AUD/USD bears look for break below 0.72 as risk sentiment deteriorates

- AUD/USD buckles under the pressure of risk-off sentiment.

- Eyes on Evergrande, the FOMC, iron ore prices, global stocks and the futures markets.

At the time of writing, AUD/USD is trading near 0.7245 and down over 0.2% in a risk-off mood. A number of factors are in play that makes for treacherous grounds for Australian dollar traders this week.

On the one hand, investors will be looking out for more information about the timing and duration of tapering from the upcoming FOMC meeting. On the other, markets should also continue to debate the prospects for growth amid ongoing global disruptions from the Delta variant and developments surrounding the Evergrande risk in China. Safe-haven flows are likely to benefit USD and JPY crosses as markets await the upcoming Fed meeting and weigh on AUD.

A renewed risk-off tone gripped the market last week. China’s disappointing Retail Sales and weaker Industrial Production raised concerns about slowing economic growth, while strong US retail sales bolstered prospects of early Fed tapering. Coupled with the hard data, the Evergrande story began to gain traction in the forex space. More on this here in an article published just ahead of Asia open on Monday: Evergrande: Risk-off tone for APAC, a USD win-win scenario, bad for AUD

Evergrande weighs heavily on markets

Investors are concerned about the potential impact on the wider economy and dumped Chinese property stocks overnight, seeking refuge in safe-haven assets. Regulators have warned that it's $305 billion of liabilities could spark broader risks to China's financial system if its debts are not stabilised.

The global stock markets skidded as a result and the US dollar firmed as investors fretted about the spillover risk to the global economy. US stocks were sharply lower, with the S&P 500 down nearly 2% and on pace for its biggest one-day percentage drop in more than four months.

Evergrande executives are working to salvage its business prospects, but the default scenario is balanced between bad and worse outcomes. We can expect a messy meltdown at worst, a managed collapse or the less likely prospect of a bailout by Beijing as a best-case scenario for financial markets. In this regard, markets are keeping a watchful eye for a deadline of an $83.5 million interest payment on one of its bonds that is due on Thursday. Overall, the company has $305 billion in liabilities.

Implications for AUD/USD

As explained in Evergrande: Risk-off tone for APAC, a USD win-win scenario, bad for AUD, AUD could be hit the hardest in a worst-case scenario.

The problem is not isolated to Evergrande. The entire Chinese property sector has been caving -in for a long time and there are a number of heavyweight companies that are in distress as per the following image:

This image represents over half a trillion dollars of total liabilities between 10 Chinese developers which include not only debt but payments to suppliers, employees and remaining construction costs. In short, the Chinese property-development ecosystem is on the brink of collapse.

China is Australia's biggest trade partner. Australia relies on iron ore exports to China. Any significant reduction in Chinese demand would have significant ramifications for the Australian economic income from iron ore operations and for the federal budget. (Every $US10 the price of iron ore falls nominal GDP decreases by $6.5 billion and the budget coffers are drained of $1.3 billion, that is according to the 2021-22 federal budget).

Meanwhile, the price of iron ore is already sliding which is a negative for AUD. ''Iron ore prices tanked on intensifying pressure in China to reduce steel output to curb carbon emissions. Rising risks of a substantial slowdown in property following the Evergrande crisis aided the bearish sentiment,'' analysts at ANZ Bank explained.

Positioning to weigh on spot

Looking to the latest positioning data that came out last Friday, the Net AUD short positions ramped higher and are at their highest levels since our records began. This is down to the price of iron ore price falling like a stone, as well as the lockdowns that have risen concerns about the economic outlook. With the Evergrande implications, the Reserve Bank of Australia will have even more on its plate to contend with for a considerable time to come. The futures market's sentiment would be expected to weigh on the spot price in the coming days and weeks ahead.

AUD/USD technical analysis

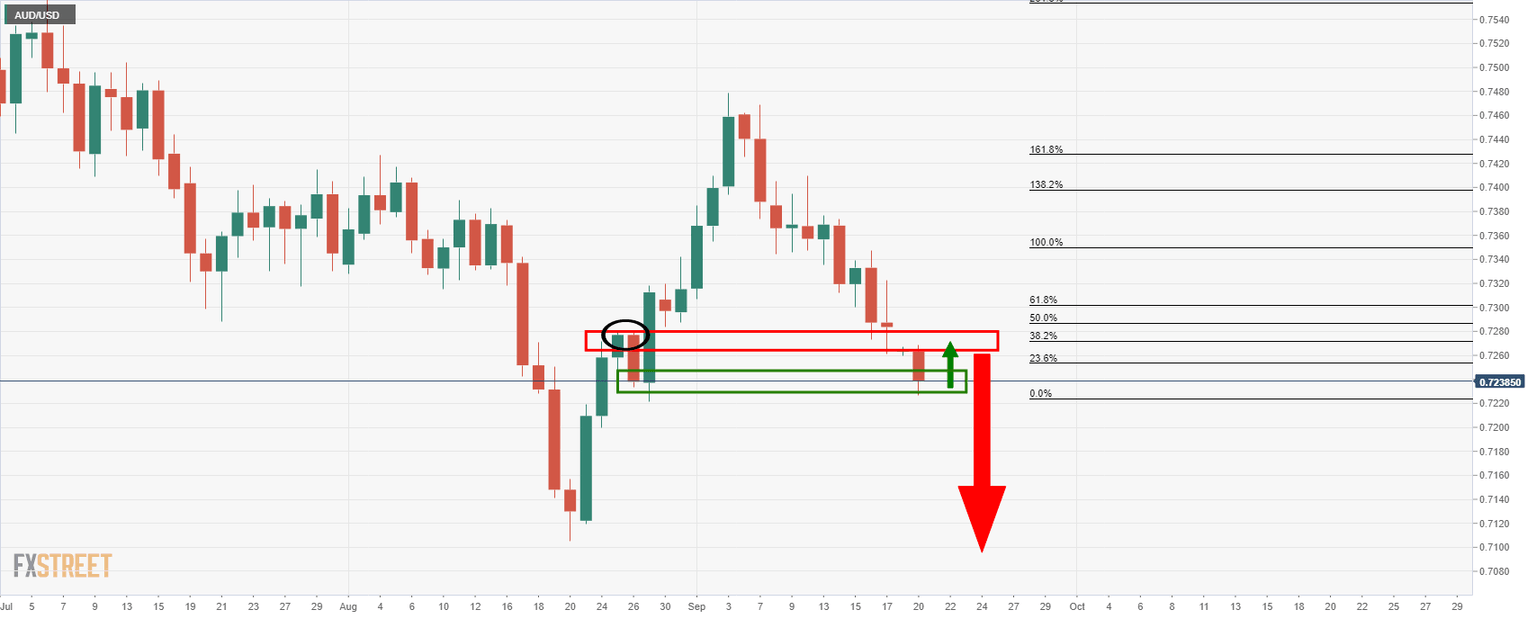

Technically, the price is offered into prior lows that are acting as a support structure. Ordinarily, we would expect a correction at this juncture to test at least the 23.6% or 38.2% Fibonacci ratios before the next leg to the downside. A move to the downside would target the mid-Aug lows of 0.7105. However, if sentiment really deteriorates a big risk-off move making for disorderly gyrations in the financial markets would be expected to weigh heavily on proxy currencies such as the Aussie.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.