AUD/NZD Price Analysis: Buyers approach 1.1200 inside bearish channel after RBA

- AUD/NZD picks up bids after the RBA’s 0.50% rate hike, extends the previous day’s bounce off two-week low.

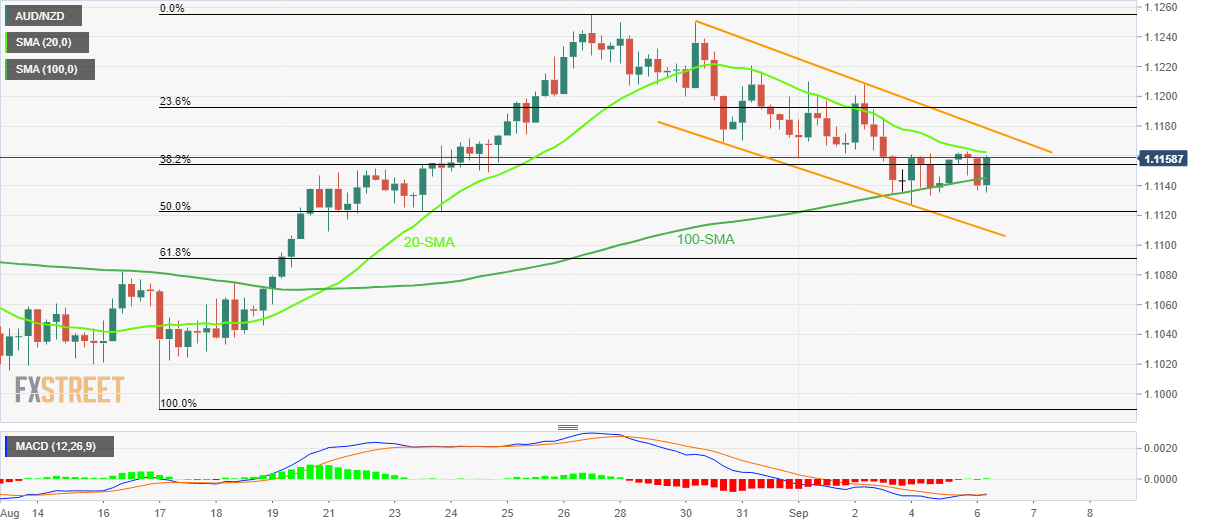

- Impending bull cross on MACD, rebound from the 100-SMA also keep buyers hopeful.

- Sellers can aim for channel’s support, 61.8% Fibonacci retracement level during fresh entry.

AUD/NZD adds to the daily gains around 1.1155 after the Reserve Bank of Australia (RBA) announced the fourth rate increase of 0.50% heading into Tuesday’s European session.

Also read: RBA: Board is committed to doing what is necessary to ensure inflation returns to target

In doing so, the cross-currency pair bounces off the 100-SMA while staying inside a weekly bearish channel.

In addition to the rebound from the 100-SMA, at 1.1145 by the press time, the looming bull cross by the MACD line also signal the further upside of the quote.

However, the 20-SMA guards the pair’s immediate advances near the 1.1165 level before directing AUD/NZD buyers towards the stated channel’s upper line, at 1.1180 as we write.

Should the upside momentum cross the 1.1180 resistance, the odds of its run-up towards the previous monthly high near 1.1255 can’t be ignored.

Alternatively, a clear downside break of the 100-SMA surrounding 1.1145 could drag the quote to the 50% Fibonacci retracement of August 17-26 upside, near 1.1122.

Following that, the lower line of the aforementioned channel and the 61.8% Fibonacci retracement level could entertain the AUD/NZD bears respectively around 1.1110 and 1.1090.

Overall, AUD/NZD is likely to rise further but the upside break of 1.1180 appears necessary.

AUD/NZD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.