AUD/JPY Price Analysis: Bulls eye recovery as short-term momentum turns cautiously optimistic

- AUD/JPY trades near the 94.70 area with strong gains ahead of the Asian session.

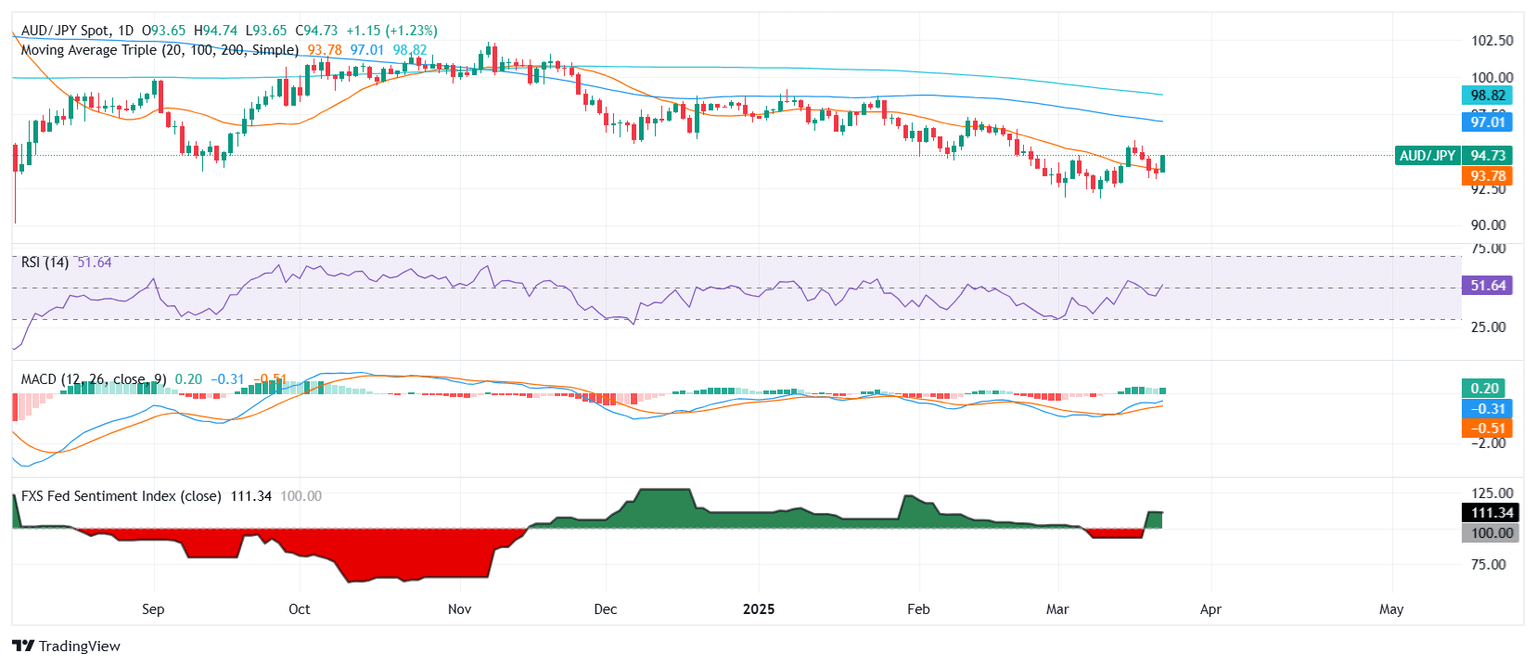

- Mixed technical outlook: short-term momentum improves while longer-term pressure persists.

- Key resistance lies above 95.00; support seen near 93.80 and the 20-day SMA around 93.50.

The AUD/JPY pair was seen trading around the 94.70 zone on Monday ahead of the Asian session, not far from the midpoint of the day’s range. The pair posted solid gains, rising more than 1% and recovering from recent weakness, with price action hinting at renewed buyer interest. Technical indicators, however, offer a nuanced view of the pair’s short-term and longer-term dynamics.

Momentum indicators are sending mixed signals. The Relative Strength Index (RSI) climbed sharply into positive territory and now sits above the 50 level, pointing to increasing bullish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) prints flat green bars, suggesting a tentative shift in bias toward the upside. Most oscillators remain neutral, underscoring the fragile nature of the recovery.

Short-term Simple Moving Averages tilt bullish and currently support the upward move, though the pair still faces resistance from longer-term averages that remain tilted to the downside. A break above the 95.00 psychological level would be key for bulls to consolidate control. On the downside, initial support is seen around 93.80, followed by the 20-day SMA near 93.50, which has served as a pivot in recent sessions.

AUD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.