AUD/JPY Price Analysis: Pokes 93.50 support on downbeat Aussie Employment Change

- AUD/JPY sellers attack a two-week-old support line on downbeat Australia employment data.

- Australia’s Employment Change marked surprise slump in July, Unemployment Rate eased.

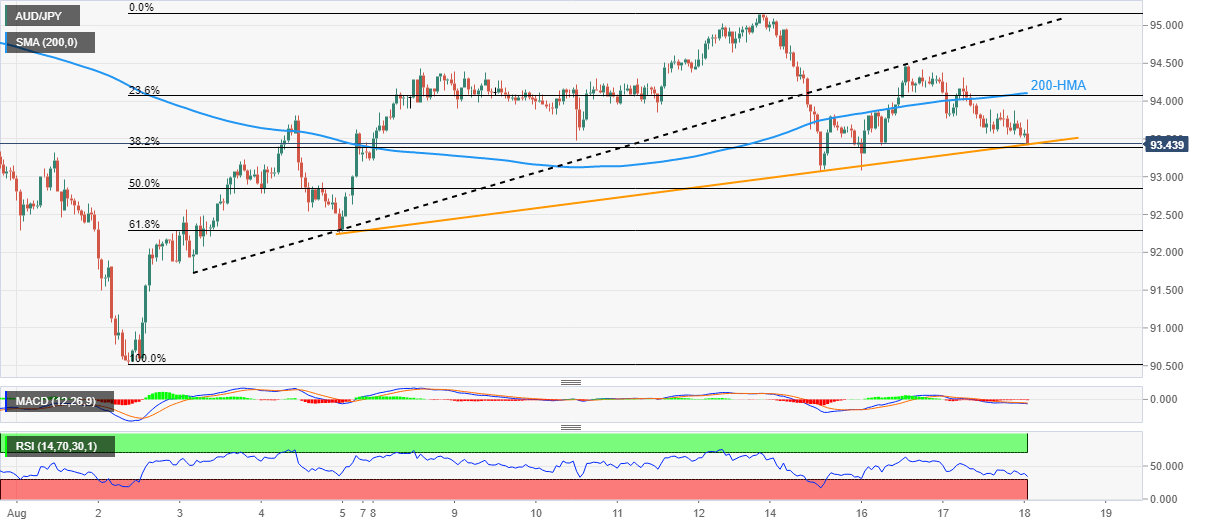

- MACD, RSI suggest sluggish conditions, which in turn challenge bears.

- 200-HMA, previous support line restricts immediate upside.

AUD/JPY remains pressured near 93.50 as sellers attack a fortnight-long support line during Thursday’s Asian session. In doing so, the cross-currency pair holds onto the previous day’s losses but maintains the weekly negative by the press time.

Australia’s headline Employment Change dropped to -40.9K versus 25K expected and 88.4K prior while Unemployment Rate eased to 3.4% versus 3.5% expected and prior. Also, the Participation Rate declined to 66.4% versus 66.8% market forecasts and previous readings.

That said, the sluggish MACD and RSI (14) also challenge the AUD/JPY sellers, in addition to the two-week-old support line near 93.50.

If the quote drops below 93.50, the odds of its slump towards the 61.8% Fibonacci retracement level of August 02-12, around 92.30, can’t be ruled out.

It’s worth noting that the AUD/JPY pair’s weakness past 92.30 makes it vulnerable to testing the 90.00 threshold, with the monthly low near 90.50 likely acting as an intermediate halt.

Alternatively, a convergence of the 200-HMA and 23.56% Fibonacci retracement level, around 94.10, guards the quote’s immediate upside.

Following that, the previous support line from August 03, around 95.00, precedes the monthly peak of 95.10, to challenge the AUD/JPY pair’s further advances.

Overall, AUD/JPY is likely to remain firmer but the upside room appears limited.

AUD/JPY: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.