AUD/NZD Price Analysis: Hanging just below 1.09 in the Aussie CPI run-up

- The AUD/NZD is strung along the topside just below 1.0900 heading into Wednesday's Aussie CPI inflation reading.

- The Aussie has been gaining firmly against the Kiwi, closing flat or higher for ten straight trading days.

- RBA's closely-watched Trimmed Mean CPI inflation indicator to be a make-or-break for AUD momentum.

The AUD/NZD has been grinding up the chart paper with the Aussie (AUD) gaining 0.34% in Tuesday's trading window and climbing 2.4% against the Kiwi (NZD) since hitting the last bottom of 1.0624 two weeks ago.

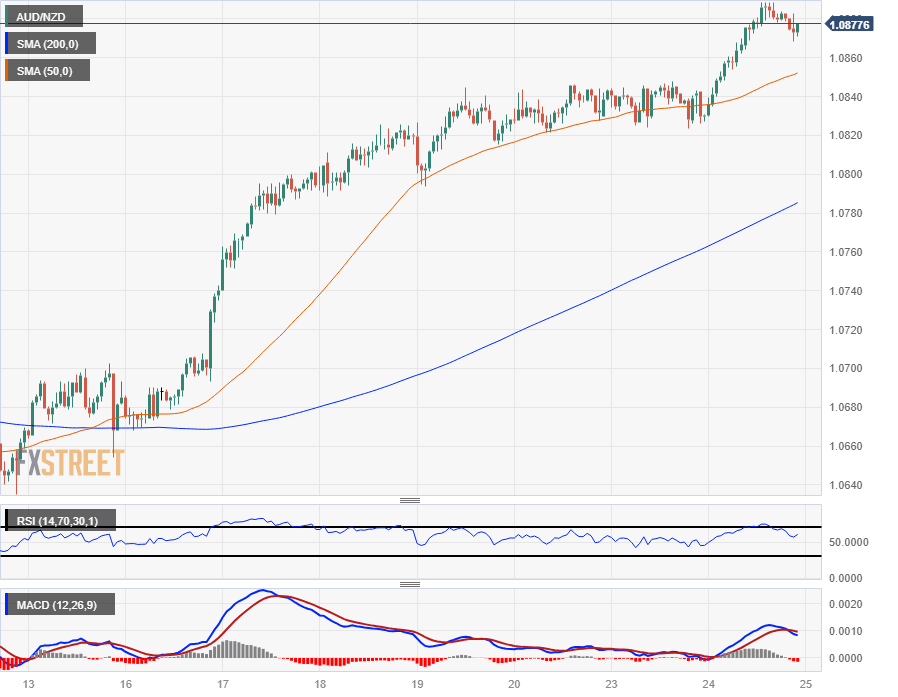

intraday trading has the pair catching some firm lift on the hourly candles, with prices consistently getting bolstered by technical support from the near-term 50-hour Simple Moving Average (SMA), currently huddled near 1.0852 after the AUD/NZD caught another rebound from the MA at the outset of Wednesday's trading.

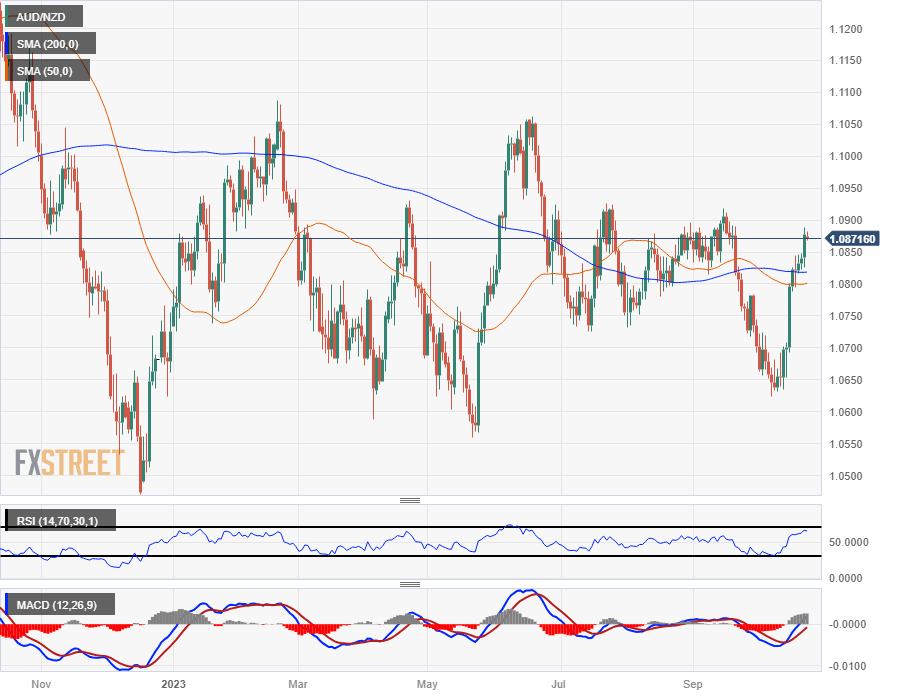

The AUD/NZD has been bound in a rough range for most of 2023, cycling the 1.0800 major handle as the pair consolidates long-term.

Australia CPI Forecast: Core inflation expected to slow in Q3

Early Wednesday sees the latest round of Consumer Price Index (CPI) inflation figures for Australia, with markets broadly expecting an uptick in the headline annualized Monthly Consumer Price Index for September, forecast to print at 5.4% versus the previous month's 5.2%. Core inflation, meanwhile, is expected to show a minor decline, with the Reserve Bank of Australia's (RBA) Trimmed Mean CPI for the year into 3Q expected to slow to 5% from 5.9%.

The AUD/NZD has been rotating around the 200-day SMA for the past five months, and the long-term moving average is currently settling flat just north of 1.0800.

The pair's constrained chart patterns sees the 50-day SMA coiling around the long-run MA as the AUD/NZD struggles to develop any meaningful long-term momentum, and investors will be looking for wider deviations between the Aussie and Kiwi central bank rates to kick the pair back into trend territory.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.