- AUD/JPY continues to lose ground, falling below the Kijun-Sen line and reaching a four-week low at 94.11.

- Despite recent losses, the pair maintains an upward bias, remaining above the Ichimoku Cloud.

- Key support levels to watch are at 94.00, followed by the Senkou Span B line at 93.41, and December 13 daily high turned support at 93.35. Breach of these could expose the 93.00 level.

- To reverse the trend, AUD/JPY buyers must reclaim the Kijun-Sen line at 95.18 and challenge the Tenkan-Sen line at 95.47.

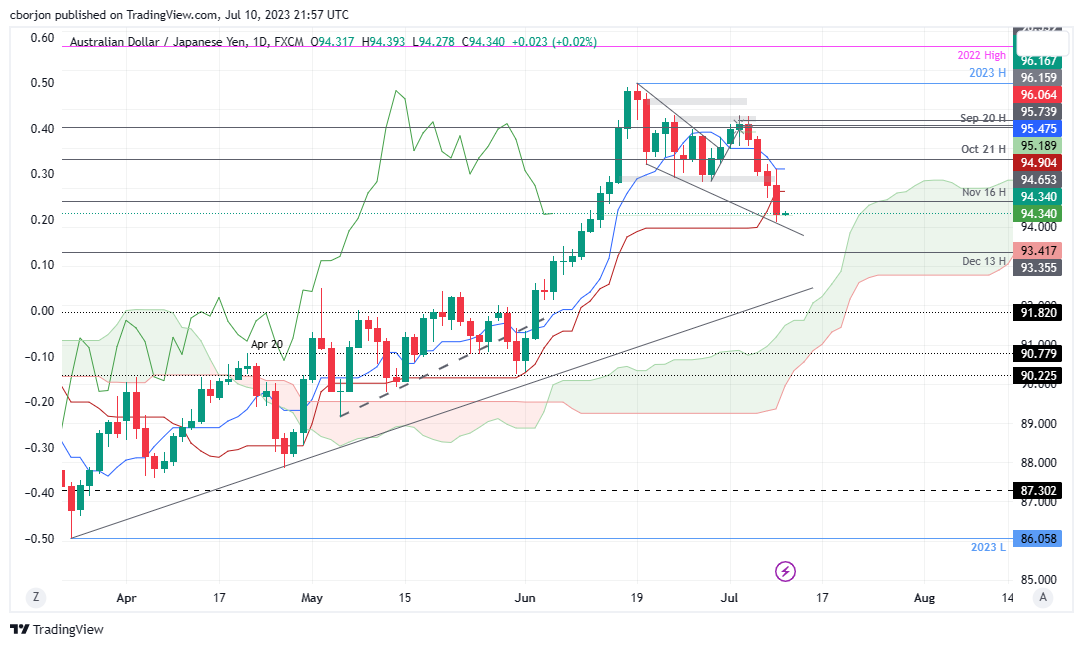

AUD/JPY extended its losses below the Kijun-Sen line after sellers broke technical support levels at around 95.18 before cracking the former at 94.90. The AUD/JPY slid to a new four-week low at 94.11 before stabilizing around current exchange rates. At the time of writing, the AUD/JPY is trading at 94.32, down 0.03% as the Asian session begins.

AUD/JPY Price Analysis: Technical outlook

From a technical perspective, the AUD/JPY is still upward biased, as it remains above the Ichimoku Cloud, with the latest dip putting into play support levels not seen in a month. The 94.00 figure is next, followed by the Senkou Span B line at 93.41, and the December 13 daily high turned support at 93.35. If the cross falls below the latter, that could expose the 93.00 figure.

Conversely, the AUD/JPY buyers must reclaim the Kijun-Sen line at 95.18, so they can threaten to lift the pair above the Tenkan-Sen line at 95.47. In that outcome, the AUD/JPY's next resistance would be the October 21 high at 95.74, ahead of reaching the 96.00 mark.

AUD/JPY Price Action – Daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD Weekly Forecast: Sellers gain confidence alongside the Fed Premium

GBP/USD Weekly Forecast: Pound Sterling stays vulnerable ahead of UK inflation data Premium

The Pound Sterling (GBP) booked the second straight weekly loss against the US Dollar (USD), sending the GBP/USD pair to the lowest level in a month below 1.3050.

Gold Weekly Forecast: XAU/USD holds above key support area after bearish action to start week Premium

Gold (XAU/USD) declined sharply in the first half of the week but regained its traction after coming within a touching distance of $2,600.

Bitcoin Weekly Forecast: Will BTC decline further?

Bitcoin’s (BTC) price fell over 6% at some point this week until Thursday, extending losses for a second consecutive week, as it faced rejection from a key resistance barrier.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.