AUD/JPY Price Analysis: Sellers have a bumpy road beyond 83.80

- AUD/JPY consolidates the heaviest losses in over a week.

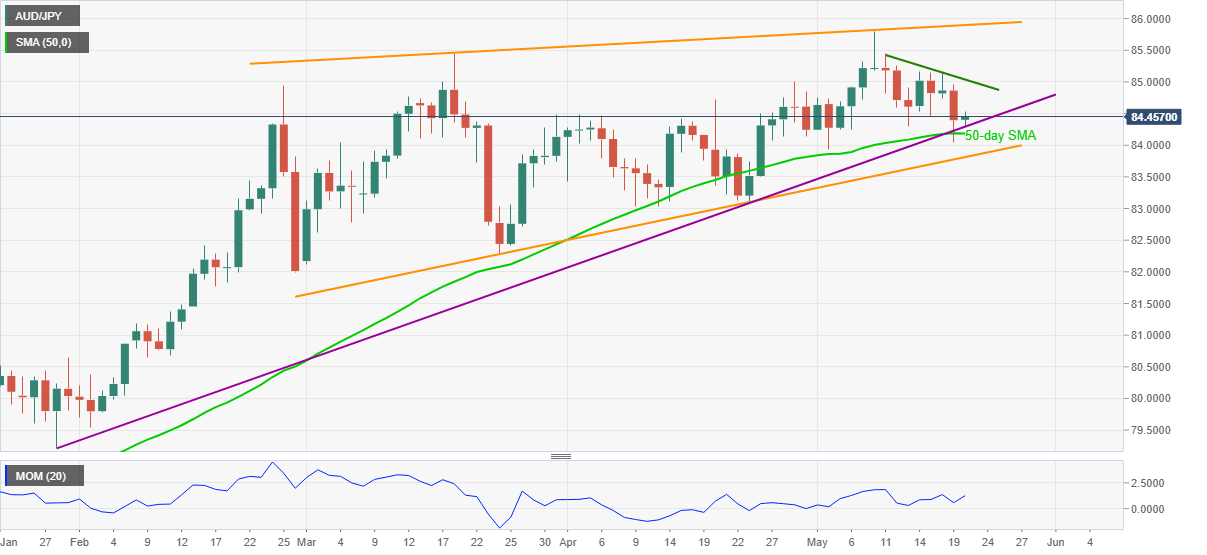

- Four-month-old support line, 50-day SMA tests short-term sellers inside rising wedge.

- Descending trend line from May 11 guards immediate upside.

- Momentum uptick, nearness to the key support probe bears.

AUD/JPY refreshes intraday top with 84.53, up 0.10% around 84.48 while writing, as the quote consolidates the previous day’s losses during Thursday’s Asian session. The pair awaits key Aussie employment data for fresh impulse.

Read: Australian Employment Preview: End of JobKeeper wage subsidy impedes labor market recovery

However, the quote’s bounce off a multi-day-old support line near 84.30, not to forget the refrain from breaking the 50-day SMA level of 84.18, keep buyers hopeful.

Even if the quote breaks 84.18, the 84.00 threshold and lower line of a two-month-long rising wedge bearish formation near 83.80 raise bars for the AUD/JPY sellers’ entry.

Meanwhile, corrective pullback needs to cross a one-week-old resistance line near 85.00 before directing buyers toward the rising wedge’s resistance line close to 85.90.

Also acting as an upside barrier is the 86.00 round figure and early January 2018 low near 87.20.

AUD/JPY daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.