AUD/USD edges higher though is back below 0.7100 despite a hawkish RBA

- The Aussie dollar gains some 0.72% on Tuesday, following the RBA’s 0.25% rate hike.

- The RBA notes it will begin its Quantitative Tightening.

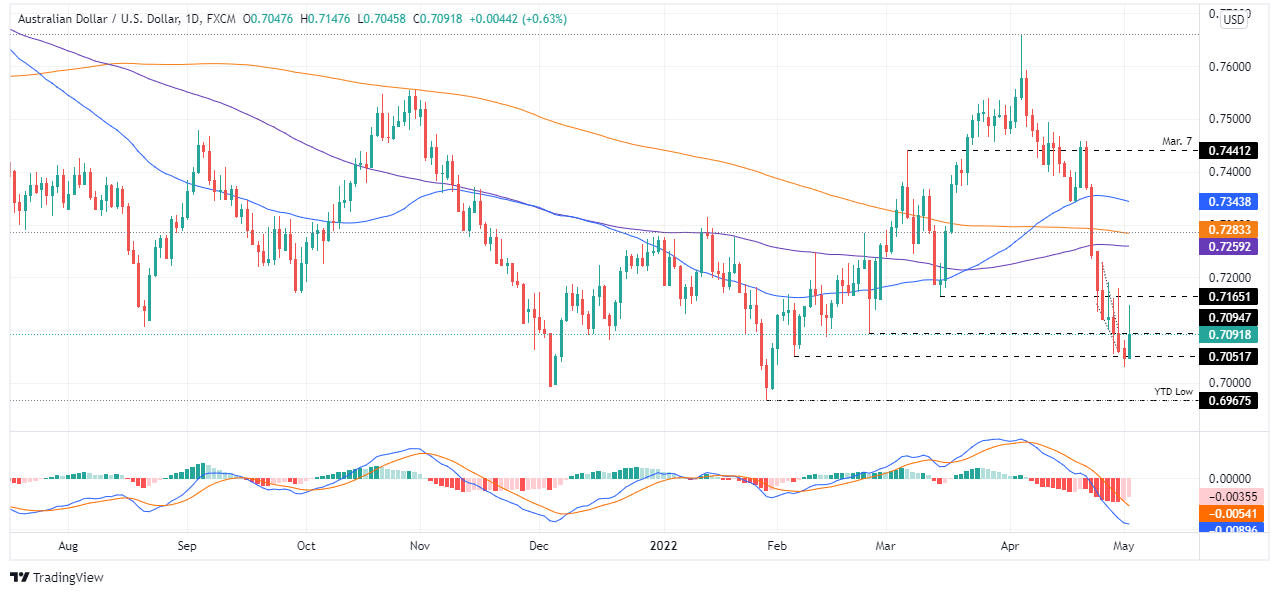

- AUD/USD Price Forecast: Failure at 0.7165 paves the way for further losses.

The Australian dollar registers solid gains after the Reserve Bank of Australia (RBA) delivered a “surprising” rate hike of 25 bps earlier during the day to lift rates to the 0.35% threshold. However, after recording a daily high at 0.7147, the AUD/USD retreats as the Federal Reserve May meeting looms and, at the time of writing, trades at 0.7091.

RBA hikes rates by 25 bps to 0.35%

During the Asian session, the RBA surprised market participants with its monetary policy decision. In its statement the RBA said, “The economy has proven to be resilient and inflation has picked up more quickly, and to a higher level than expected.” It’s worth noting that the bank pulled the trigger ahead of knowing the Wage Price Index, which was the reason holding back the central bank, before committing to tightening monetary policy. Regarding the aforementioned, the RBA stated, “There is also evidence that wages growth is picking up.” Additionally, the RBA began its Quantitative Tightening (QT) as it decided not to reinvest any maturing proceeds of its balance sheet.

On the macroeconomic front, the US docket featured US Factory Orders for March, which grew by 2.2% m/m, higher than the 1.1% estimates. At the same time, March’s US JOLTs Job Openings came at 11.549M, beating expectations of 11M, showing the tightness of the US labor market.

The mixed data would not derail the Federal Reserve from delivering the so-telegraphed 50 bps rate hike on Wednesday. Of late, as the Fed decision looms, the AUD/USD has retreated from daily highs.

Sentiment-wise, China keeps struggling trying to contain the Covid-19 spread. However, its zero-tolerance of the coronavirus is hurting its economy, as Fitch Ratings cut its forecast for China’s 2022 GDP to 4.3% from 4.8%. Furthermore, the Ukraine-Russia tussles seem to desensitize market players, and unless market-moving events develop, it will remain in the backseat.

Meanwhile, the US Dollar Index, a measurement of the greenback’s value against its speers, slumps 0.08%, sitting at 103.526, also weighed by falling US Treasury yields. The 10-year US Treasury yield sits at 2.946%, retreated five bps from the YTD high at 3%, reached on Monday.

AUD/USD Price Forecast: Technical outlook

The AUD/USD failure to break March’s 15 daily low-turned-resistance at 0.7165 opened the door for further losses, meaning that the Aussie dollar is trading back below 0.7100. With that said, the AUD/USD first support would be February’s 4 cycle low at 0.7051. Once cleared, the following line of defense would be 0.7000, followed by the YTD low January’s 28 swing low at 0.6967.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.