AUD/JPY slumps further as Aussie sheds weight on the week

- AUD/JPY extends a decline, testing back below 97.00.

- Australian Trade Balance climbs after Imports steeply contract.

- Aussie home lending growth falls back, Chinese CPI contracts further.

The AUD/JPY extended declines into a second day on Friday, with the Aussie (AUD) shedding weight against the Japanese Yen (JPY) with broader markets bidding up the Yen with the AUD set to round out the week’s trading as the single worst performer of the major currency bloc.

The AUD/JPY is set to close in the red for the fourth of the last five consecutive trading days as Australian economic data continues to miss the mark. Australian Retail Sales beat expectations on a seasonally-adjusted basis early Wednesday, helping to keep the AUD bid into the midweek, but a steep decline in Australian Imports leading to a surprise buildup in the Aussie Trade Balance swamped out AUD bulls on Thursday, wit the downtrend continuing on Friday after Australian Investment Lending for Homes declined to 1.9% MoM in November compared to October’s 4.9% (revised down slightly from 5.0%).

China’s annualized Consumer Price Index (CPI) beat market expectations on Friday, but still contracted in December compared to the same month a year prior, declining 0.3% compared to November’s -0.5% YoY decline, slipping below the median market forecast of a -0.4% contraction.

Japan’s Current Account grew less than expected on Friday, printing at ¥1,925.6 billion in November versus October’s print of ¥2,582.8 billion. Markets were hoping for a final reading of ¥2,385.1 billion.

Next week will see Australian Westpac Consumer Confidence for January which last grew by 2.7%, as well as Japan’s Producer Price Index (PPI) figures for December. Australian Securities Inflation follows closely behind, and early Wednesday will see Gross Domestic Product (GDP), Industrial Production, and Retail Sales figures from China.

