AUD/NZD Price Analysis: Aussie rises back above 1.0400, still in danger zone

- Rally of the Aussie post-RBA turns short-lived.

- AUD/NZD hits weekly lows under 1.0400, but then rebounds.

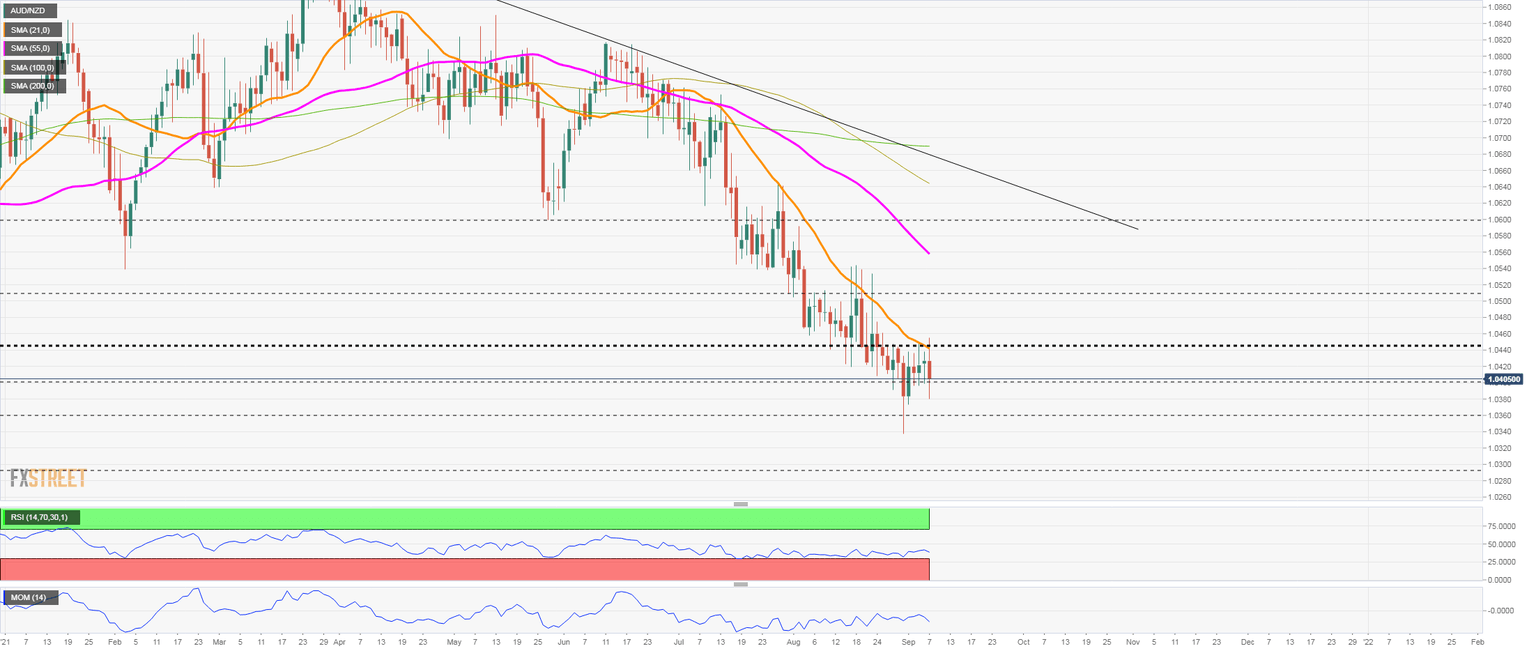

The rebound of the AUD/NZD after the Reserve Bank of Australia meeting was short-lived. The cross then dropped to 1.0380, the lowest since last week. It is hovering around the critical area of 1.0400.

Despite avoiding so far a sharp breakout under 1.0400, technical indicators on the daily chart still favor the downside. A close above 1.0450 would be a positive development for the aussie, suggesting a consolidation ahead with a potential recovery to 1.0500. The next resistance is seen at 1.0510 followed by 1.0540.

While under 1.0450, AUD/NZD seems vulnerable and a consolidation under 1.0400 should target; below the next support stands at 1.0300.

AUD/NZD daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.