- The daily chart portrays the cross-currency pair in consolidation as bulls eye 95.00.

- Short term, the AUD/JPY uptrend remains in charge, with bulls eyeing 95.00.

The Australian Dollar (AUD) exchanges hands near the weekly highs vs. the Japanese Yen (JPY(, but remains trading sideways amidst the lack of clear catalysts that boost or undermine the former. As Wednesday’s Asian session begins, the AUD/JPY is trading at 94.48, down by 0.02%.

AUD/JPY Price Analysis: Technical outlook

The daily chart depicts the pair as neutral to upward based, capped on the upside by the September 5 swing high of 94.71. If the pair breaks that level, the next resistance would be the 95.00 figure, followed by the July 25 swing high at 95.85. On the downside, the AUD/JPY finds support at the top of the Ichimoku Cloud (Kumo) at 94.20. A breach of the latter, the pair could edge toward the September 8 low of 93.58 before dropping toward the August 18 low of 92.78.

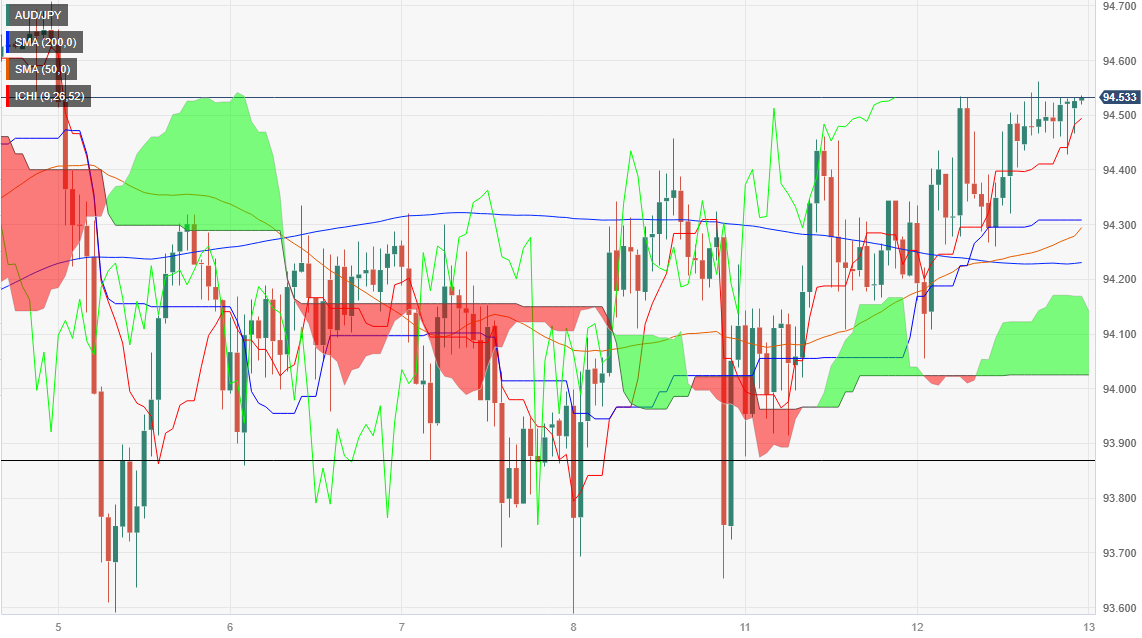

The AUD/JPY hourly chart depicts the pair consolidating around the weekly highs. Although buyers are in charge, they would need a decisive break of the September 4 high at 94.52, followed by the August 31 high at 94.93, before testing 95.00. On the downside, the pair’s first support would be the Tenkan-Sen at 94.48; once cleared, the next support would be the Kijun-Sen at 94.30, followed by the psychological 94.00 figure.

AUD/JPY Price Action – Daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD soars past 1.1200 as China's tariffs confirmed at 145%

EUR/USD soared beyond 1.1200 amid headlines confirming the latest round of tariffs, levies on Chinese imports reached 145%. Wall Street collapses amid renewed concerns that Trump's policies will hit the American economy. Soft US inflation data released earlier in the day adds to the broad US Dollar's weakness.

GBP/USD closes in to 1.3000 on renewed USD selling

GBP/USD resumed its advance and nears the 1.3000 mark, as speculative interest resumed US Dollar selling. Softer than anticipated US CPI figures and persistent tensions between Washington and Beijing over trade weigh on the American currency and Wall Street.

Gold resumes record rally, reaches $3,175

Gold extended its record rally on fresh tariff-related headlines, trading as high as $3,175 a troy ounce in the American session. The White House confirmed 35% levies on Mexico and Canada, 145% on Chinese imports, resulting in a fresh round of USD selling and pushing XAU/USD further up.

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.