AUD/JPY holds above the 95.60 mark ahead of RBA decision

- AUD/JPY gains traction around 95.68, up to 0.12% on Tuesday.

- JPY remains under pressure after the central bank's unplanned purchase of $2 billion in Japanese government bonds on Monday.

- Market players await the Reserve Bank of Australia's (RBA) interest rate decision.

- AUD/JPY trades within a descending trend channel lines from June 18.

The AUD/JPY cross extends its upside and trades in positive territory for the third consecutive day during the early Asian trading hours on Tuesday. The cross currently trades around 95.68, gaining 0.12% on the day. Market players await the Reserve Bank of Australia's (RBA) interest rate decision later in the day.

Australia’s TD Securities Inflation figure dropped to 5.4% YoY from 5.7% in June. Meanwhile, Australia’s Private Sector Credit fell to 0.2% MoM and 5.5% YoY in June, compared to 0.4% and 6.2% prior, respectively.

Additionally, Australian Retail Sales experienced their largest decline this year in June. Australia's Retail Sales fell 0.8% MoM, against the market expectation of 0.0% and 0.7 prior. The Producer Price Index (PPI) data for the second quarter were disappointing at 3.9% YoY and 0.5% QoQ. This softer report indicated that rising borrowing costs and high prices have an impact on the Australian economy. Nevertheless, 55% of economists in a Reuters poll anticipated that the RBA is likely to raise interest rates by a quarter percentage point on Tuesday before pausing for the entire year.

On the other hand, the Japanese Yen remains under pressure as the Bank of Japan's (BoJ) unscheduled operation on Monday to purchase 300 billion ($2 billion) worth of Japanese government bonds (JGB) keeps yields stable for the first time since February 2022.

Japan’s Economy Minister Shigeyuki Goto stated on Tuesday that the BoJ's decision last week was intended to increase the sustainability of monetary easing by increasing the flexibility of the YCC. He added that he does not believe that the BoJ's decision on Friday represented a shift in its monetary easing stance.

AUD/JPY: Technical outlook

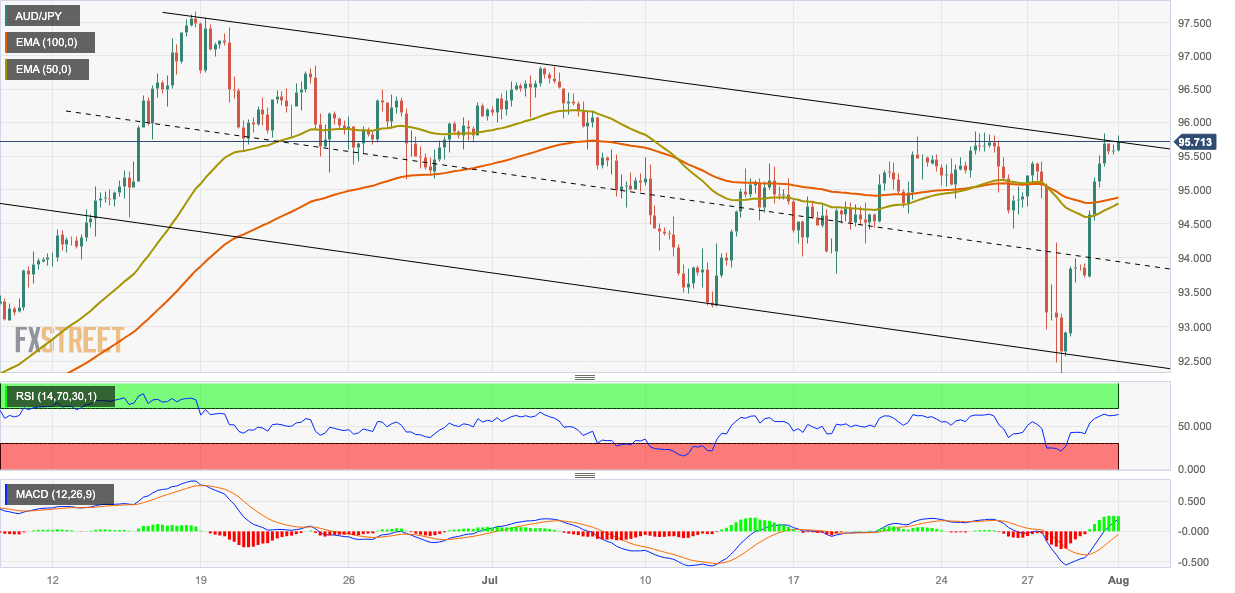

According to the four-hour chart, AUD/JPY trades within a descending trend channel line from the middle of June. The Relative Strength Index (RSI) and MACD hold in bullish territory, suggesting that the path of least resistance is to the upside.

Resistance levels: 95.80 (High of July 31, upper boundary of a descending trend channel), 96.85 (High of July 4), and 97.60 (High of June 16, YTD high).

Support level: 94.90 (100-hour EMA), 94.80 (50-hour EMA), 94.00 (a psychological round mark, midline of descending trend channel), and 93.30 (Low of July 12).

AUD/JPY four-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.