- AUD/JPY fades bounce off 80.64, snapped five-day uptrend on Tuesday.

- Bearish candlestick formation gains major attention near the highest since December 2018.

- Bullish MACD, multiple tops in January will test intraday sellers.

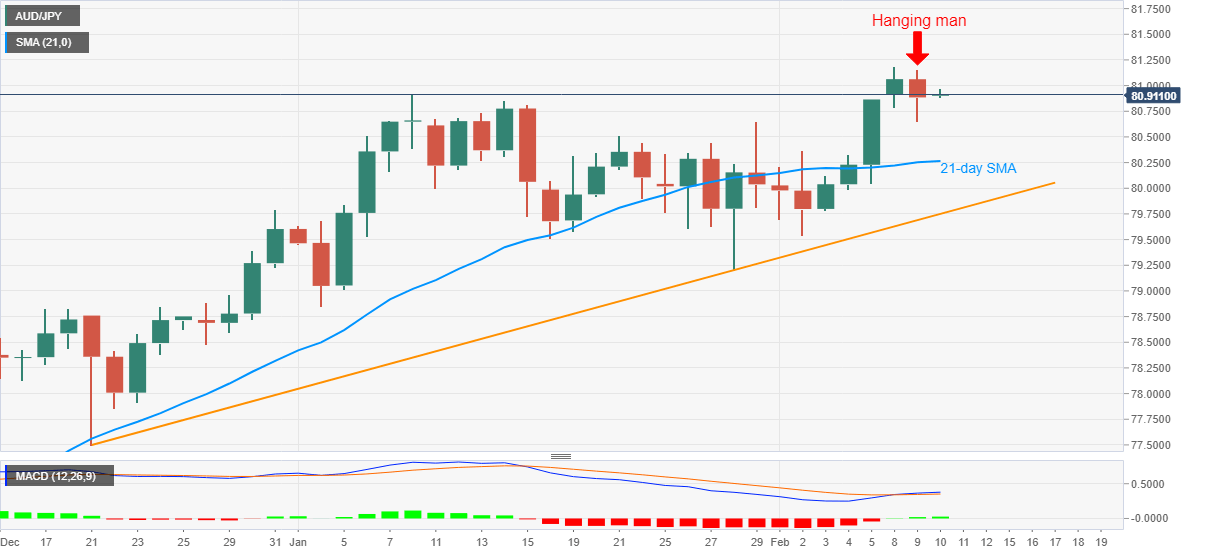

AUD/JPY drops to 80.91 during the early Wednesday’s Asian session. In doing so, the cross justifies the previous day’s hanging man candlestick formation on the daily (D1) chart.

With the bearish candlestick on the multi-day top, AUD/JPY is likely to extend its latest pullback from 81.19. However, bullish MACD and multiple stops marked during January, also including 21-day SMA challenges the quote’s short-term downside.

The late January top near 80.65 could be the immediate support to watch ahead of the 21-day SMA level of 80.26.

Also likely to test the AUD/JPY bears is the 80.00 round-figure and an ascending trend line from December 21, 2020, currently around 79.75.

Meanwhile, an upside clearance of Monday’s top of 81.19 will initially eye for the 82.00 round-figure ahead of targeting the December 13, 2018 high near 82.20.

AUD/JPY daily chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0800 after German inflation data

EUR/USD struggles to gain traction and trades in a narrow channel above 1.0800 on Monday as the risk-averse market environment helps the US Dollar stay resilient against its rivals. Meanwhile, the data from Germany showed that the annual CPI inflation declined to 2.2% in March, as expected.

Gold sits at record highs above $3,100 amid tariff woes

Gold price holds its record-setting rally toward $3,150 in the second half of the day on Monday. The bullion continues to capitalize on safe-haven flows amid intensifying global tariff war fears. US economic concerns weigh on US Treasury bond yields, allowing XAU/USD to push higher.

GBP/USD stays in range near 1.2950 as mood sours

GBP/USD fluctuates in a narrow channel at around 1.2950 at the beginning of the new week. Growing concerns over US President Donald Trump's tariffs igniting inflation and dampen economic growth weigh on risk mood and don't allow the pair to gain traction.

Seven Fundamentals for the Week: “Liberation Day” tariffs and Nonfarm Payrolls to rock markets Premium

United States President Donald Trump is set to announce tariffs in the middle of the week; but reports, rumors, and counter-measures will likely dominate the headline. It is also a busy week on the economic data front, with a full buildup to the Nonfarm Payrolls (NFP) data for March.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.