AUD/JPY Price Analysis: Gains momentum, as morning-star emerges

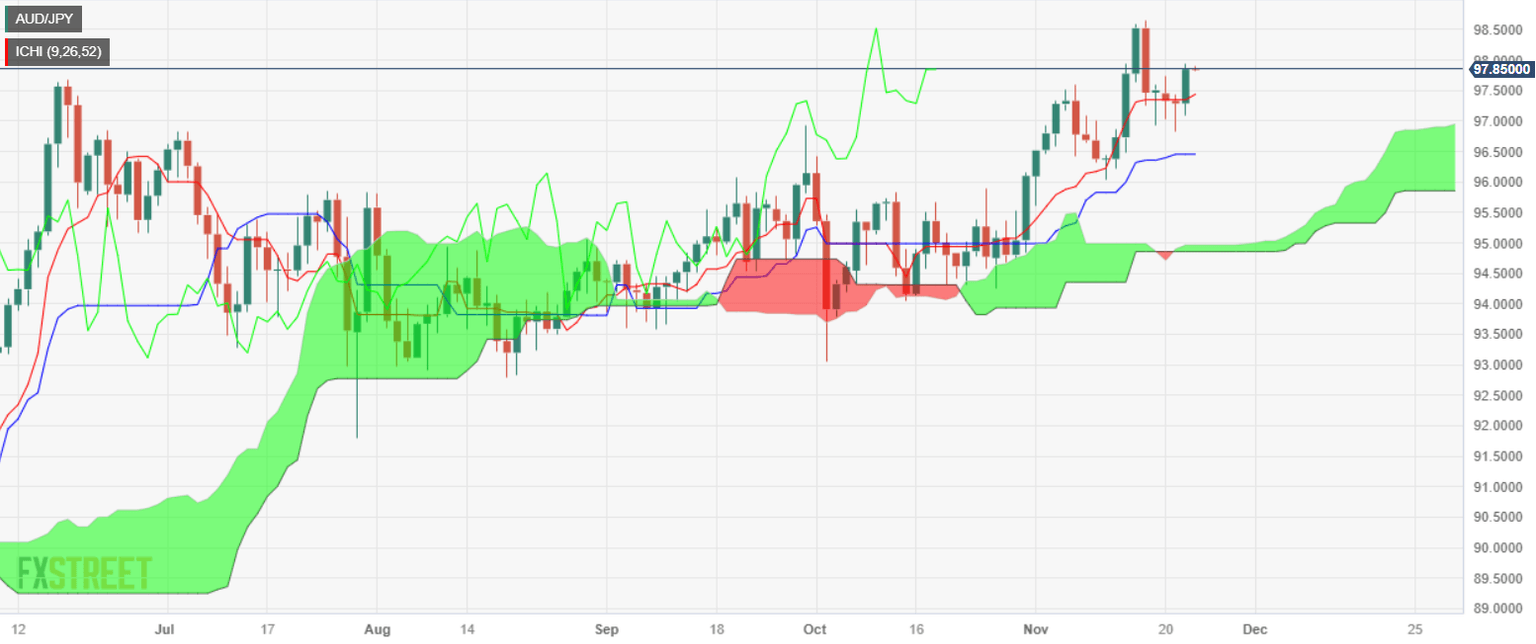

- AUD/JPY remains bullish in the near term after bulls reclaimed the Kijun-Sen, eyeing 98.00.

- If the cross drops below 97.50, the AUD/JPY could challenge 97.00, ahead of dropping below 96.50.

The AUD/JPY rallied more than 0.50% late in the North American session on Wednesday, ahead of the Thanksgiving holiday, which would drain liquidity in the financial markets on Thursday. Therefore, the currency pair is expected to remain within a narrow trading range, exchanging hands at 97.87.

The AUD/JPY daily chart portrays the pair as neutral to upward biased after breaking the Tenkan-Sen at 97.31. The formation of a ‘morning star’ opened the door to test the June 2023 high of 97.67, ahead of challenging the 98.00 figure. A breach of 98.00 and the pair could climb to 99.00.

On the other hand, if the pair slips below the November 21 high of 97.42, AUD/JPY sellers could drag the price towards the 97.00 figure. Once that level is cleared, the next stop would be the Senkou Span A at 96.90 before dropping toward the Kijun-Sen at 96.42.

AUD/JPY Price Analysis – Daily Chart

AUD/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.