AUD/JPY Price Analysis: Plunges over 1% as bearish engulfing pattern emerges, 93.00 in sight for bears

- AUD/JPY witnessed a significant drop, trading around 94.57 in the Asian session.

- Bearish engulfing candlestick pattern on the daily chart signals potential further declines.

- Key support and resistance levels are outlined amidst the prevailing bearish bias.

AUD/JPY plunged more than 1% on Thursday as investors speculated the US Federal Reserve (Fed) could increase rates before the end of 2023, a headwind for risk-perceived currencies like the Aussie Dollar (AUD). Therefore, the cross-pair extends its losses and exchanges hands at around 94.57 as the Asian session begins.

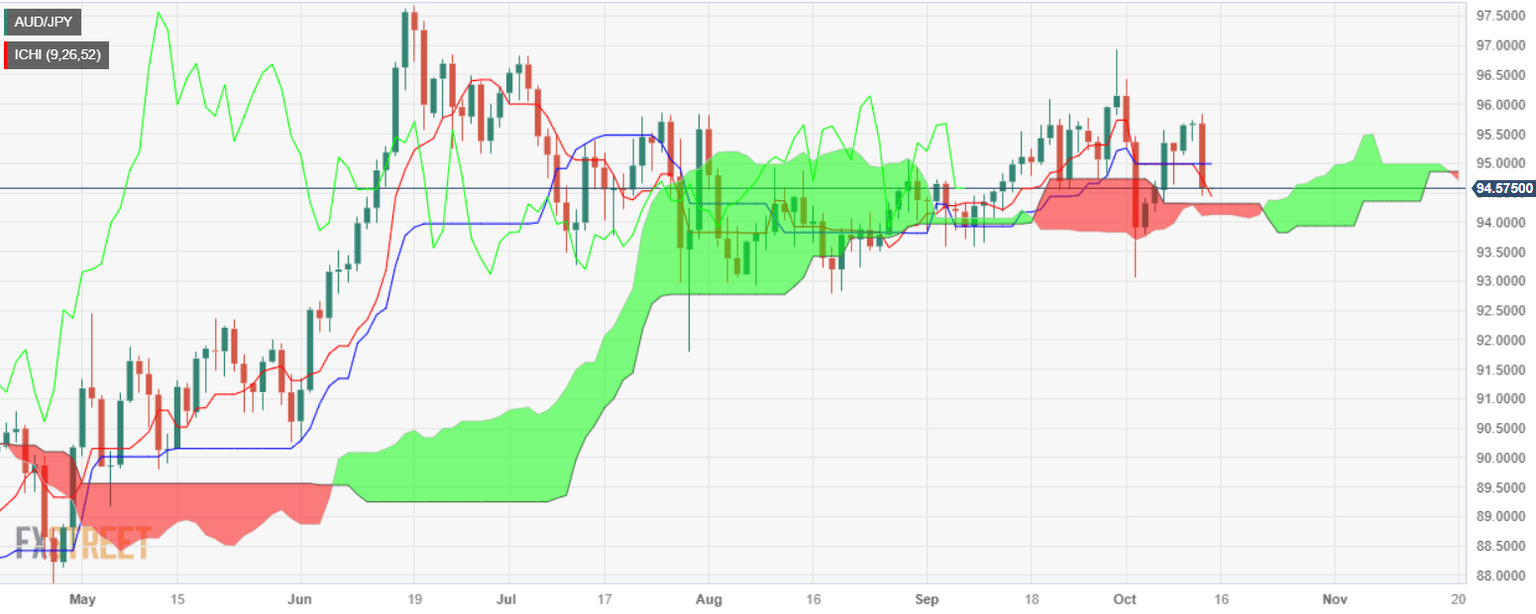

From a daily chart perspective, the pair is neutral to downward biased; due to aggressive selling pressure mounting on Thursday, it formed a bearish engulfing candlestick pattern that comprises price action from the whole week. That said, the AUD/JPY could print new lows below the 94.00 figure.

The AUD/JPY first support would be the Ichimoku Cloud (Kumo) at around the 94.10/30 area, which, once cleared, would expose the psychological 94.00 mark. If that level is broken, the following demand area to test would be October 3, swing low of 93.01, before the pair slumps towards July 28, swing low of 91.79.

Conversely, if AUD/JPY stays above 94, the first resistance would be the Kijun-Sen at 94.97 before climbing above 95.00. If rallying above that level, up next would be the July 3 high at 96.83.

AUD/JPY Price Action – Daily chart

AUD/JPY Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.