AUD/NZD Price Analysis: Extends pullback from monthly resistance as Aussie inflation disappoints

- AUD/NZD takes offers to refresh intraday low after downbeat Australia inflation.

- Australia’s headline CPI, RBA Trimmed Mean CPI and Monthly CPI all print softer figures in the latest readings.

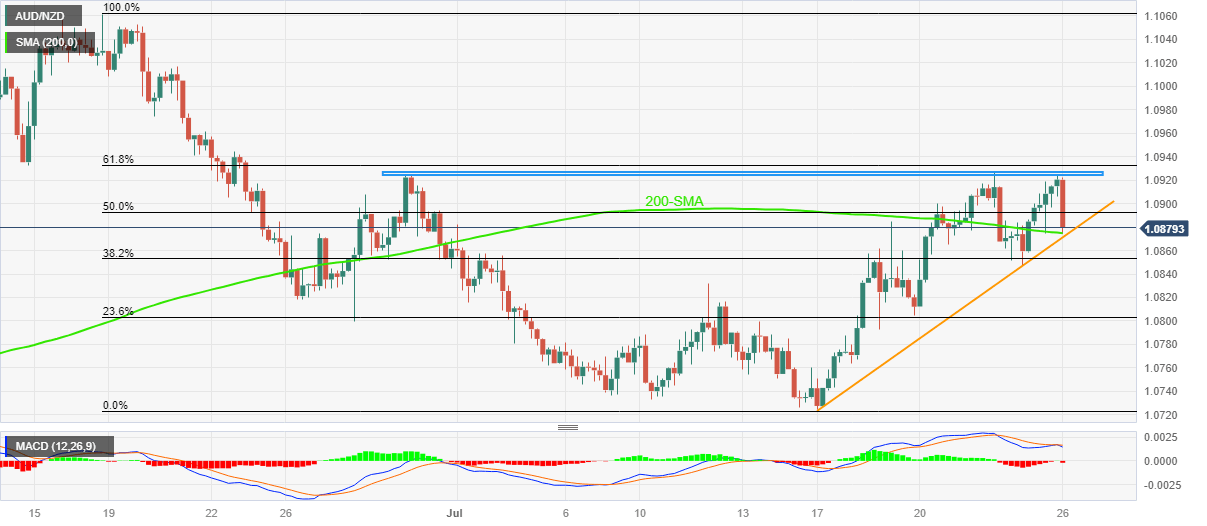

- 200-SMA, one-week-old rising support line test sellers despite bearish MACD signals.

- Bulls need clear break of 1.0945 to retake control.

AUD/NZD portrays the market’s disappointment with Australian inflation data while declining to 1.0880 early Wednesday. In doing so, the exotic pair extends reversal from a one-month-old horizontal resistance while poking the 200-SMA of late.

That said, Australia’s Consumer Price Index (CPI) for the second quarter (Q2) of 2023 drops to 0.8% QoQ versus 1.0% expected and 1.4% prior while the Reserve Bank of Australia (RBA) Trimmed Mean CPI came in as 1.0% compared to 1.1% market forecasts and 1.2% prior for the said period. Further, the Monthly CPI matches 5.4% analysts’ expectations for June versus 5.6% prior.

With this, the RBA’s latest pause in the rate hike trajectory gets validation and suggests further hardships for the Australian Dollar (AUD) bulls, especially amid the shift in the sentiment ahead of the Federal Open Market Committee (FOMC) monetary policy meeting announcements.

Technically, the AUD/NZD pair’s inability to cross the multiple hurdles marked since late June around 1.0925 joins the bearish MACD signals to keep the sellers hopeful.

However, the 200-SMA and a one-week-old rising support line, respectively near 1.0875 and 1.0870, prod the AUD/NZD bears. Following that, a quick fall towards the 1.0800 round figure can’t be ruled out.

Meanwhile, an upside break of the aforementioned horizontal resistance line, near 1.0930, isn’t an open ticket for the AUD/NZD buyers as the 61.8% Fibonacci retracement of June-July fall and June 22 swing high, close to 1.0935 and 1.0945 in that order, could challenge the bulls afterward.

AUD/NZD: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.