AUD/NZD caught in slow grind lower ahead of RBA rate call

- AUD/NZD drifting into the bottom end after near-term peak at 1.0700.

- RBA due early Tuesday, expected to hold rates steady.

- AUD/NZD tested into its lowest bids since May last week.

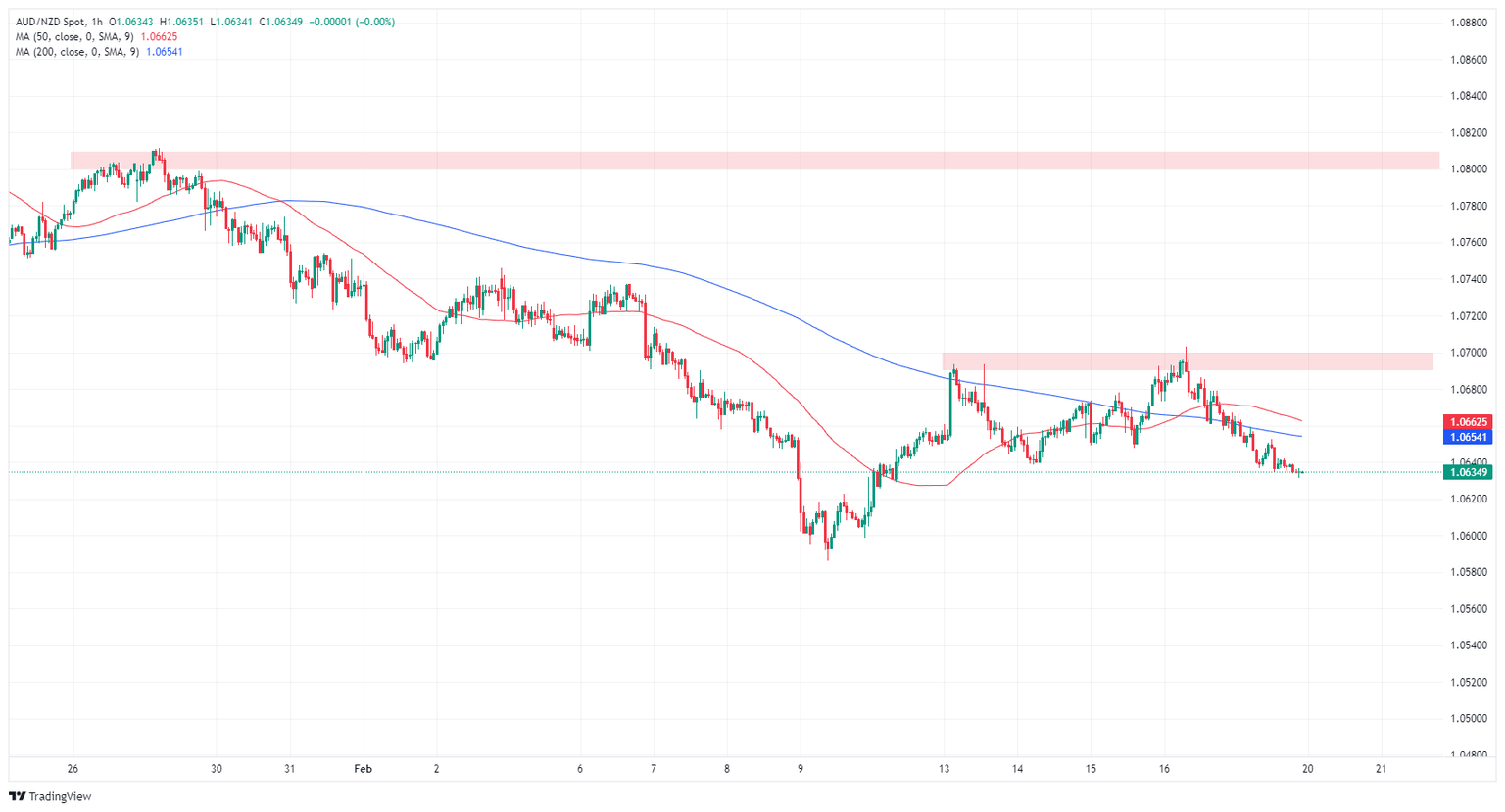

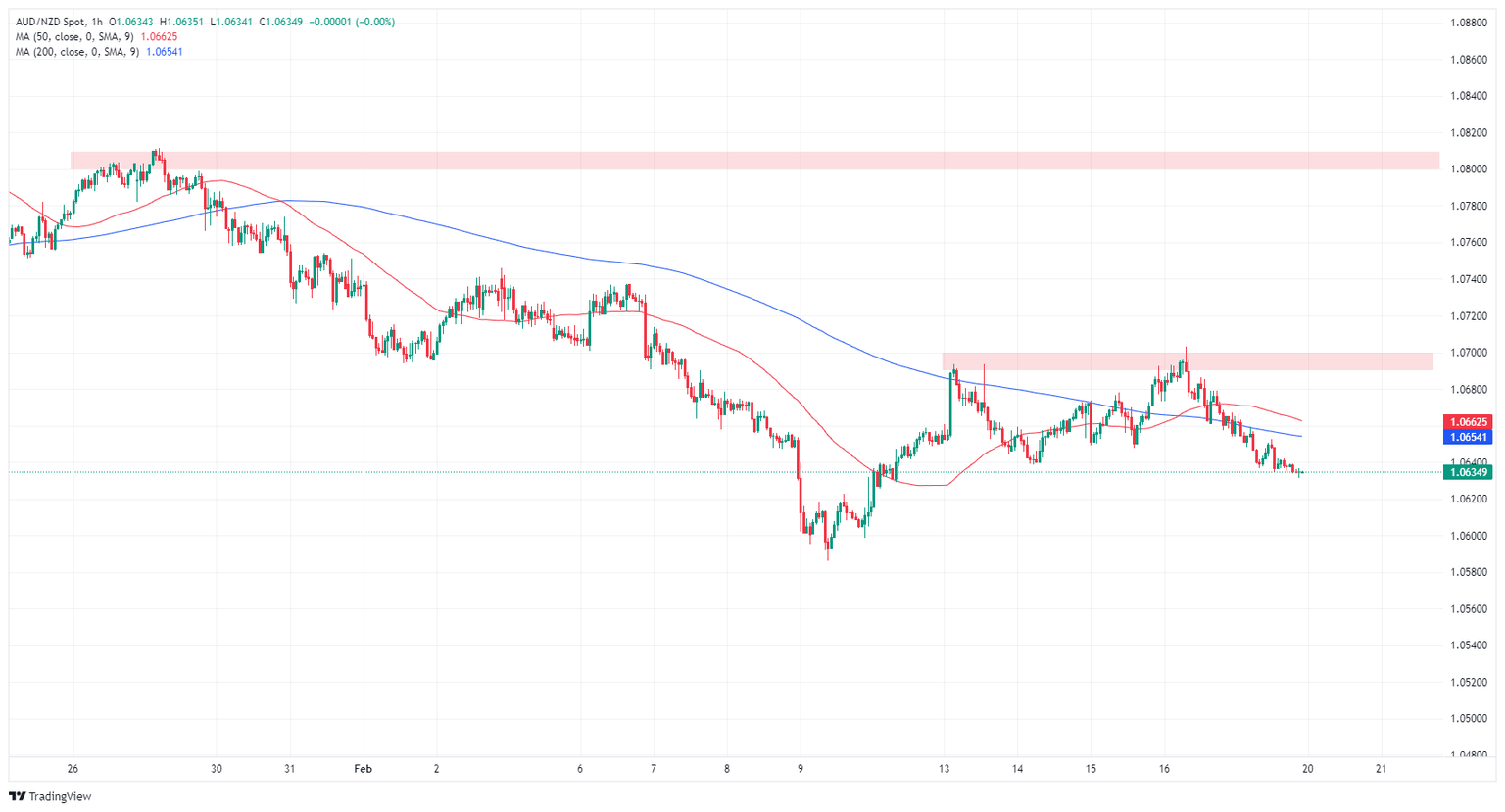

The AUD/NZD is caught in a near-term downside drift ahead of Tuesday’s latest showing from the Reserve Bank of Australia (RBA), and the pair is down around seven-tenths of a percent after peaking near the 1.0700 handle last week.

The pair recently dipped into multi-month lows, testing into its lowest bids since last May and dropping into the 1.0590 region, but bullish momentum has drained out of a limited recovery that sees the pair struggling on the bearish side of a descending 200-hour Simple Moving Average (SMA) dropping into 1.0650.

