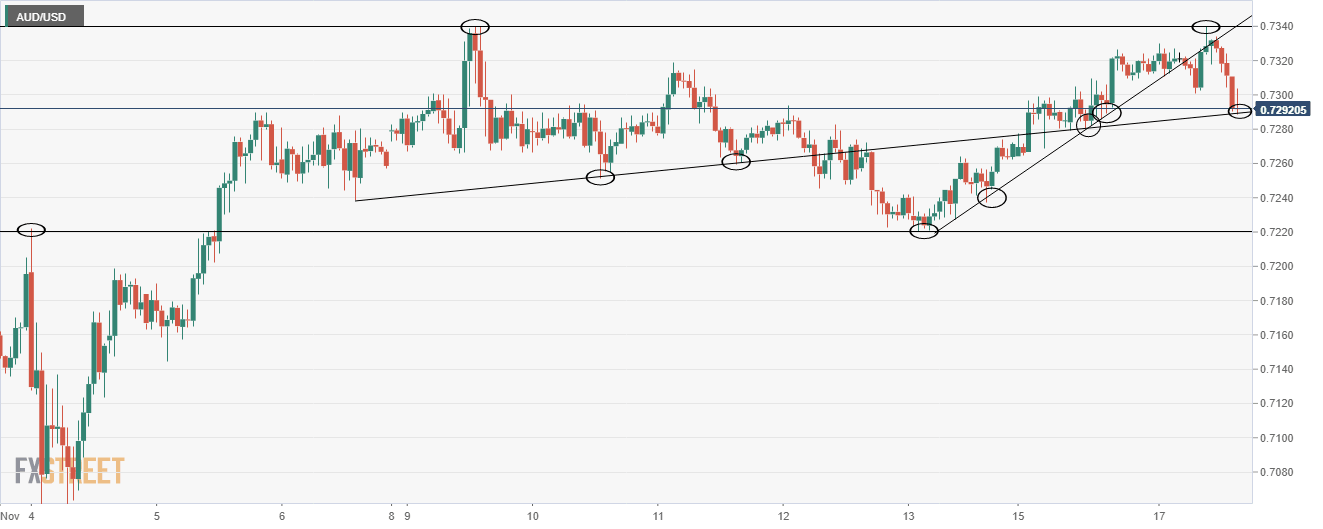

AUD/USD drops below 0.7300 mirroring equity market downside

- AUD/USD has dropped below 0.7300 amid post-US cash open/soft US retail sales data downside in US equities.

- Having failed to break above 0.7340, the upper bound of its recent range, further near-term consolidation seems likely.

AUD/USD has been on the back foot in recent trade, most recently dropping below the 0.7300 level to set fresh lows of the day around 0.7290s. The pair now trades with losses on the day of around 30 pips or 0.4%.

Risk-off flows post-soft US retail sales data weigh on AUD

Risk sensitive currencies have been seeing downside alongside US equities in wake of a bearish US equity cash open at 14:30GMT, with the downside most pronounced in AUD and NZD, both of which are now the worst-performing G10 currencies on the day and trade roughly 0.4% lower on the day versus the US dollar.

Prior to the US equity cash open, risk appetite had already taken a knock due to disappointing US retail sales numbers for October. Headline retail sales grew at a more sluggish than expected MoM rate of 0.3% in October (the expected rate of growth was 0.5%), as did Core retail sales, growing at a rate of just 0.2% MoM versus expectations for a growth rate of 0.6%.

According to Pantheon Macroeconomics, a reversal of September’s strong gains in department store sales (down 4.6% versus a +9.4% in September), clothing sales (down 4.2% versus a +13.6% in September) and sporting goods (down 4.2% versus a +8.0% in September) all weighed. But the Economic Consultancy thinks that October’s data is old news and “expect a much bigger drop in November as people reduce their social interactions and states/cities limit or close indoor dining”.

Recent underperformance in the Aussie marks quite a turnaround in fortunes from earlier on in the session; AUD/USD tested monthly highs during the European morning session at 0.7340 and was one of the better performing G10 currencies, amid ongoing renminbi strength (CNH and CNY still trade 0.3% and 0.4% higher respectively versus the US dollar at the time of writing) and RBA minutes which firmly reiterated that the bank does not see rates going negative any time soon.

AUD/USD snaps four-day uptrend but buyers re-emerge at longer-term support

Having failed to break above its monthly highs at 0.7340 during the European morning session, AUD/USD has proceeded to break to the downside of a recent, four-day upwards trend channel from the 13 November low (around 0.7220). However, the pair has promptly found decent buying interest around 0.7290, an area where a longer-term uptrend, that has been in play as both support and resistance since 3 November, resides.

If risk-off flows continue, however, a break below this trend support remains a possibility for AUD/USD, which would open the door to more protracted downside towards the lower bound of the pairs range of the last 12 or so days at 0.7220 (the 3 November high and 13 November low).

On which note, AUD/USD’s failure to break above the upper end of its recent range at 0.7340 signifies that in the medium-term, further consolidation within its recent 0.7220-0.7340 range seems the most likely outcome.

AUD/USD one hour chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset