AUD/NZD Price Analysis: Aussie looking for a leg up to cap downside

- The AUD/NZD has drifted back, but the Aussie is looking for a foothold.

- The pair's push into fresh highs early this week was met with a sharp correction lower.

- Daily candles look to be firming up a consolidation pattern.

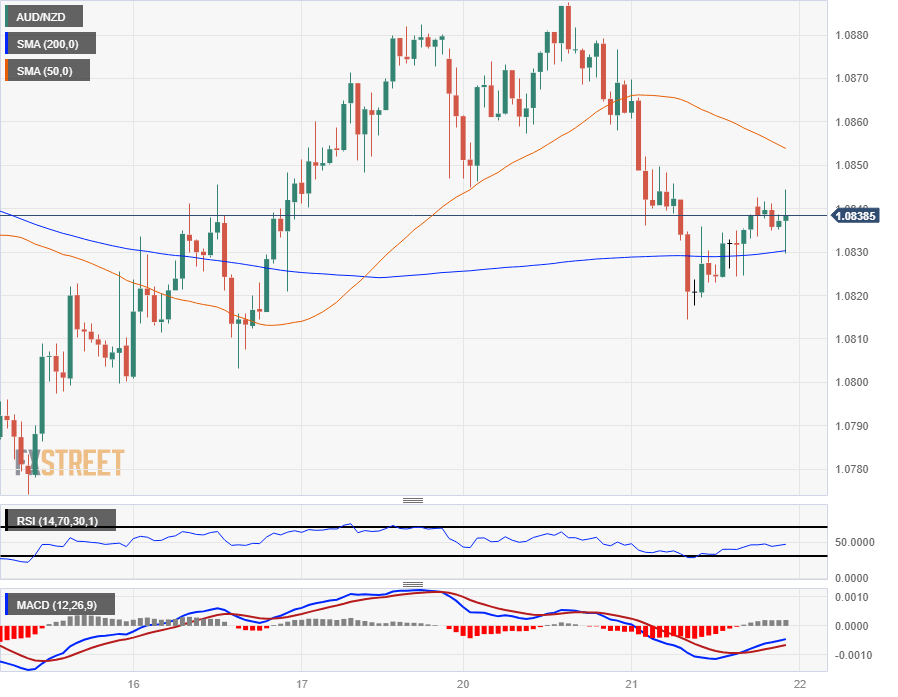

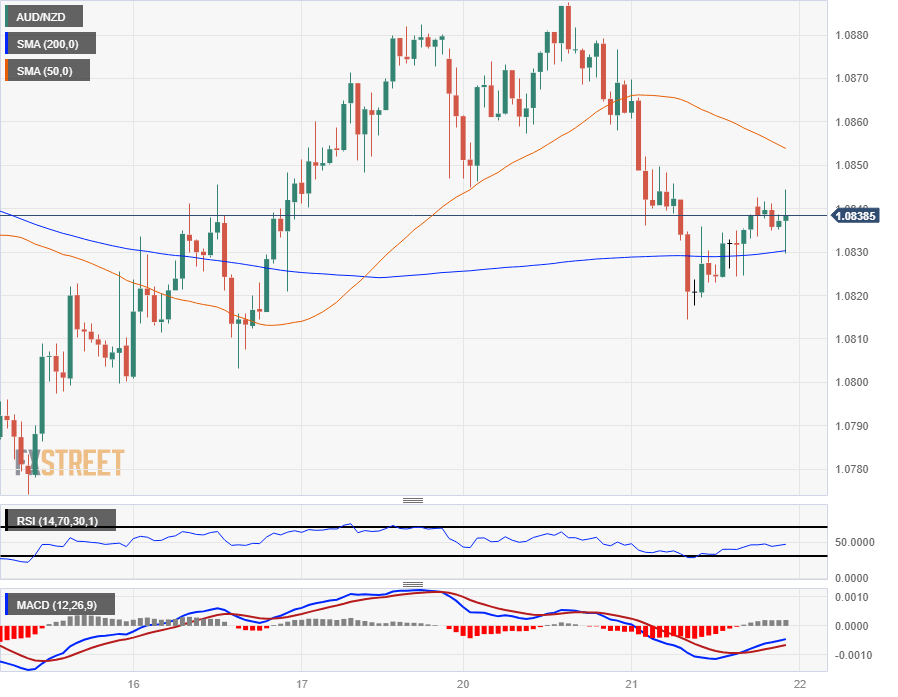

The AUD/NZD kicked off Tuesday's trading with a backslide into 1.0815 from the day's opening bids near 1.0860, extending a pullback from Monday's peak at 1.0887.

The Aussie-Kiwi pair has run into technical support at the 200-hour Simple Moving Average (SMA) and is looking for a bounce, trading near the 1.0830 level.

Tuesday's decline set a new low for the week, and the AUD/NZD heads into Wednesday's market session exposed to further declines as the Aussie struggles to find momentum for a bullish recovery.

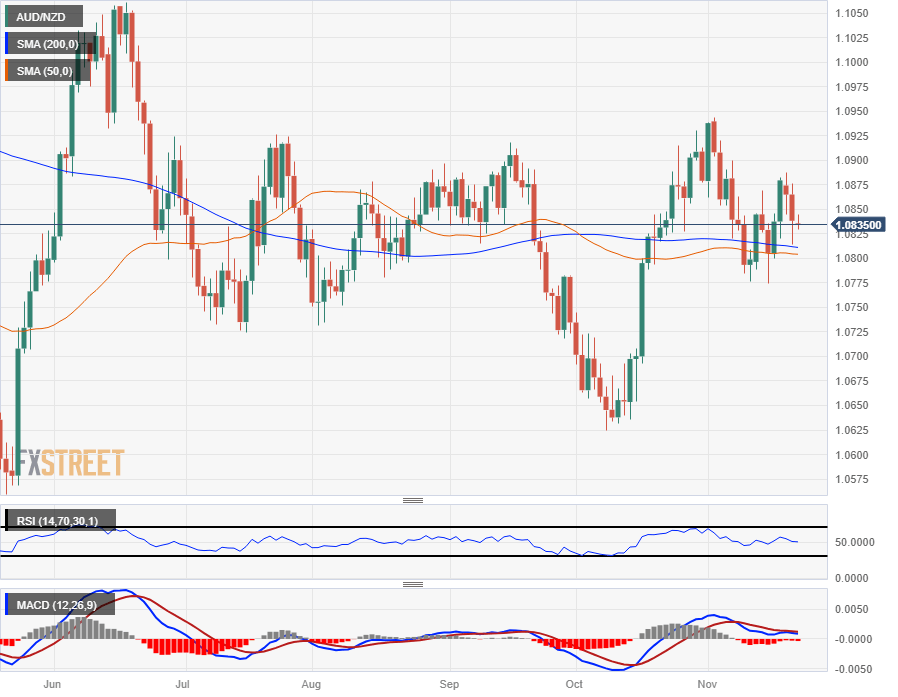

The AUD/NZD has been sticking close to the 200- and 50-day SMAs, which are currently consolidating near the 1.0800 handle, and the pair's long-term momentum appears decidedly bearish, with technical indicators drifting into the midrange.

AUD/NZD Hourly Chart

AUD/NZD Daily Chart

AUD/NZD Daily Chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.