AUD/USD bears in control ahead of a busy event week

- It is a busy week ahead for AUD/USD on the economic calendar.

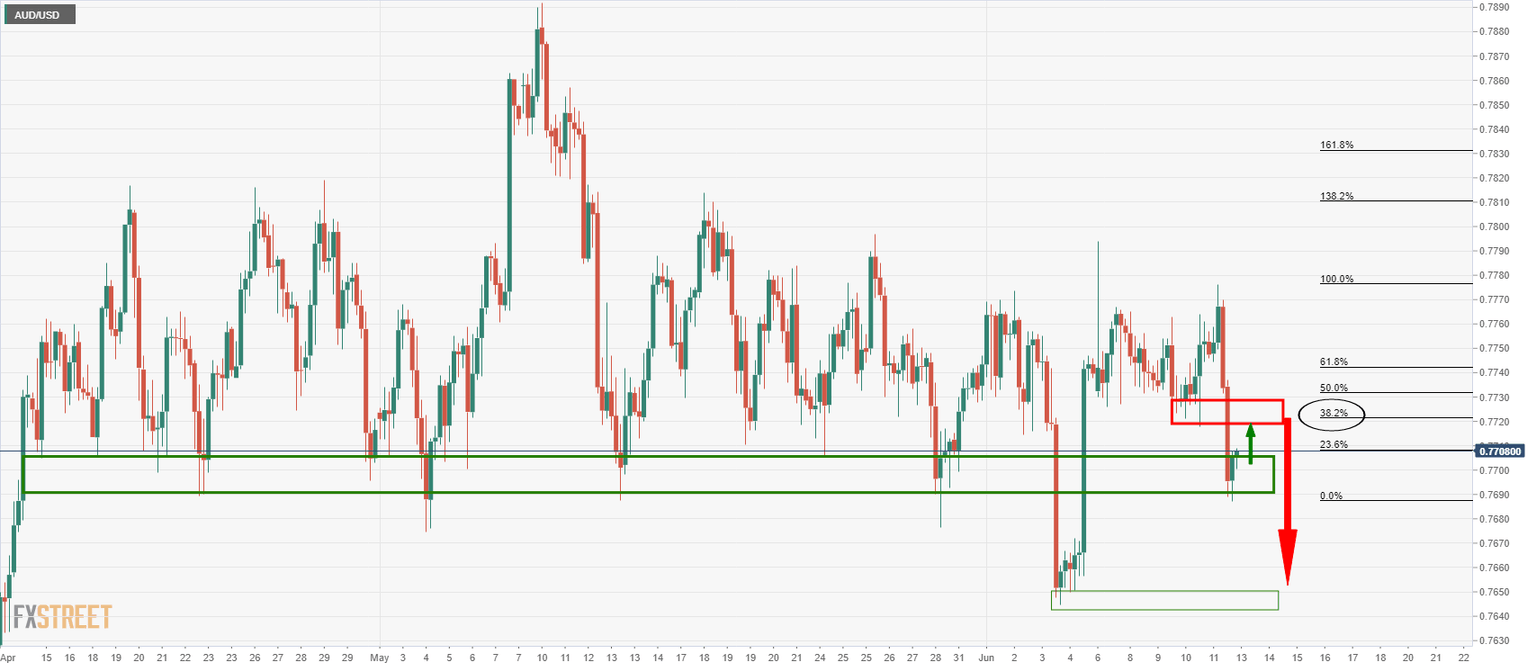

- AUD/USD is on the verge of a downside extended move to prior support.

Due to the strength in the greenback, AUD/USD ended Friday lower by 0.6% testing the 0.77 level after falling from a high of 0.7775 to a low of 0.7688.

All in all, markets ended the week in a consolidative mode as investors look ahead to the Federal Reserve interest rate decision this week after digesting the European central bank, the Bank of Canada and US Consumer prices last week.

The yield on the US 10-yr note moved higher by 2bps to 1.45% after stocks climbed on the University of Michigan preliminary consumer sentiment reading for May that rose to 86.4 vs 82.9. However, inflation expectation eased, which will be welcomed by the Fed. The one-year expectation fell to 4.0% vs 4.6% and the 5-10 year reading eased to 2.8% vs 3.0%.

In the medium-to-longer term, inflation expectations remain well-anchored which markets are pricing for as well as no change in Fed guidance on Wednesday.

The Fed's Chair Jerome Powell will likely downplay any rise in the dot plot amid the prevailing view that the inflationary pressures will recede once the supply side of the economy adjusts to re-opening, analysts at ANZ bank argued.

''It is also expected that the FOMC will maintain its view that inflation will converge closer to target over the medium term. For markets, that is what is important from a policy perspective as the central bank looks through the current gyrations.''

In other events for the week ahead, US May Retail Sales will also be closely watched whereby headline sales are expected to have fallen 0.6% MoM.

However, on the domestic front, the main news event for the Aussie will be in Thursday’s jobs data for the month of May.

This will be especially important as it will be the last key release before the 9 July Reserve Bank of Australia meeting.

There could be changes to the shape and possibly size of the QE and a rather strong headline print and a drop in the Unemployment Rate could lead to a less dovish RBA and a brighter inflation outlook for the second quarter after the underwhelming 1first quarter print.

The minutes of June’s RBA meeting will also be slated this week where a discussion about tweaking QE in July could be noted. The RBA Governor, Philip Lowe, will also deliver a speech on Thursday before the jobs report.

AUD/USD technical analysis

The price is testing 4-hour prior support at the lows and a break here for the open will put S1 in focus at 07640 which would be expected to hold initial tests.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.