AUD/JPY consolidates as Iranian official states no immediate retaliation against Israel

- AUD/JPY holds ground after partially recovering losses as an Iranian official stated that no immediate plan for retaliation against the Israeli airstrikes.

- The Japanese Yen gained support from the hawkish remarks made by BoJ Governor Kazuo Ueda on Thursday.

- The Australian Dollar lost ground as soft domestic jobs data reinforced a dovish outlook on RBA’s monetary policy.

AUD/JPY continues to trade in the negative territory after paring intraday losses on Friday. The risk aversion sentiment evolved across financial markets, as ABC News reported that Israeli missiles had struck a site in Iran. Before that, the Japanese Yen received minor support from the release of Japan's inflation data on Friday. The National Consumer Price Index (CPI) for March rose by 2.7% year-over-year, compared to a 2.8% increase in February, according to the latest data from the Japan Statistics Bureau. This index assesses the price fluctuations of goods and services bought by households.

The Japanese Yen (JPY) received upward support from the hawkish remarks made by Bank of Japan’s (BoJ) Governor Kazuo Ueda on Thursday. According to a Reuters report, Ueda mentioned in a press conference that the central bank might consider raising interest rates again if significant declines in the Yen substantially boost inflation. This underscores the influence that currency movements could have on the timing of the next policy shift.

The Australian Dollar (AUD) experienced losses, along with a decline in the ASX 200 Index on Friday. Additionally, Australia’s 10-year government bond yield dropped below 4.3%, stepping back from over four-month highs. This retreat was attributed to soft domestic jobs data, which reinforced a dovish outlook on the Reserve Bank of Australia’s (RBA) monetary policy.

Daily Digest Market Movers: AUD/JPY depreciates on dovish RBA outlook

- Japan’s National CPI, excluding fresh food but including fuel costs, increased 2.6% year-over-year in February, decelerating from a four-month high of 2.8% in January and falling below forecasts of 2.7%. The slowdown was attributed to mild increases in food prices, although it remained above the Bank of Japan’s 2% target due to the weakness of the Yen and high commodity prices.

- Bank of Japan board member Asahi Noguchi stated on Thursday that the pace of future rate hikes would probably be much slower than that of its global counterparts in recent policy tightening. This is because the impact of rising domestic wages has yet to be fully transmitted to prices, as reported by Reuters.

- Analysts at Rabobank suggested that stronger Japanese economic data, coupled with stronger expectations that the Bank of Japan (BoJ) may raise rates again later this year, would likely provide the Japanese Yen (JPY) with broad-based strength. They posit that if Japanese real household incomes turn positive later this year, there is a possibility of another BoJ rate hike.

- On Thursday, Australia’s Employment Change posted a reading of -6.6K for March, against the expected 7.2K and 117.6K prior. Australia’s Unemployment Rate rose to 3.8% in March, lower than the expected 3.9% but higher than the previous reading of 3.7%.

- According to a Westpac report, while the central bank signaled that rates are unlikely to be raised further, greater confidence in the inflation outlook is required before contemplating the possibility of rate cuts.

