AUD/JPY Price Analysis: Back below 94.00 as sellers eye 93.00

- The Australian Dollar registers decent losses vs. the Japanese Yen amidst an upbeat sentiment.

- The lack of catalyst and price action trapped within 93.00-94.00 keeps the AUD/JPY sideways.

- AUD/JPY Price Analysis: RSI’s turning bearish could open the door for a fall to 93.00.

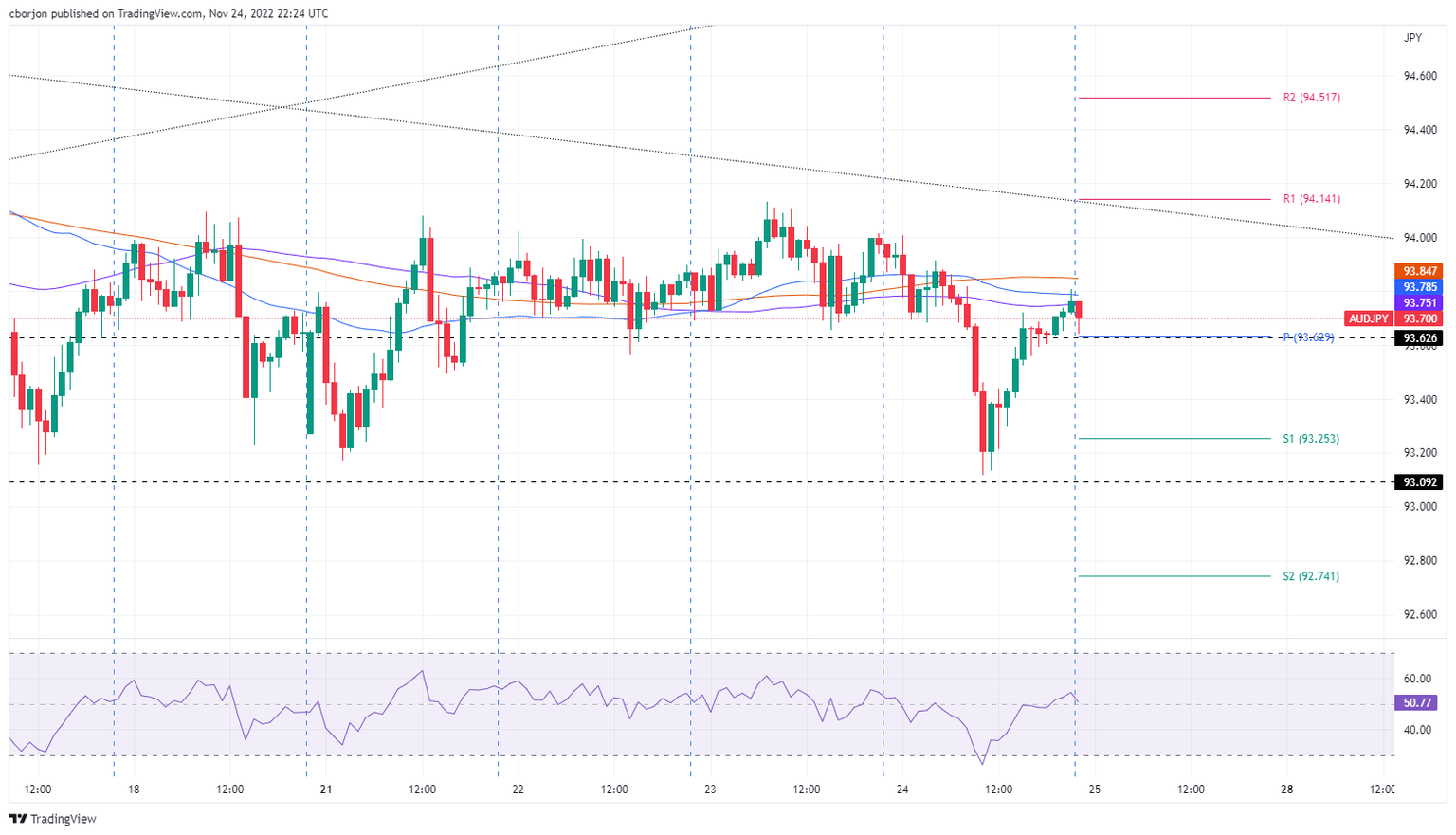

The Australian Dollar (AUD) edges lower against the Japanese Yen (JPY) after traveling throughout the day within the 94.00-93.11 range on Thursday, hoovering below the 50 and 100-day Exponential Moving Averages (EMAs). As the Asian Pacific session begins, the AUD/JPY is trading at 93.70, below its opening price by 0.20%.

AUD/JPY Price Analysis: Technical outlook

The AUD/JPY daily chart portrays the cross, consolidated within the 93.00-94.00 range, for the last six days. Even though the 50 and 100-day Exponential Moving Averages (EMAs) around 93.87 and 94.28, respectively, above the spot price, suggest the cross is downward biased, a flat slope confirms a neutral bias.

Short term, the AUD/JPY 1-hour chart portrays the 50, 100, and 200-EMAs seesawing around the price action. On Thursday, the AUD/JPY dived sharply below the Exponential Moving Averages (EMAs), opening the door for lower prices. Investors should be aware that the Relative Strength Index (RSI) crossed below the 50-midline to bearish territory, showing that sellers are gathering momentum.

Therefore, the AUD/JPY first support would be the daily pivot point at 93.63. The break below will expose the S1 daily pivot at 93.25, followed by this week’s low at 93.11. In the event of breaking upwards, the AUD/JPY first resistance would be the 200-EMA at 93.84, which, once cleared, would expose the 94.00 figure.

AUD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.