AUD/JPY Price Analysis: Trapped between the 81.00-70 range

- The AUD/JPY advances for the first day out of the last three, up some 0.09%.

- A risk-off market mood keeps investors flowing through safe-haven assets, thus favoring the Japanese yen.

- The AUD/JPY is downward biased, but the price action is under consolidations as portrayed by the last two trading days.

Despite the financial markets' risk-off mood, the Australian dollar snaps three consecutive days of losses advances some 0.09%. At the time of writing, the AUD/JPY is trading at 81.47.

Market participants are getting ready for the Federal Reserve to unveil its first monetary policy statement of the year. Investors have already priced in a 25 bps rate hike in the March meeting, but the questions that remain to be answered by the Fed are the pace of the Quantitative Tightening (QT) and when it will start. Alongside the uncertainty of the US central bank tightening, geopolitical events keep the USD and the JPY on the right foot, to the detriment of risk-sensitive currencies.

The conflict between Ukraine and Russia has been escalating in the last week. The US Department of Defense maintains 8,500 American troops on heightened alert and could be deployed if Russia invades Ukraine.

On Tuesday, the AUD/JPY remained in the 81.05-81.78 range, seesawing around the 50-hour simple moving average (SMA), with no apparent bias, trapped around the latter and the 100-hour SMA at 81.83.

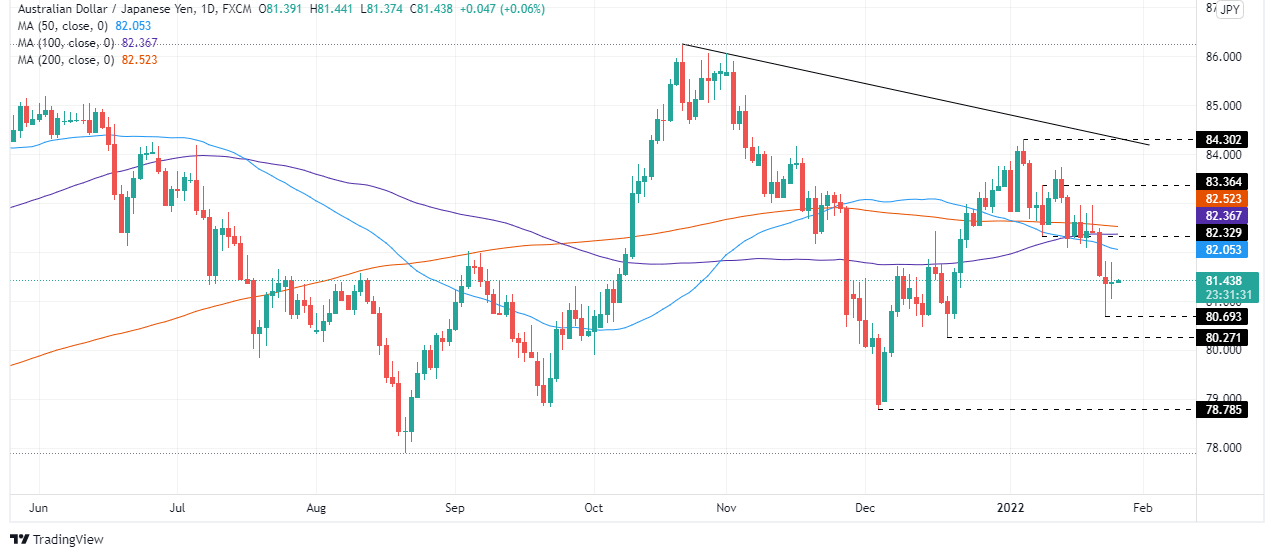

AUD/JPY Price Forecast: Technical outlook

From a technical perspective, Monday's AUD/JPY price action witnessed a jump from the YTD lows around 80.69, which pushed the pair above the 81.00 handle, courtesy of the recovery of the US stock market by the end of the day. That said, on Tuesday, a doji emerged, which could be the signal of a pause of the downtrend or might be an early signal of a reversal candle pattern.

To the upside, the AUD/JPY first resistance level would be the 50-day moving average (DMA) at 82.05. A breach of the latter would expose the confluence of the January 10 daily low previous support-turned-resistance and the 100-DMA in the 82.33-37 range, that once broken, would give way for a test of the 200-DMA at 82.52.

On the flip side, the first support would be 81.00. A break under that level will keep bears in control and will open the door for further gains. The next demand area would be the January 24 daily low at 80.69, followed by December 20, 2021, daily low at 80.27.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.