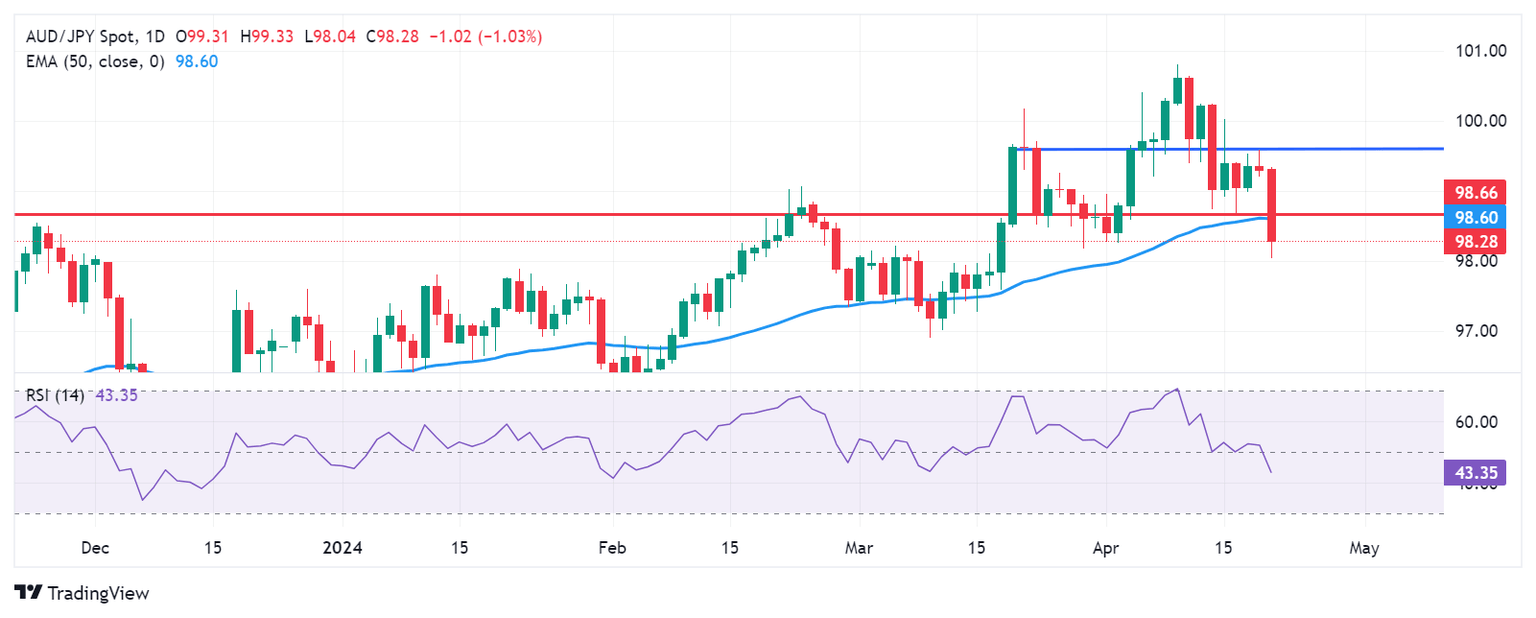

Technical Analysis: AUD/JPY remains below 99.00

The AUD/JPY traded around 98.20 on Friday. The breach below the significant support level of 98.65, coupled with the 14-day Relative Strength Index (RSI) persisting below the 50 level, indicates a bearish sentiment for the pair. The AUD/JPY cross could find immediate support at the psychological level of 98.00. A break below this level could lead the pair to approach the major level of 97.50. On the upside, the major level of 98.50 appears as the barrier, followed by the 50-day Exponential Moving Average (EMA). A breakthrough above the latter could support the AUD/JPY cross to explore the region around the psychological level of 99.00.

AUD/JPY: Daily Chart

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.09% | -0.07% | -0.13% | 0.05% | -0.12% | 0.15% | -0.53% | |

| EUR | 0.09% | 0.01% | -0.04% | 0.14% | -0.01% | 0.24% | -0.40% | |

| GBP | 0.07% | -0.01% | -0.05% | 0.13% | -0.02% | 0.23% | -0.42% | |

| CAD | 0.13% | 0.04% | 0.04% | 0.18% | 0.03% | 0.28% | -0.37% | |

| AUD | -0.06% | -0.15% | -0.13% | -0.18% | -0.15% | 0.11% | -0.55% | |

| JPY | 0.11% | 0.03% | 0.00% | -0.03% | 0.17% | 0.25% | -0.39% | |

| NZD | -0.15% | -0.25% | -0.24% | -0.28% | -0.10% | -0.26% | -0.65% | |

| CHF | 0.52% | 0.41% | 0.41% | 0.37% | 0.54% | 0.39% | 0.64% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.