AUD/JPY Price Analysis: Bearish pressure intensifies, potential short-term rebound signalled

- The hourly chart portrays the RSI in the oversold territory, signaling a potential short-term rebound.

- On a broader perspective, the AUD/JPY remains above the main SMAs, indicating long-term bullish sentiment.

- The daily RSI is also in negative territory, showing increasing selling pressure.

- In the next sessions, the sellers may take a step back to consolidate their movements.

In Friday's session, the AUD/JPY pair is now trading at 97.49, demonstrating a loss of 0.38%. While the pair is currently dominated by sellers, oversold conditions seen on the hourly chart suggest that the pair may see some upside in the short term to consolidate.

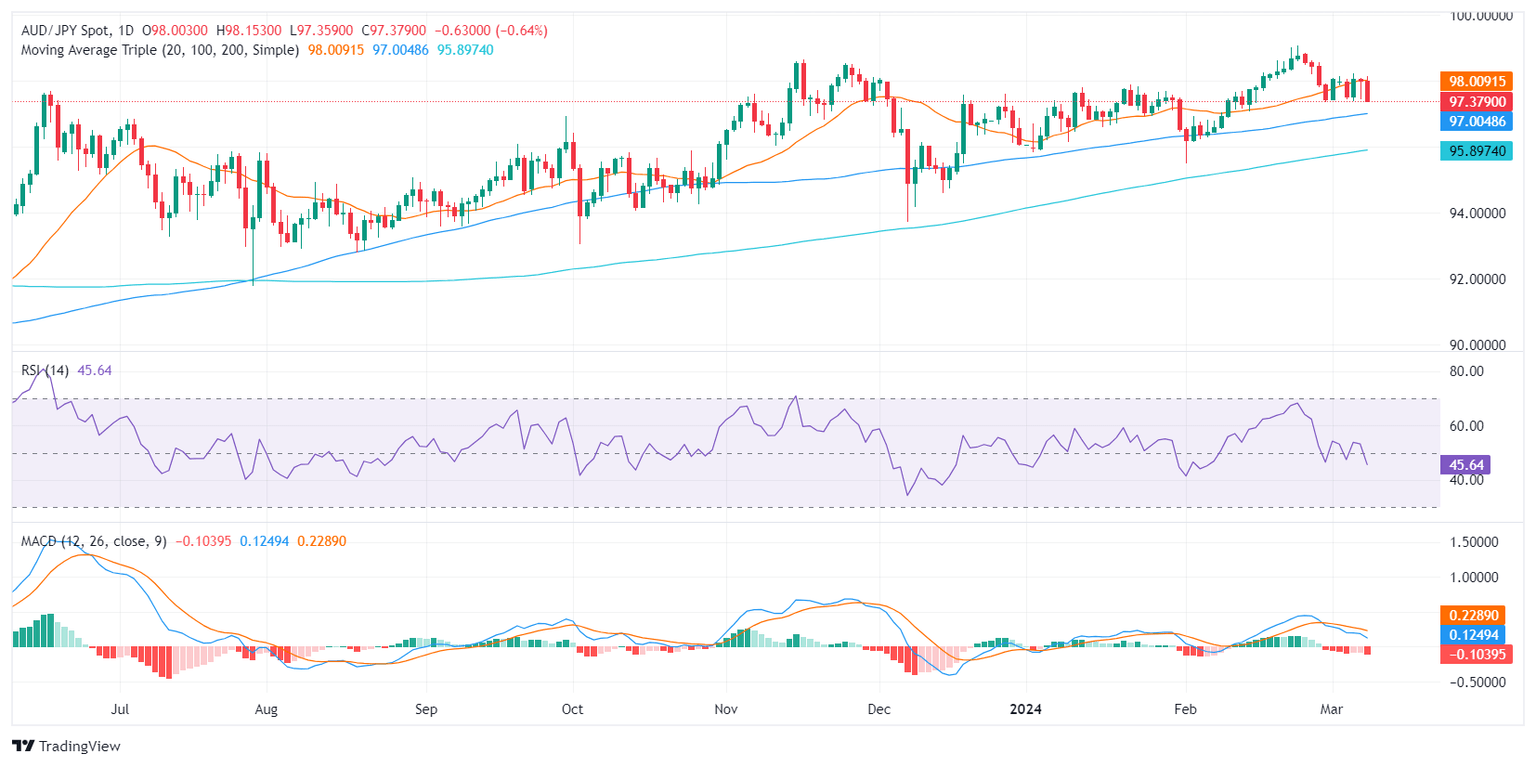

Analyzing the daily chart, the pair's Relative Strength Index (RSI) sits in negative territory, showcasing stronger selling momentum. In line with that, the Moving Average Convergence Divergence (MACD) histogram shows increasing negative momentum with rising red bars. Despite the ongoing bearish tendency, the pair manages to stay above the 100 and 200-day Simple Moving Averages (SMAs), which signifies a favorable condition for the bulls overall.

AUD/JPY daily chart

Zooming to the hourly chart, the RSI is currently located in the oversold territory, contrasting sharply with the daily chart, suggesting a possible short-term rebound due to oversold conditions. Likewise, the MACD illustrates increasing negative momentum on the hourly chart, aligning with the daily analysis. Despite differing conditions outlined in the hourly and daily charts, both depict dominant bearish forces, with bulls maintaining their stance in the broader spectrum and with the possibility of a bullish rebound in the short term.

AUD/JPY hourly chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.