AUD/USD bulls move in and take back 0.6700, eye 0.6720s

- AUD/USD bulls have eyes on the 0.6720s despite hawkish Fed.

- The US dollar has dropped from the post-Fed rate hike highs.

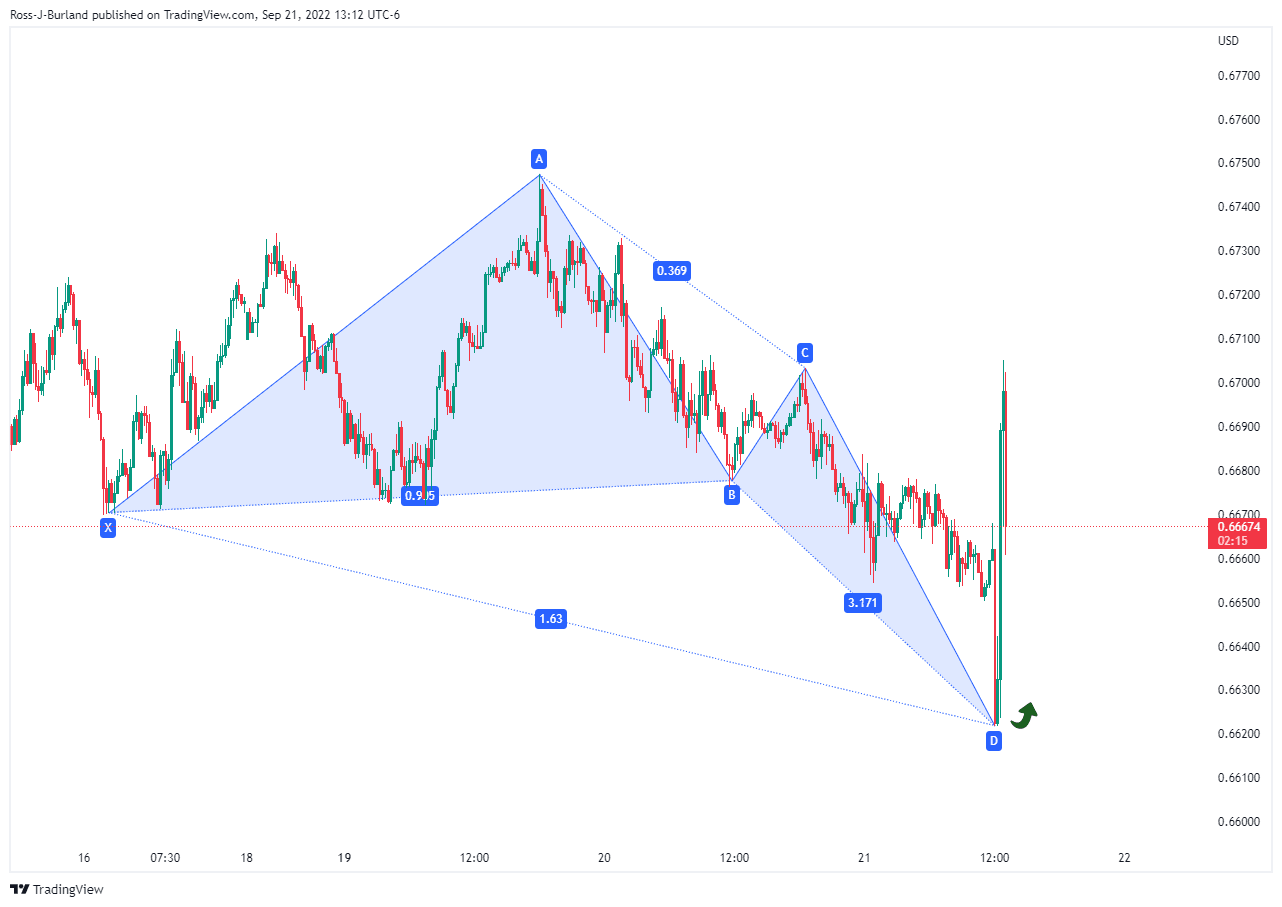

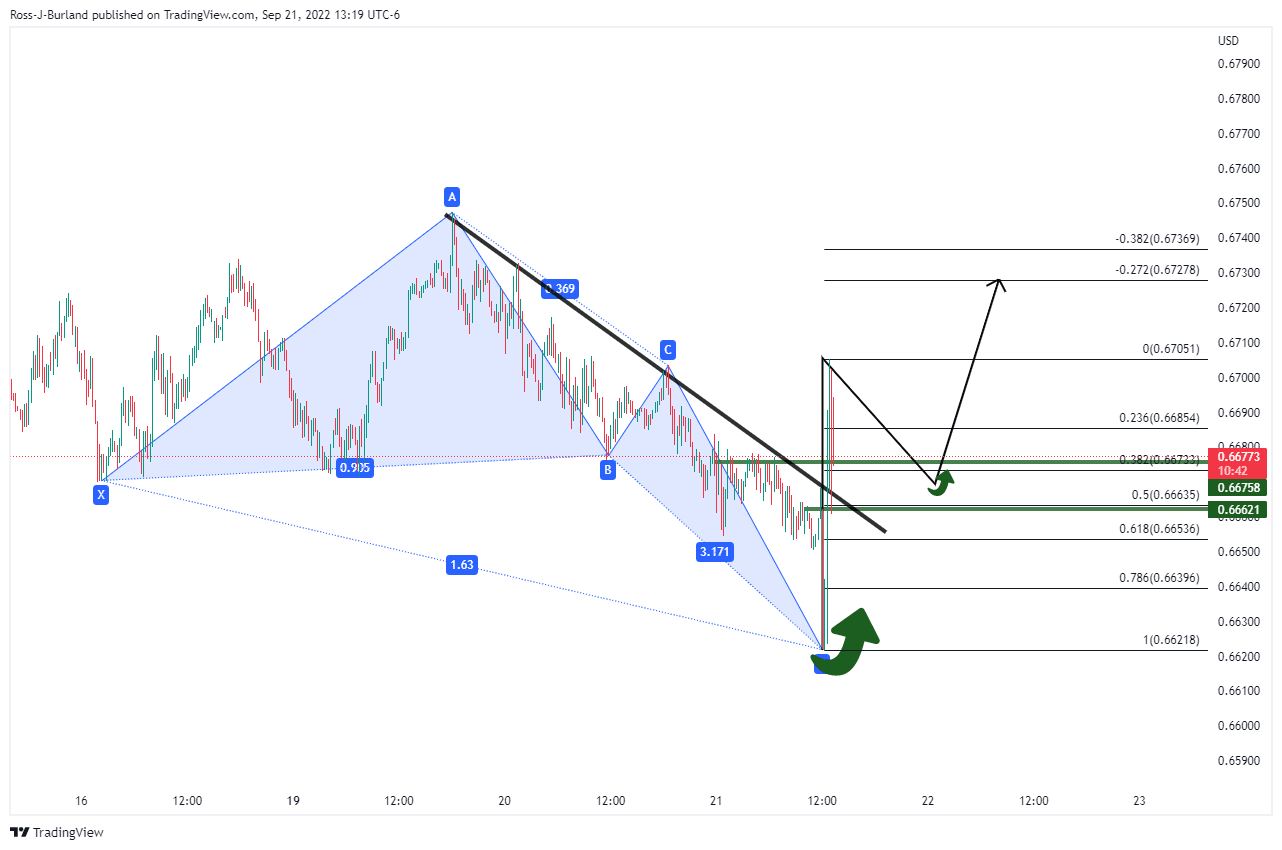

AUD/USD has rallied following a 30 pip drop below the round 0.6650 level that came on the back of the knee-jerk reaction to the Fed's interest rate hike. AUD/USD, however, recovered from a session low of 0.6621 to 0.6705 during the Fed's presser and back into the Tokyo highs in an explosive move vs. the bearish creeping trend. Technically, the rally came on the back of a harmonic pattern as illustrated below.

Meanwhile, Federal Open Market Committee's conclusion to its two-day meeting resulted in the Federal Reserve deciding unanimously between its board members to hike interest rates by 75bps. The decision and further details surrounding the Fed's dot plot and economic forecasts have pressured the US yields and the dollar higher initially, however, there has been a turnaround with the greenback now trading back below the 111 area.

The expectations for higher rates and a decision by Russian President Vladimir Putin to mobilize more troops for the conflict in Ukraine had already pushed the dollar to a two-decade high before the Fed. The DXY index that measures the US dollar against a basket of currencies was breaching into the 111 area but on a post-Fed announcement, the index shot up to a high of 111.578. It has since stumbled back to test a trendline support area near 110.60.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

Fed chairman presser

Meanwhile, Fed's chairman, Jerome Powell has been speaking to the press:

-

Powell speech: MBS sales not something I expect to be considering in near term

-

Powell speech: There is no painless way to bring inflation down

- Powell speech: No one knows if we will get a recession

-

Powell speech: Just moved into lowest levels of what we consider restrictive today

-

Powell speech: Dot plot projections do not represent plan or commitment

-

Powell speech: No grounds for complacency on inflation

-

Powell speech: Economy does not work without price stability

AUD/USD technical analysis

The price completed a deep crab harmonic pattern. Following the sell-off to 0.6620's, the price rallied back to engage buyers and to trip stops at and around the 0.6650s for a run on positions accumulated towards the 0.67 area in what has been a creeping bearish trend established since the open of the week.

The price would now be expected to complete a measured move to the 0.6720s following a correction to the upper quarter of the 0.66 area if not back to 0.6650 following the break of those structures and the trendline resistance that would be now be expected to act as a counter trendline support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.