AUD/NZD firmly higher for Friday, into 1.07 as Aussie steps up and Kiwi hesitates

- The AUD/NZD caught a firm bid on Friday, climbing into the 1.0700 handle to close out the trading week.

- The Aussie managed to eke out a new high for the week late in the game, climbing 0.42% for Friday.

- Kiwi traders will get to take first swing at the economic calendar next week with Business NZ's services index.

The Aussie (AUD) came out on top of the two Antipodeans after a week of push-and-pull against the Kiwi (NZD), and the AUD/NZD closes out the Friday trading session testing the 1.0700 major handle.

The Aussie dipped against the Kiwi in the early week, and upside momentum remained constrained until early Thursday's Business NZ Purchasing Manager Index (PMI) for New Zealand came in worse than the previous reading, printing at 45.3 versus the previous 46.1, the worst print for the indicator in over two years.

Coming up on the economic calendar next week will be Business NZ's Performance of Services Index (PSI) in the early Monday market session, which last printed at 47.1.

Following that will be another showing for the Kiwi, with New Zealand's Consumer Price Index (CPI) inflation figures for the third quarter, which is forecast to jump from 1.1% to 2% for the quarter-over-quarter figure and decline from 6% to 5.9% for the annualized reading.

Aussie traders will get their chance when the Reserve Bank of Australia (RBA) drops their latest Meeting Minutes and give investors to take a peek at the RBA's internal dialogue on inflation and growth concerns.

The RBA's minutes are slated to publish early Tuesday at 00:30 GMT.

AUD/NZD Technical Outlook

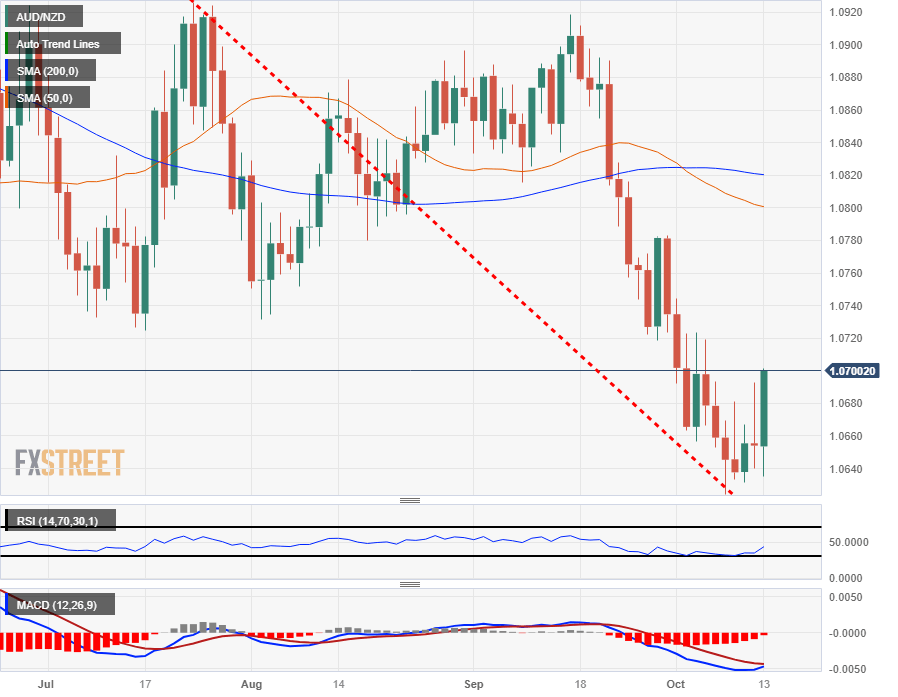

Intraday action for the Aussie-Kiwi pairing has the 50-hour Simple Moving Average making a bullish cross of the 200-hour SMA as near-term median prices accelerate to the topside, and the longer moving average is providing technical support from the 1.0670 level.

Daily candlesticks see the AUD/NZD firmly on the low end in the medium term, with the pair still down over 2% from September's peak of 1.0920 despite Friday's bullish move.

The pair remains firmly planted in bear territory, with price action trading well below the 200-day SMA near 1.0820, and the pair is nearly flat for the year, trading close to 2023's opening bids of 1.0730.

AUD/NZD Daily Chart

AUD/NZD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.