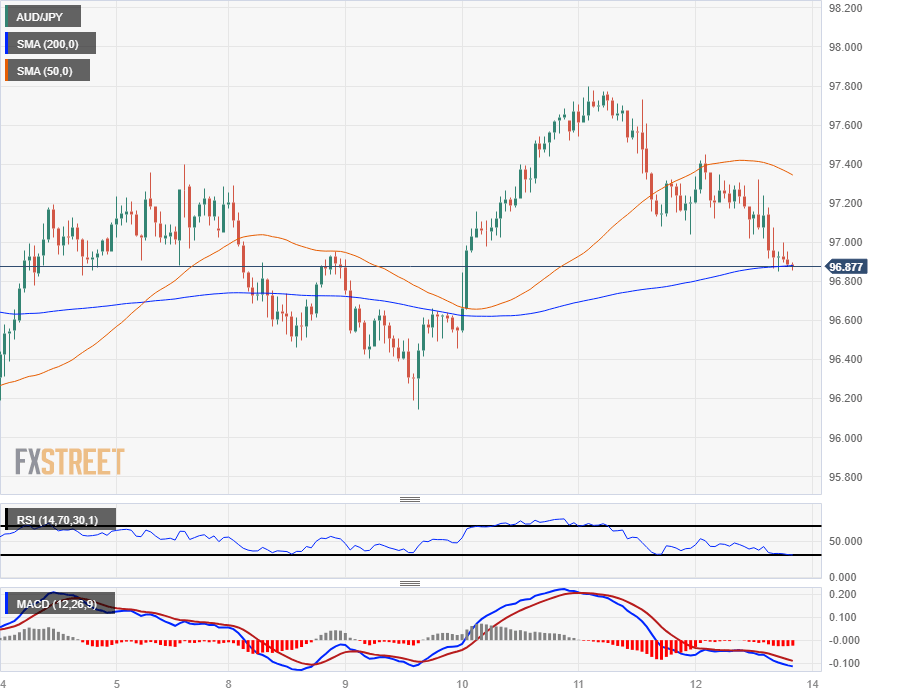

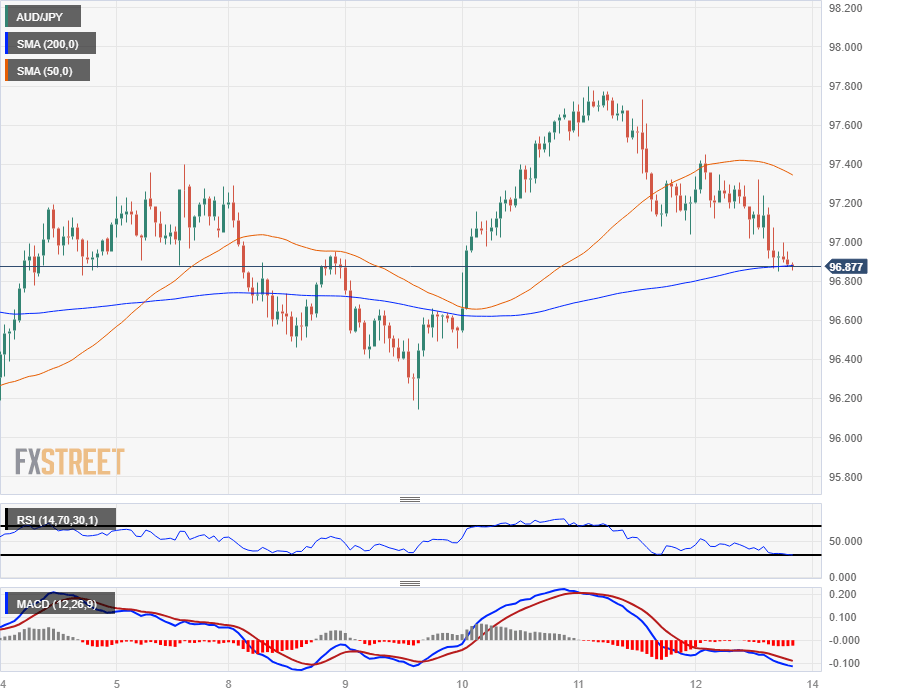

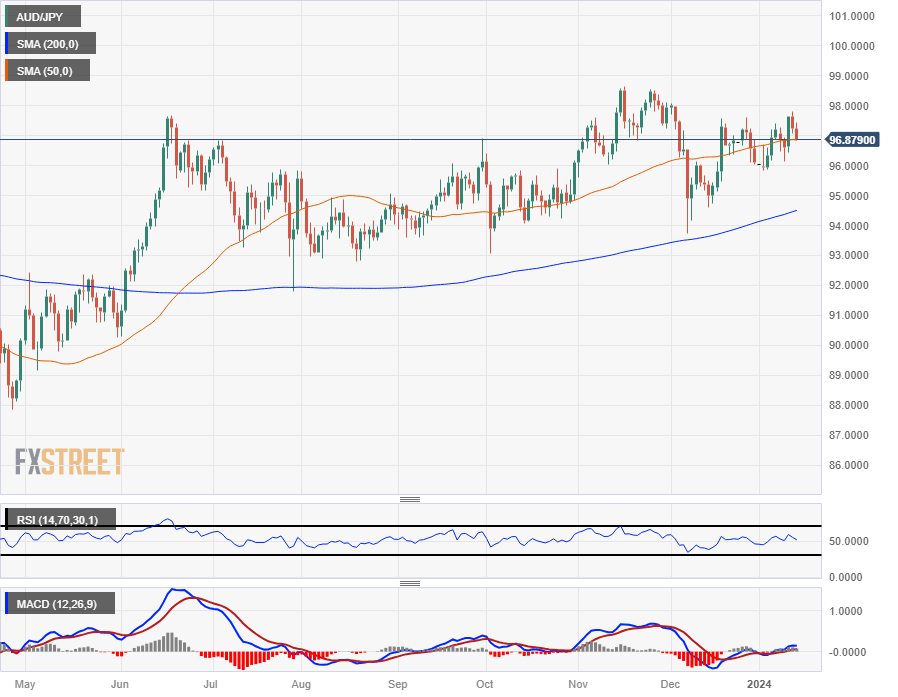

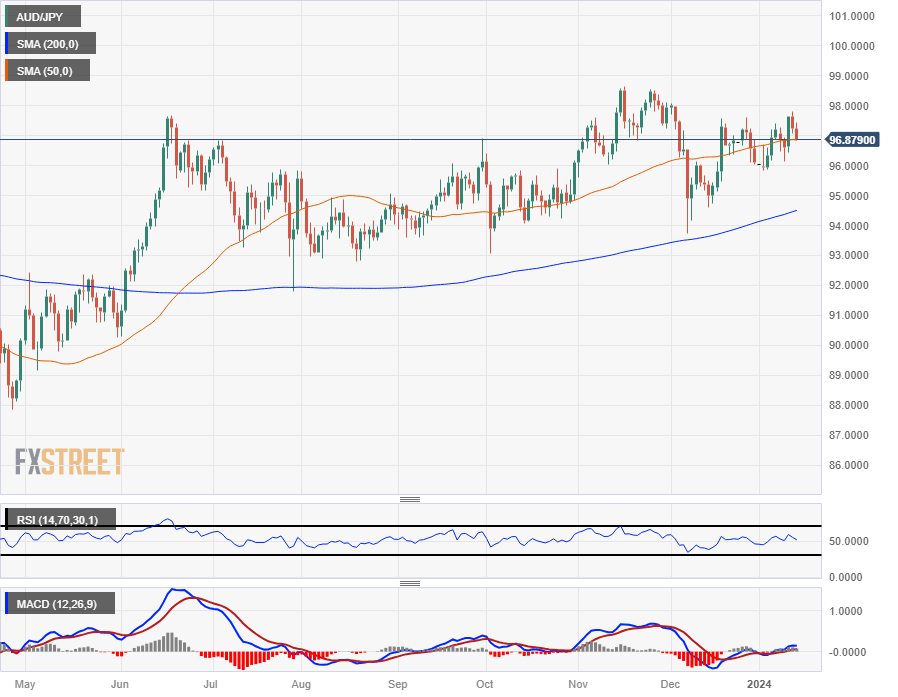

AUD/JPY Technical Outlook

The Aussie’s dip against the Japanese Yen on Friday sends the AUD/JPY falling back into the 200-hour Simple Moving Average (SMA) near 96.90, and the pair is at risk of further entrenching into a medium-term consolidation pattern that has plagued the AUD/JPY since November.

Daily candlesticks have been pinned to the 50-day SMA for close to six months as the AUD/JPY struggles to develop meaningful momentum, buoyed by a 200-day SMA rotating higher into 94.50.

The pair hasn’t claimed any meaningful territory above 98.00 despite breaking above the key handle several times since September of 2022 as bulls struggle to develop momentum.

AUD/JPY Hourly Chart

AUD/JPY Daily Chart

AUD/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.