AUD/USD bears sinking their teeth in as hawks circle above

- AUD/USD pressured as US stocks sink on hawkish Fed chatter.

- AUD/USD bears are seeking a downside extension to test 0.720 the figure.

AUD/USD has started to correct the correction of the daily bearish impulse in line with the broader bearish trend.

The Federal Reserve hawks are circling over the Jackson Hole which has given a boost to US yields and the US dollar, pressuring risk appetite, US stocks and the commodity complex.

AUD is correlated to risk sentiment and is thus feeling the pain on Thursday.

AUD/USD is currently trading near 0.7240 after falling from a high of 0.7279 and en-route to surpass the low of the day 0.7237, which is the prior day's swing low.

More on that below.

Meanwhile, Federal Reserve's James Bullard, Robert Kaplan and Esther George have spoken up the day before a marquee speech by Fed Chair Jerome Powell to urge the central bank to begin paring bond purchases.

All three of the hawks have downplayed the impact of the coronavirus delta variant in separate interviews.,

Both George and Kaplan said their business contacts were telling them the economic effects remained limited.

"By and large what we are hearing..is they are weathering this resurgence at least as well as previous surges, and many are telling us the impact on their business is more muted," Kaplan told CNBC.

George told Fox Business that she expected there would be more information coming after the Fed's Sept. 21-22 meeting.

Bullard said the Fed was "coalescing" around a plan and the combination of these comments have pushed US stocks lower and sent US yields to the highest levels in almost two weeks.

With strong inflation and expected continued job growth "there is an opportunity to begin to dial back on asset purchases," Fed's George argued, with her preference being that the process start "sooner rather than later."

Markets are now anticipating a hawkish outcome from Powell's keynote speech on Friday and are pricing in the start of a taper and the timings that could be announced as soon as the September Fed meeting.

Whatsmore, trading is very thin today, with summer vacations drawing to a close, volumes are still down in the US stock markets so it doesn't take much to move the needle.

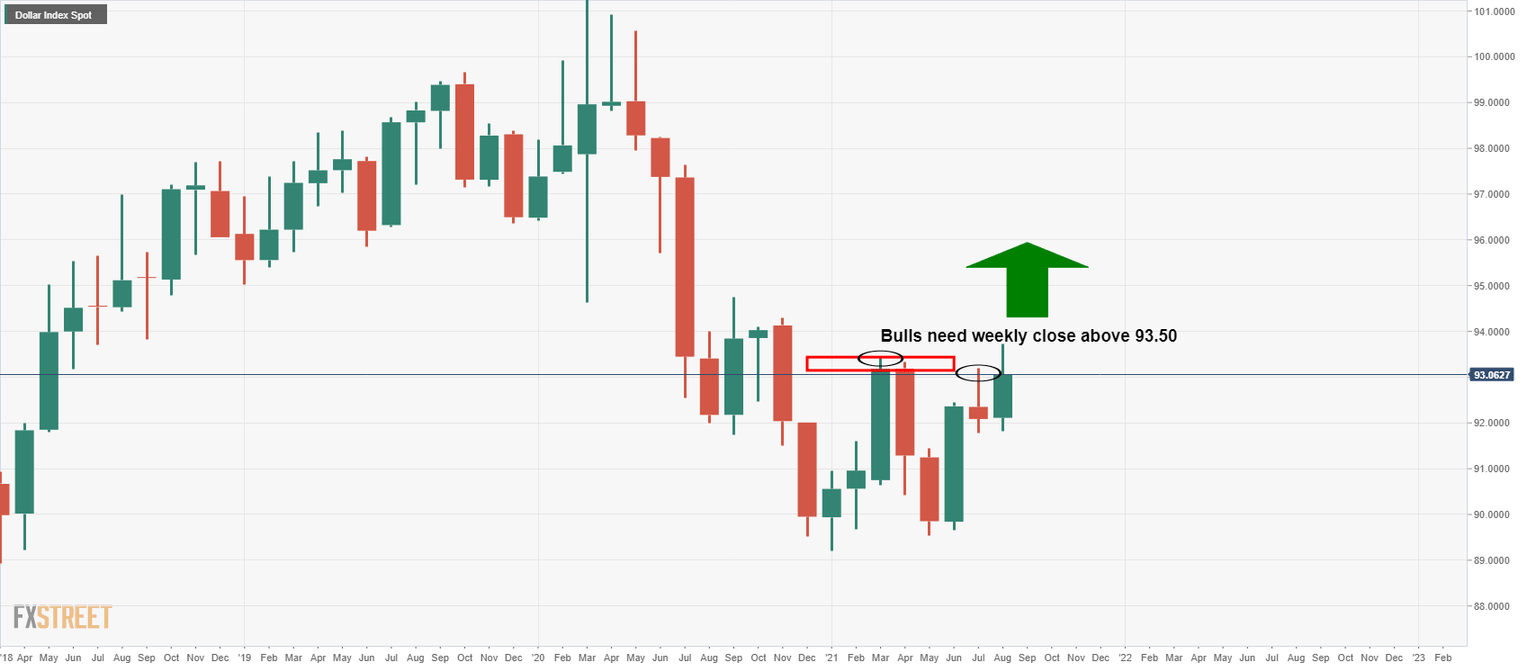

As a consequence of a drop in US stocks, the US dollar jumped from one-week lows and headed toward a key resistance level in the DXY, which measures the greenback against a basket of six major trading currencies.

That critical level is between 93.13/93.16 on the hourly charts.

DXY is up 0.26% in afternoon trading and has traded between 93.810/93.078, so far.

AUD/USD technical analysis

As per the prior analysis, AUD/USD Price Analysis: 61.8% Fibo eyed as potential resistance, the bulls have capitulated near to the mark on Thursday which exposes the downside for the days ahead.

However, until the Jackson Hole is out of the way, positions taken around the event will be subject to prospects of higher volatility.

Nevertherthe less, a break higher in the DXY will most probably seal the deal for the bears.

DXY bulls will want to see a break above 93.50 in the coming days to close the month in the highly bullish territory.

The outcome of tomorrow's Powell speech could be the catalyst for a weekly close above the level:

In AUD/USD, initially, the bears will want to see the hourly support structure broken, as touched on at the start of this article:

From a daily perspective, 0.7050s will be where the bears will be looking to take profits on a continuation to the downside, as per the prior analysis:

Daily chart, prior analysis

''On the daily chart, the price is moving on on old support at 0.7289 and a near confluence of the 61.8% Fibonacci retracement level.

The correction could start to decelerate at this juncture....''

... and it has done just that ...

Live market update, daily chart

the bears will be keen to test the 0.72 figure that aligns with the 61.8% Fibo of the correction's range at 0.6998.

The first port of call will be the -272% Fibo at 0.70585.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.