AUD/NZD Price Analysis: grinding against support from the bullish side of 1.0800

- The AUD/NZD continues to grind it out towards the midrange just north of 1.0800.

- The Aussie-Kiwi pairing has been getting a little frothy on the intraday charts.

- Topside momentum goes to the AUD for the time being amidst NZD weakness.

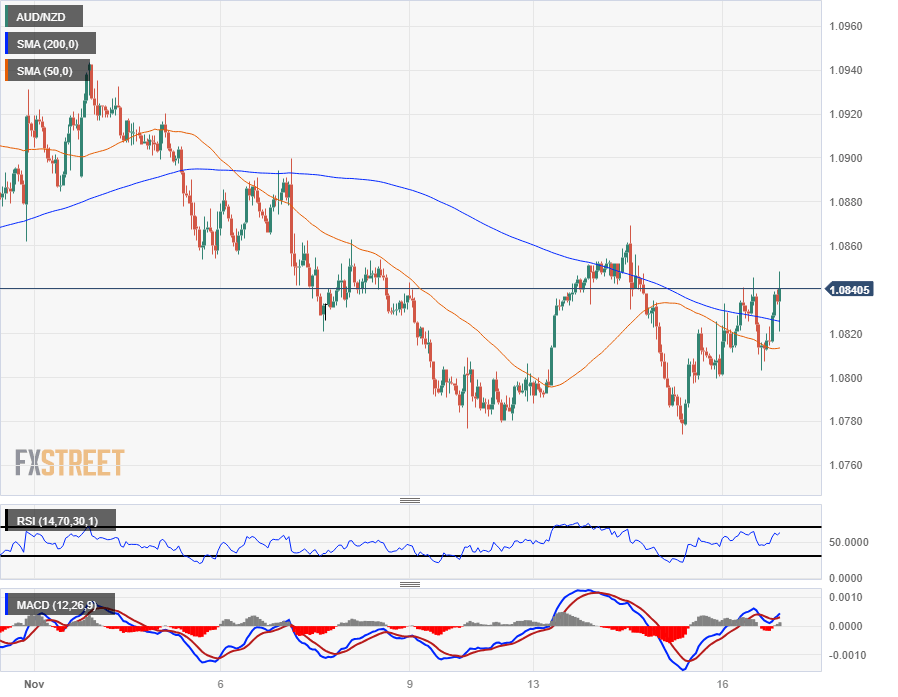

The AUD/NZD is leaning towards the topside on the intraday charts, with hourly candles grasping to climb over the 200-hour Simple Moving Average (SMA) descending into 1.0820. Bids on the pair have been pushing to reclaim the week's peaks near 1.0870.

Near-term momentum has been tilting towards the upside, but not enough to send the 50-hour SMA into a bullish stance, and the moving average is hesitating on the bearish side of the 200-hour SMA.

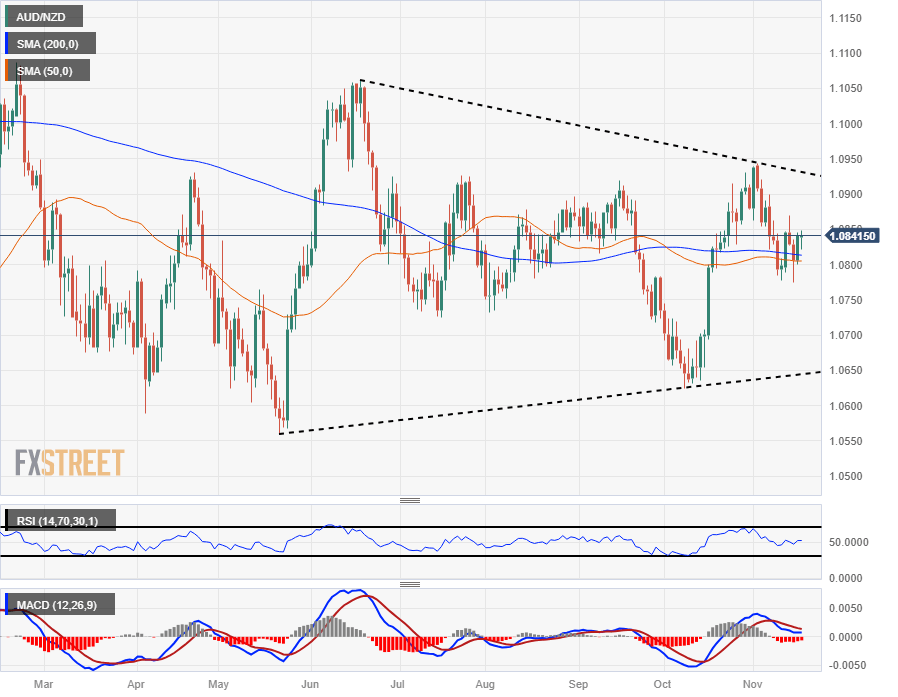

On the daily candlesticks, the AUD/NZD has been churning around the 200- and 50-day SMAs, which are similarly grinding sideways while stacked bearishly, with the 50-day SMA paddling just south of the longer moving average.

The pair's last two price level breaks in either direction resulted in failed breakouts, and constraining volatility peaks on both sides of the bids is setting up a technical breakout that could develop legs with firm chart support forming up in either direction.

Directional momentum remains low for the meantime, and technical indicators have ground to a halt in their midranges. The Relative Strength Index (RSI) is cycling the 50.0 non-directional level and the Moving Average Convergence-Divergence (MACD) has its long-run histogram bleeding towards the middle ground.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.