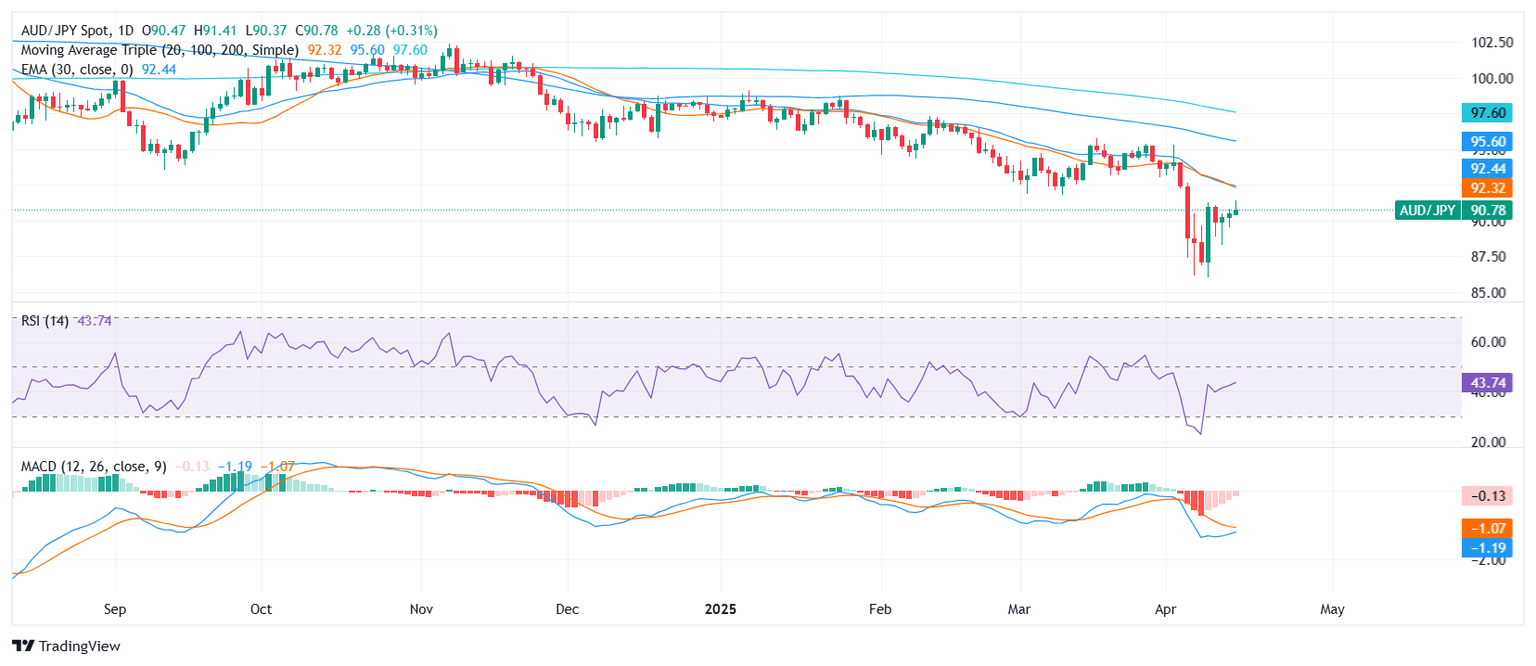

AUD/JPY Price Analysis: Aussie yen edges higher but technical bias remains bearish

- AUD/JPY trades near the 90.90 zone after modest gains during Tuesday’s session

- Despite intraday strength, indicators and moving averages reinforce a bearish outlook

- Key resistance stands near 91.40, with support seen around the 90.80 region

The AUD/JPY pair advanced on Tuesday, rising toward the upper end of its daily range and hovering near the 90.90 area ahead of the Asian session. The cross posted modest intraday gains, though the broader technical structure still points south as moving averages and trend signals maintain a bearish stance.

The Relative Strength Index (RSI) is currently at 44.316, suggesting neutral momentum. However, the Moving Average Convergence Divergence (MACD) is issuing a sell signal, in line with the prevailing bearish bias. The 10-period Momentum indicator at −2.989 suggests potential for a short-term bounce, although this is countered by a neutral Bull Bear Power reading of −0.430.

Price action remains pressured by multiple key moving averages. The 20-day (92.328), 100-day (95.660), and 200-day (97.724) Simple Moving Averages are all sloping downward. Similarly, the 30-day Exponential Moving Average at 92.458 and the 30-day SMA at 92.812 align with this view, confirming sustained downside pressure despite recent gains.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.