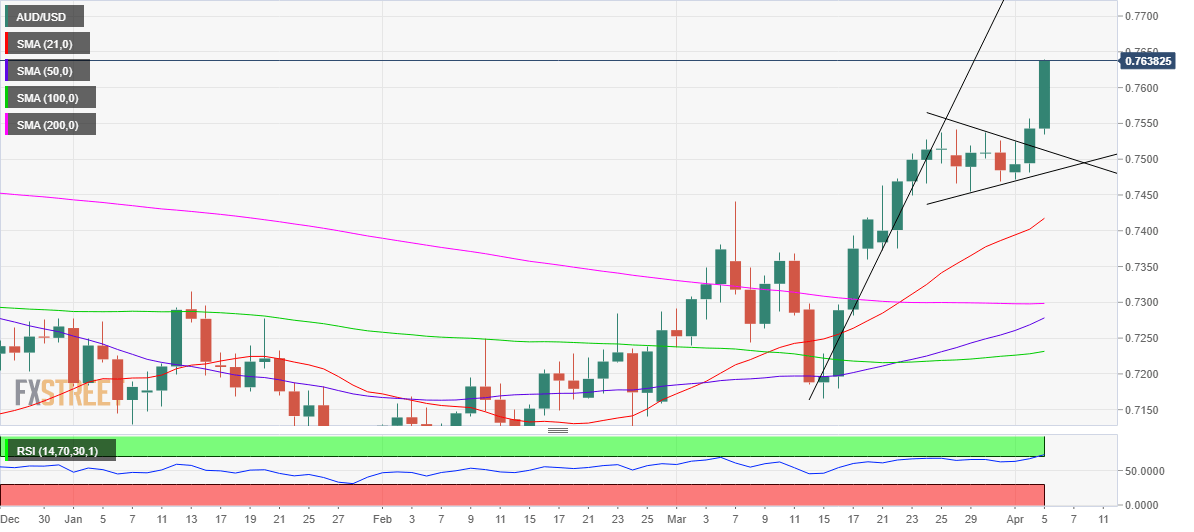

AUD/USD explodes to test 0.7650 on hawkish RBA, bull pennant

- AUD/USD holds the higher ground, rising over a big figure on RBA’s hawkish surprise.

- The US dollar eases amid a better market mood, supporting the aussie pair.

- Bull pennant breakout on the 1D chart on Monday justifies the explosion.

AUD/USD is sitting at the highest level since June 2021, eyeing a test of the 0.7650 barrier, as the buying interest around the aussie dollar remains unabated on the RBA’s hawkish pivot.

The RBA, at its April monetary policy meeting, kept the key rate unchanged at 0.10%, as widely expected. But what the trick for aussie bulls was the change in the central bank’s forward guidance, as it dropped its ‘patient’ pledge on the inflation developments, hinting at a potential rate hike in the upcoming meetings.

Further, the Russia-Ukraine crisis-driven surge in oil prices combined with holiday-thinned trading exaggerated the move higher in the major.

Meanwhile, the US dollar trades on the defensive amid a better market mood, despite looming risks of additional Western sanctions and penalties.

Next of relevance for the aussie remains the US ISM Services PMI and Fedspeak while the UN Security Council meeting will be also closely followed.

Technically, AUD/USD has extended the upside breakout from a bull pennant confirmed on Monday.

The pattern got validated after the pair closed Monday above the falling trendline resistance at 0.7519.

AUD/USD: Daily chart

AUD bulls remain poised for the further upside towards 0.7700, although the 14-day Relative Strength Index (RSI) is peeping into the overbought region, warranting caution.

Therefore, a minor pullback cannot be ruled before the major resumes the next uptrend.

Tuesday’s low of 0.7535 could emerge as powerful support, below which the 0.7500 level could be tested should the retracement gain momentum.

AUD/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.