- AUD/JPY bears sink in their teeth and are plenty hungry.

- The Ukraine crisis has been turned up a notch and the cracks in risk sentiment and flowing through to the yen.

As per the prior analysis of AUD/JPY, as illustrated in the following article that warned of prospects of a turn in risk appetite due to blatant prospects of escalated tensions surrounding, the Ukraine crisis has started to play out as warned:

AUD/JPY structure and a blueprint for potential price trajectory were drawn out on the daily chart with a bearish bias as follows:

AUD/JPY, daily chart, prior analysis

''If there is going to be a meaningful move in sentiment, the forex markets risk barometer, AUD/JPY, that is retesting the daily counter-trendline, could be shaken out of its tree in the coming days. Eyes will be on whether it can take out the recent lows of 82.12: ''

AUD/JPY live market analysis

Meanwhile, although we saw a secondary breach of the resistance in Asia and European sessions amidst a market that continued to price more benign outcomes of the crisis, the price has indeed succumbed to the growing angst:

Given the latest escalation of the Ukraine crisis, it would only be fair to forecast a more extreme outcome in price action that might be representative of the grave troubles that lie ahead for the global economy. After all, the volatility on the pair today has seen the price move between a range of 80 pips, most of which occurs in the first half of the New York session.

What is key to acknowledge on the daily chart is the prospect of today's close leaving an accompanying double top wick, similar in length to that of 10 Feb. If the price is to react to the news feeds just as it did on Feb 10, when UK Foreign Secretary Liz Truss and Russian FM Sergey Lavrov held fruitless talks, in the first signs that diplomacy was never going to be an option, then it wouldn't be too ambitious to expect a similar 2% follow through to the downside in the coming days.

If there risk sentiment continues to be beaten down into the end of the week, taking into consideration the bearish market structure in USD/JPY as well, along with a less hawkish outlook for the Reserve Bank of Australia, then we could see the makings of a bearish structure below the counter trendline once again resulting in a bearish M-formation, as illustrated on the drawings above. The key levels in this respect are 83.05, 82.50 and 82.12 with 81.50 as the longer-term, target.

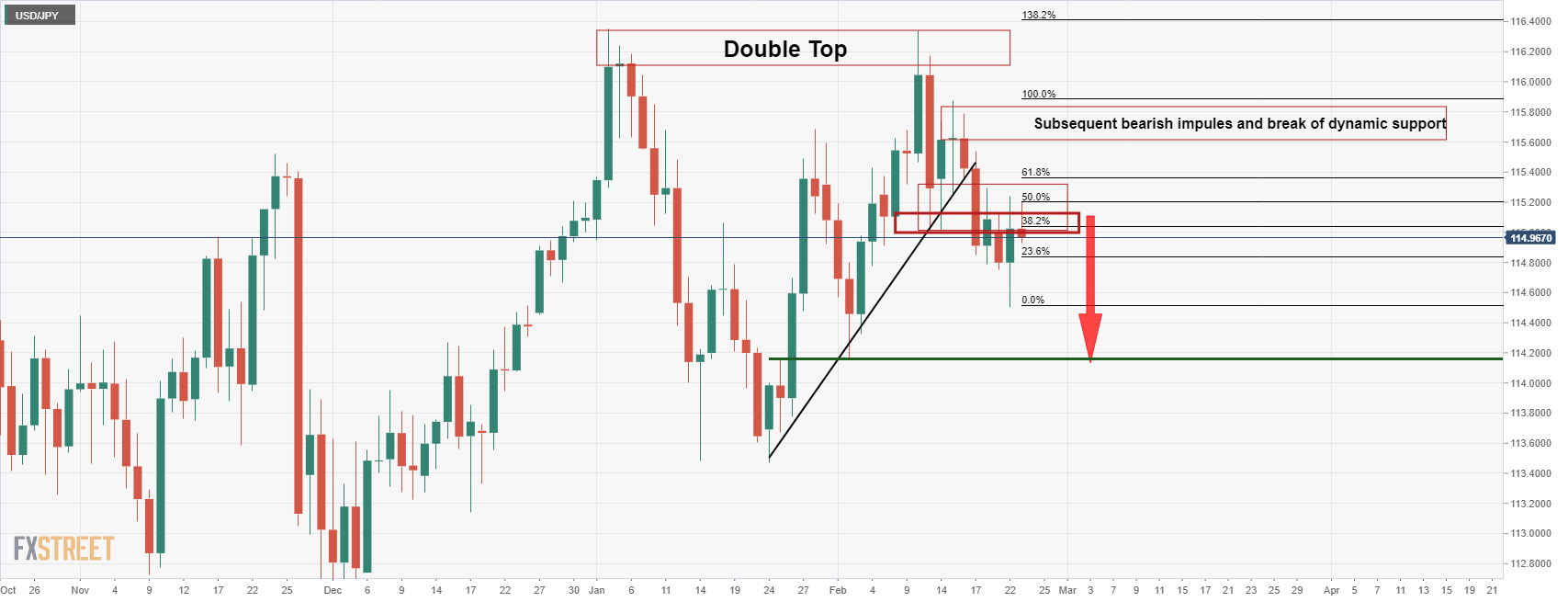

USD/JPY daily chart

''The above analysis, as per USD/JPY's Price Analysis: Weekly and daily pin bars are highly bearish, illustrates the bearish bias given the series of bearish events in price action since the double top was accompanied by a bearish engulfing close on Feb. 11. We have since seen a break of the trendline support and retests back into the cluster of offers below 115.30.

The price is failing there and near a 50% mean reversion of the bearish impulse that broke the dynamic support. This leaves the attention on the downside towards 114.20 for the days ahead as the last defence for much lower levels.''

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays below 1.0400 ahead of US inflation data

EUR/USD struggles to stage a rebound on Friday and continues to trade below 1.0400 following Wednesday's sharp decline that was caused by the Federal Reserve's hawkish tone. Investors await November PCE inflation data from the US.

GBP/USD touches fresh multi-month low below 1.2500

GBP/USD recovers to the 1.2500 area after touching its lowest level since May near 1.2470. The pair stays on the back foot after the Fed and the BoE policy announcements this week pointed to a potentially diverging policy outlook.

Gold price holds above $2,600 amid risk-off mood, retreating US bond yields and softer USD

Gold price maintains its bid tone through the first half of the European session on Friday amid the prevalent risk-off mood. Against the backdrop of persistent geopolitical risks and trade war fears, the threat of a US government shutdown drives some haven flows towards the bullion.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.