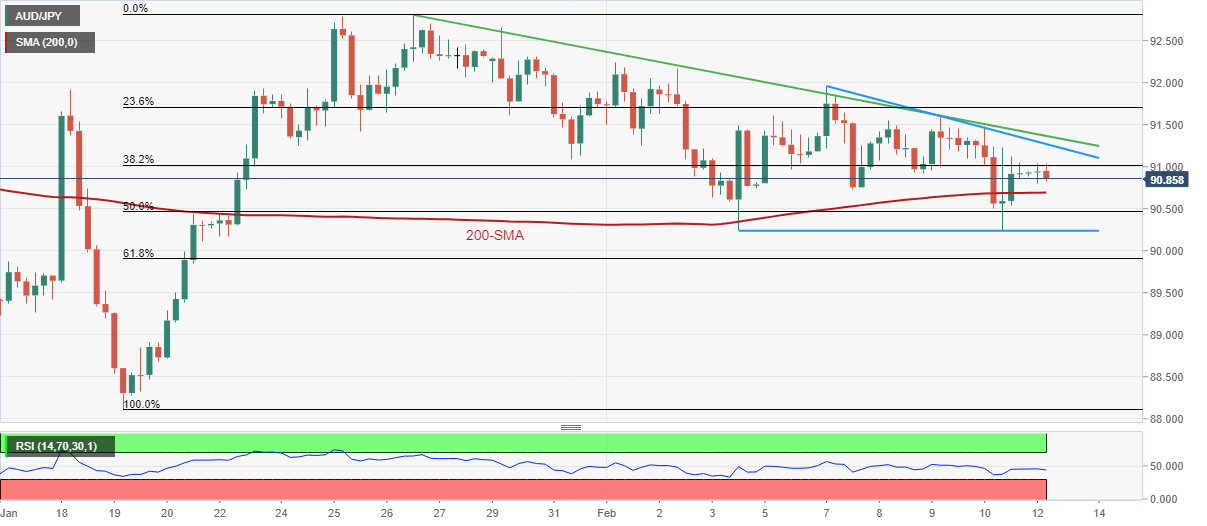

AUD/JPY Price Analysis: Bullish triangle, 200-SMA probe bears near 91.00

- AUD/JPY prints mild gains to snap two-week downtrend.

- Sustained trading beyond 200-SMA, existence of bullish triangle joins steady RSI to favor AUD/JPY bulls.

- Sellers need validation from 90.00 to retake control.

AUD/JPY clings to mild gains around 91.00 as global markets remain dicey during early Monday. In doing so, the cross-currency pair seesaws inside a weekly bullish triangle while floating above the 200-SMA.

It’s worth noting that the steady RSI joins the quote’s sustained trading above the 200-SMA to keep AUD/JPY buyers hopeful.

Even so, a clear upside break of the weekly bullish triangle, currently between 91.30 and 90.20, becomes necessary for the AUD/JPY buyers to keep the reins. However, a downward-sloping resistance line from January 26, 2023, close to 91.40 at the latest, challenges the AUD/JPY upside.

In a case where the cross-currency pair remains firmer past 91.40, the odds of witnessing a run-up toward the previous monthly high near 92.80 can’t be ruled out. That said, the current monthly peak of 91.95 may act as an intermediate halt during the run-up.

Alternatively, the 200-SMA level surrounding 90.70 restricts the immediate downside of the risk-barometer AUD/JPY pair.

Following that, the aforementioned weekly triangle’s lower line could challenge the AUD/JPY bears around 90.20.

Adding to the downside filters is the 90.00 psychological magnet, a break of which could drag the quote toward the late January lows near 88.10.

Overall, AUD/JPY remains on the bull’s radar unless breaking the 90.00 round figure.

AUD/JPY: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.