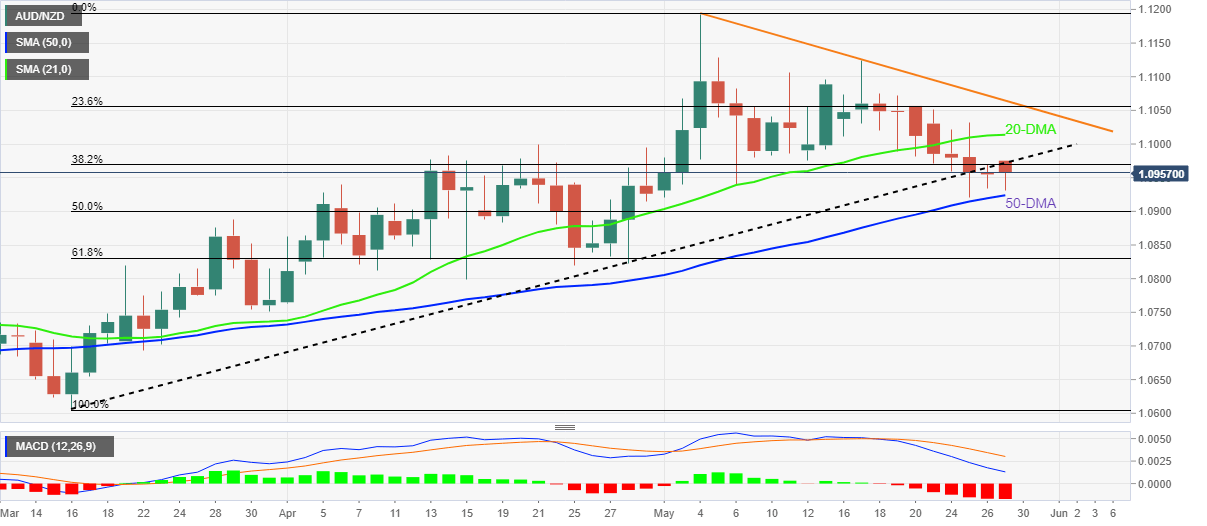

AUD/NZD Price Analysis: Buyers lurk around 50-DMA

- AUD/NZD bounces off intraday low but struggles to reject key support break.

- Bearish MACD signals, sustained trading below 20-DMA keep sellers hopeful.

- Bulls need validation from three-week-old resistance line, 1.0830 appears a tough nut to crack for sellers.

AUD/NZD picks up bids to consolidate intraday losses around 1.0955 during Friday’s Asian session.

In doing so, the cross-currency pair marks another bounce off the 50-DMA. However, the clear downbeat break of the previous support line from mid-March, around 1.0975 by the press time, keeps the bears hopeful.

Also favoring the bearish bias is the MACD conditions and successful trading below the 20-DMA.

That said, the quote’s further weakness needs validation from the 50-DMA level of 1.0920 before declining towards the 1.0830 key support, including the 61.8% Fibonacci retracement (Fibo.) of March-May upside.

On the contrary, an upside break of the support-turned-resistance line, near 1.0975, will direct the AUD/NZD prices towards the 20-DMA level of 1.1015.

However, the pair buyers remain unconvinced until the quote stays below a downward sloping resistance line from early May, close to 1.1065.

AUD/NZD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.