AUD/JPY Price Analysis: Mild recovery fails to shift bearish outlook

- AUD/JPY posts a modest recovery after last week’s sharp losses.

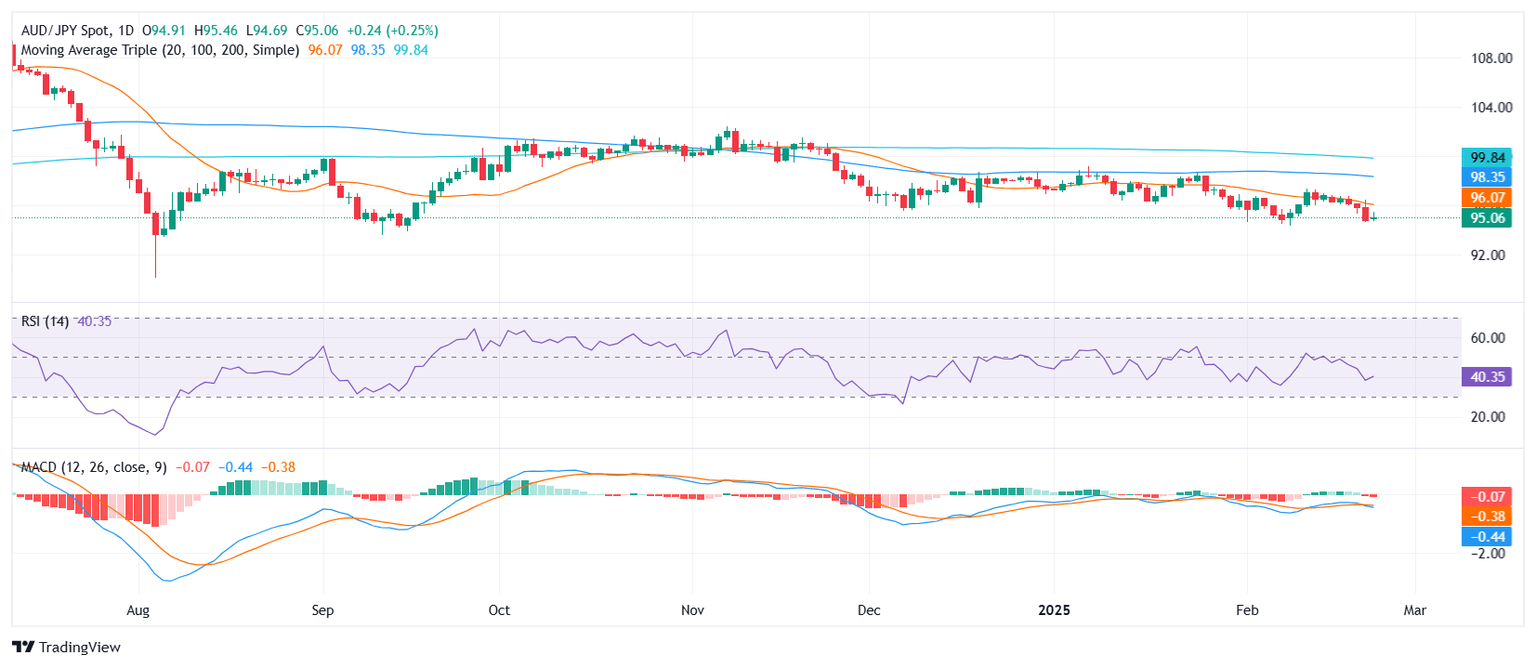

- RSI remains stuck in negative territory, signaling limited bullish momentum.

- The trading below the 20-day SMA confirms a bearish dominance.

The AUD/JPY cross saw a mild recovery at the start of the week, managing to halt last Friday’s steep losses. Despite this small bounce, the pair remains well below its 20-day Simple Moving Average (SMA), keeping the broader outlook tilted toward the downside. This slight uptick seems more like a technical pause rather than the start of a meaningful reversal.

Technical indicators reflect a cautious market tone. The Relative Strength Index (RSI) hovers in negative territory, indicating that sellers still hold the upper hand despite the recent stabilization. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram continues to display flat red bars, highlighting a lack of clear momentum for a sustained bullish push.

For now, the outlook remains bearish unless the cross manages to break decisively back above the 20-day SMA. If sellers regain control, the pair could revisit recent lows near the 94.50 zone. On the other hand, a rebound above key resistance around 96.00 could signal a shift in sentiment. Until then, the bearish bias appears firmly in place, with buyers struggling to establish traction.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.