AUD/JPY Price Analysis: Pair bounces back from 86.00 level as risk sentiments improve

- AUD/JPY finds support as global banking liquidity crisis eases.

- Fading Japanese Yen safe-haven demand provides relief to AUD/JPY.

- RSI signals oversold conditions, suggesting a potential pullback.

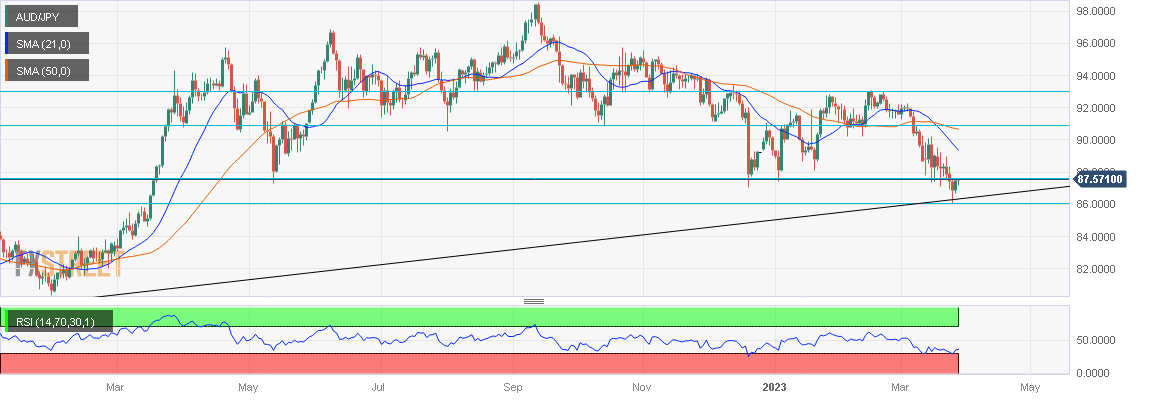

The risk proxy AUD/JPY has fallen sharply after reaching the March high near the 92.00 psychological mark on a daily timeframe, as demand for the safe-haven Japanese Yen surged amid the global banking liquidity crisis.

Investors have returned to traditional safe-haven assets like the Yen instead of the US Dollar during this banking crisis, although recent efforts to alleviate the liquidity crunch have diminished the Yen's demand somewhat.

The risk-sensitive AUD/JPY pair bounced back after finding support and registering a new March low at the key psychological level of 86.00, which also intersects the multi-year ascending trendline starting from 2020. This level is likely to be the last line of support before entering uncharted territory.

Any upside gains are expected to be limited around the current quote price, with a multi-month tested support-turned-resistance at the 87.53 mark. The 21-Day Moving Average (DMA) and 50-DMA crossover is also exerting downward pressure on the pair. A convincing break above the 87.53 mark will face challenges from both DMAs sequentially.

Key resistance is placed at 90.86, followed by 2023 high at 93.17.

The Relative Strength Index (RSI) signals an oversold condition, suggesting that a pullback in the pair may be due.