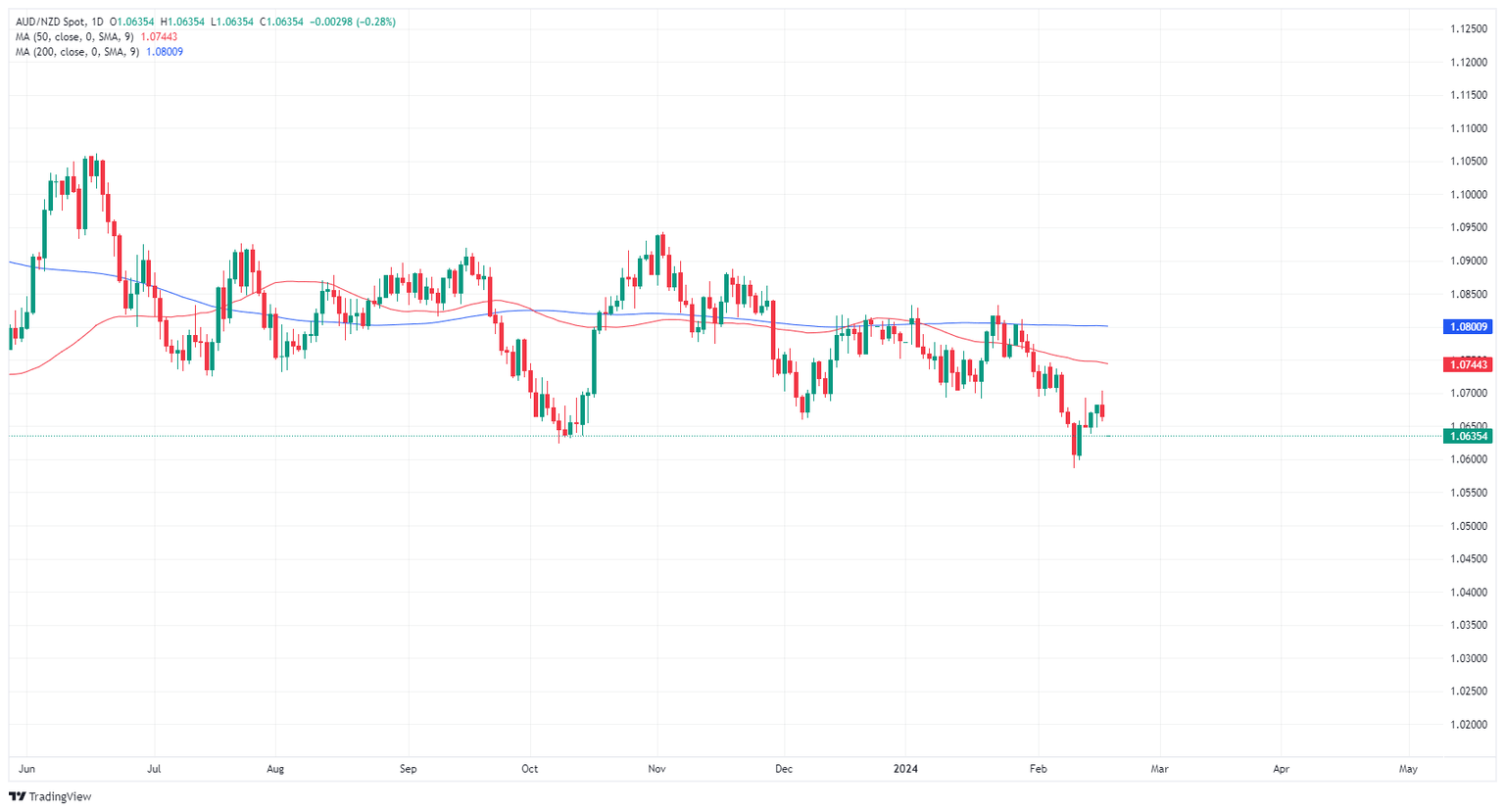

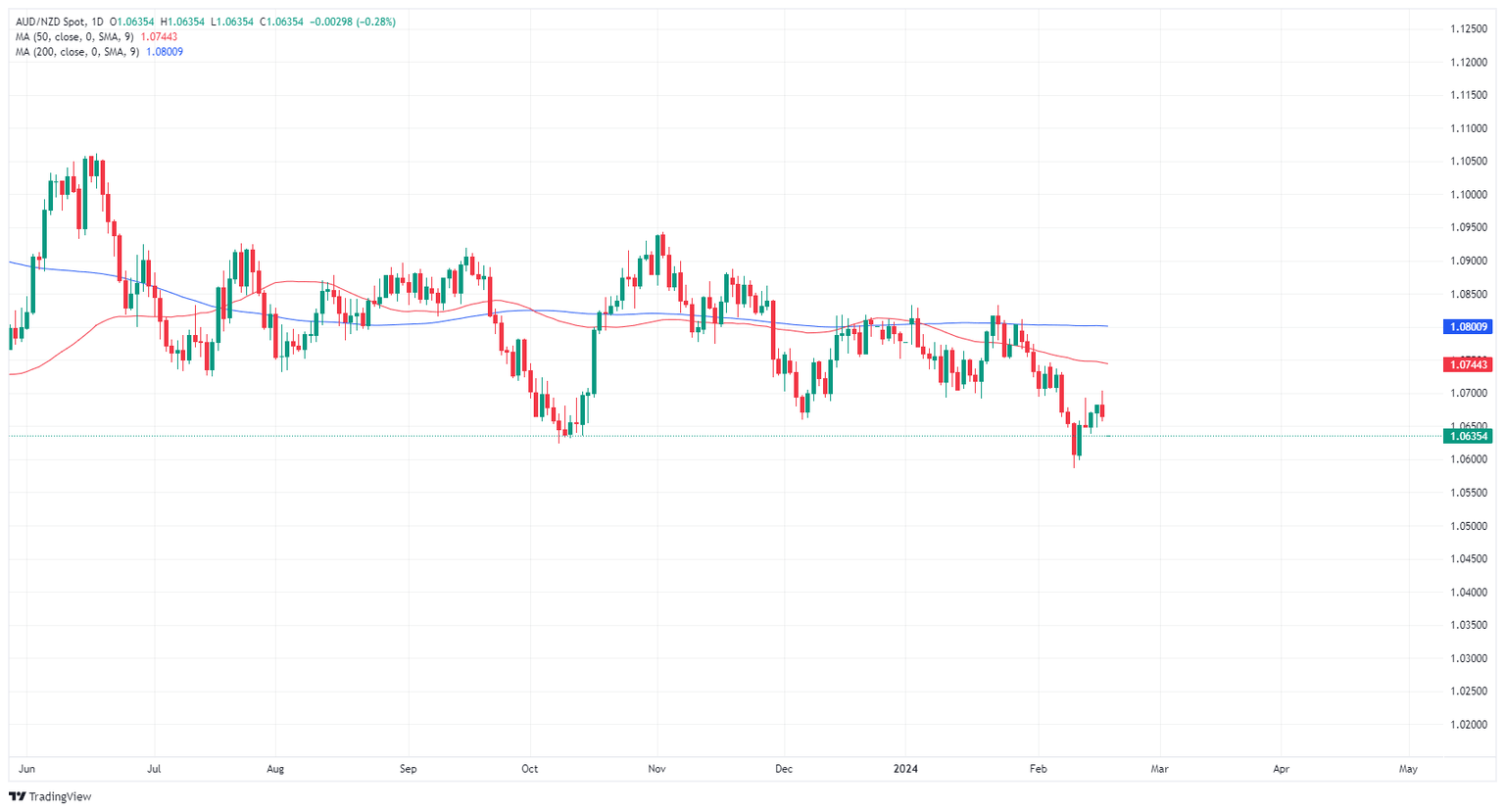

With the AUD/NZD struggling to establish a meaningful recovery, buyers are grasping for a rebound into the 200-day SMA near 1.0800 as daily candles continue to grind into bearish territory in rough sideways action that exposes the pair to rapid drops as the Antipodeans grapple for supremacy.

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.05% | 0.13% | 0.11% | -0.03% | 0.02% | -0.20% | 0.20% | |

| EUR | -0.06% | 0.06% | 0.04% | -0.08% | -0.03% | -0.26% | 0.15% | |

| GBP | -0.11% | -0.09% | -0.04% | -0.14% | -0.09% | -0.32% | 0.07% | |

| CAD | -0.09% | -0.04% | 0.02% | -0.12% | -0.07% | -0.29% | 0.10% | |

| AUD | 0.03% | 0.08% | 0.16% | 0.14% | 0.05% | -0.18% | 0.23% | |

| JPY | -0.01% | 0.03% | 0.13% | 0.09% | -0.05% | -0.22% | 0.18% | |

| NZD | 0.20% | 0.25% | 0.33% | 0.32% | 0.18% | 0.22% | 0.40% | |

| CHF | -0.21% | -0.16% | -0.07% | -0.10% | -0.24% | -0.19% | -0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

AUD/NZD hourly chart

AUD/NZD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.