AUD/JPY Price Analysis: Prints a new 7-year high around 95.60s

- The AUD/JPY reached a seven-year-old new high at 95.66, but it retraced some as the Asian Pacific session began.

- Despite verbal intervention by the Japanese Minister of Finance, most crosses rose against the battered Japanese yen.

- AUD/JPY Price Forecast: Upward biased, but oscillators approach overbought conditions.

The Australian dollar extends its rally against the Japanese yen, taking advantage of a dovish Bank of Japan (BoJ), despite comments from the Japanese Finance Minister Suzuki. At the time of writing, the AUD/JPY is trading at 95.48.

On Tuesday, the Minister of Finance Suzuki said that a weaker yen brought more demerit than merit and emphasized that they would continue monitoring the FX market with a sense of vigilance. Nevertheless, market participants widely ignored his comments, as the USD/JPY rose 1.49%, the EUR/JPY gained 1.55%, and the AUD/JPY rallied 1.83%.

AUD/JPY Price Forecast: Technical outlook

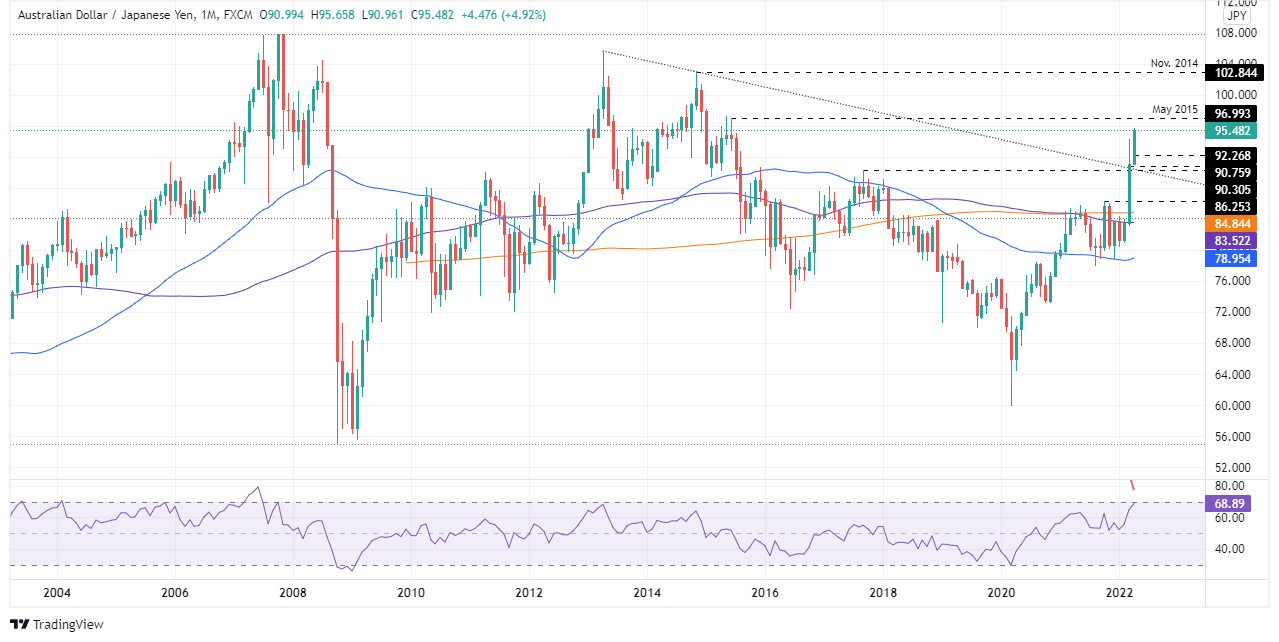

The AUD/JPY monthly chart depicts the pair as upward biased, further confirmed by the break of a nine-year-old downslope trendline in March. Nevertheless, the steepness of the rally is beginning to show on oscillators indicators, like the Relative Strength Index (RSI), which illustrates an almost vertical move towards overbought conditions, though still short at 68.87.

To the upside, the AUD/JPY’s first resistance would be May 2015 highs around 97.30. Once cleared, the next resistance would be the 100.00 mark, and then the November 2014 highs near 102.84. On the flip side, the AUD/JPY first support would be the abovementioned downslope trendline around the 90.50-70 area. A breach of the latter would pave the way for further losses. The following support would be the October 2021 highs around 86.25 and then the 200-month simple moving average (SMA) at 84.84.

Key technical levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.