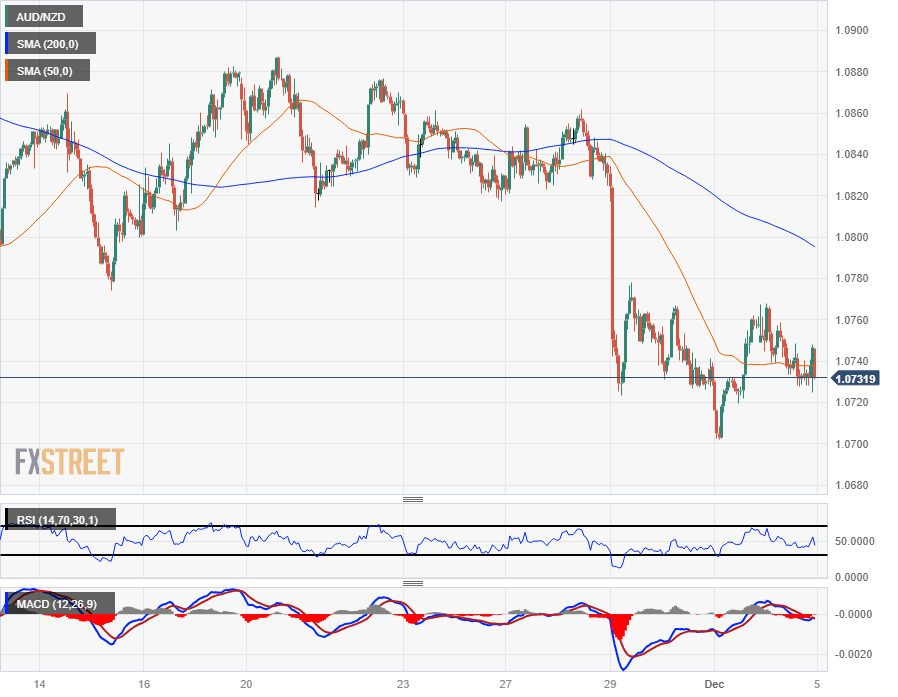

AUD/NZD Price Analysis: Aussie struggles to develop a bounce against Kiwi, stuck near 1.0730

- The AUD/NZD has been bolted to chart territory north of 1.0700 in the near-term.

- The Aussie's tumble last week has seen little paring back as the pair waffles in the midrange.

The AUD/NZD has been stuck near 1.0730 since a backslide from 1.0860 last week, and the Aussie-Kiwi pairing tumbled out of a near-term consolidation range to trade into an entirely new range just north of the 1.0700 handle.

A near-term technical floor is firming up at the 1.0730 price level, and intraday upside swings that fail to generate bullish momentum see a technical ceiling capping off upside price action from 1.0770.

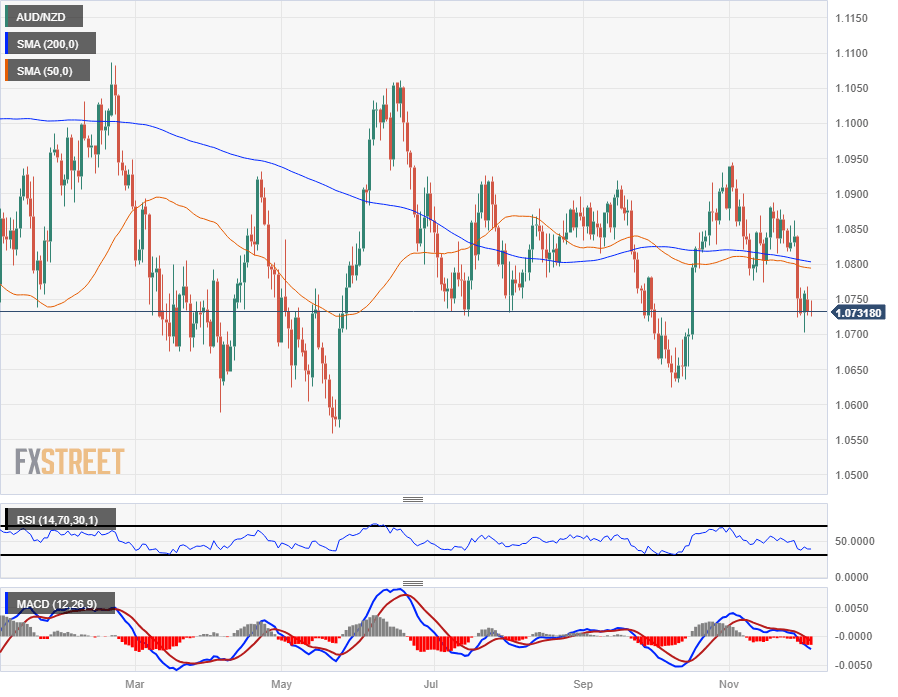

On the daily candlesticks, the AUD/NZD is set to see some technical consolidation before returning to the upside somewhere north of the 200-day Simple Moving Average (SMA), which has been consolidating with the 50-day SMA near the 1.0800 handle since mid-July.

Sideways chart churn has been the name of the game for the AUD/NZD through most of 2023's trading action, and if seller's aren't able to kick in a short extension below 1.0700, bidders will be taking the reigns to send the AUD/NZD back into recent swing highs near 1.0850.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Technical Levels

AUD/NZD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.