- AUD/JPY attracts heavy selling following the release of softer domestic GDP growth figures.

- A slightly oversold RSI on the daily chart prompts intraday short covering around the cross.

- Bets for an early RBA rate cut and December BoJ rate-hike expectations should cap the upside.

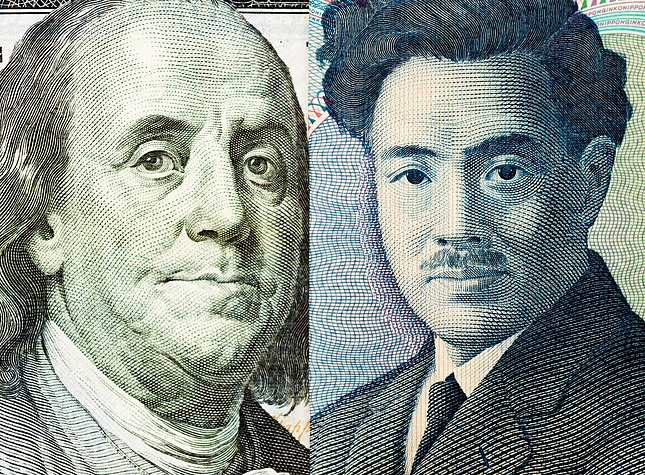

The AUD/JPY cross dropped to its lowest level since September 18 during the Asian session on Wednesday as softer Australian GDP print lifted bets for an early interest rate cut by the Reserve Bank of Australia (RBA). Moreover, expectations that the Bank of Japan (BoJ) will hike interest rates again in December contribute to the Japanese Yen's (JPY) relative outperformance and exert additional pressure on the currency pair.

Spot prices, however, managed to rebound over 70 pips from sub-96.00 levels and currently trade around 96.70, down 0.20% for the day. The Relative Strength Index (RSI) on the daily chart is flashing slightly oversold conditions and turns out to be a key factor that prompts some short-covering around the AUD/JPY cross. That said, the technical setup warrants caution before positioning for any further gains.

Last week's breakdown below the 98.00 round figure was seen as a key trigger for bearish traders. Furthermore, oscillators on the daily chart are holding deep in negative territory. This, in turn, suggests that any subsequent move up could be seen as a selling opportunity ahead of the 97.00 mark and cap the AUD/JPY cross near the 97.50 horizontal barrier. The latter might now act as a key pivotal point for short-term traders.

On the flip side, the 96.00 round figure might continue to offer some support. A convincing break and acceptance below the said handle will reaffirm the negative outlook and pave the way for deeper losses. The AUD/JPY cross might then slide to the next relevant support near the 95.30 region en route to the 95.00 psychological mark. The downfall could eventually drag spot prices to the 94.45-94.40 horizontal support and the 94.00 mark.

AUD/JPY daily chart

Economic Indicator

Gross Domestic Product (YoY)

The Gross Domestic Product (GDP), released by the Australian Bureau of Statistics on a quarterly basis, is a measure of the total value of all goods and services produced in Australia during a given period. The GDP is considered as the main measure of Australian economic activity. The YoY reading compares economic activity in the reference quarter compared with the same quarter a year earlier. Generally, a rise in this indicator is bullish for the Australian Dollar (AUD), while a low reading is seen as bearish.

Read more.Last release: Wed Dec 04, 2024 00:30

Frequency: Quarterly

Actual: 0.8%

Consensus: 1.1%

Previous: 1%

Source: Australian Bureau of Statistics

The Australian Bureau of Statistics (ABS) releases the Gross Domestic Product (GDP) on a quarterly basis. It is published about 65 days after the quarter ends. The indicator is closely watched, as it paints an important picture for the economy. A strong labor market, rising wages and rising private capital expenditure data are critical for the country’s improved economic performance, which in turn impacts the Reserve Bank of Australia’s (RBA) monetary policy decision and the Australian dollar. Actual figures beating estimates is considered AUD bullish, as it could prompt the RBA to tighten its monetary policy.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs above 1.0400 on broad USD weakness

EUR/USD gathers bullish momentum and trades above 1.0400 on Monday. The US Dollar remains under heavy selling pressure and helps the pair push higher as risk mood improves on news of US President-elect Donald Trump considering tariffs that would only cover critical imports.

GBP/USD surges above 1.2500 as risk flows dominate

GBP/USD extends its recovery from the multi-month low it set in the previous week and trades above 1.2500. The improving risk mood on easing concerns over Trump tariffs fuelling inflation makes it difficult for the US Dollar (USD) to find demand and allows the pair to stretch higher.

Gold rises toward $2,650 as US yields edge lower

Gold regains its traction and rises to the $2,650 area after dropping toward $2,620 earlier in the day. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% heading into the American session, helping XAU/USD hold its ground.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important Nonfarm Payrolls (NFP) stand out, but a look at the Federal Reserve (Fed) and the Chinese economy is also of interest.

The week ahead: Three things to watch

Analysts believe that American exceptionalism will persist in 2025, and the first trading week of the year would suggest that investors are also betting on another strong year for the US.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.