- NASDAQ:ATOS suffers a 7% fall on Wednesday.

- Atossa Therapeutics develops nasal spray for Covid-19 and cancer treatments.

- Shareholder letter outlines prospects for further growth.

Update Thursday, February 11: NASDAQ: ATOS has been sliding for the fifth consecutive day, changing hands at around $3.38 as of Thursday morning, down from the peak close of $4.33 on a week ago. Shares of the promising Seattle-based pharmaceutical firm have been struggling since their surge in late January and early February when its medical breakthroughs propelled it higher. Atossa Therapeutics Inc may still attract traders later on as bargain-seekers jump on the stock. See all the latest hot stocks news.

Update Thursday, February 11: Atossa Therapeutics (ATOS) suffered a sharp fall on Wednesday, with shares closing down 7%. Atossa shares have been very strong in 2021, quadrupling in value. ATOS has been boosted by the results of its Phase 2 trial for the treatment of breast cancer. In a letter to shareholders on Wednesday CEO, Dr Stephen Quay said ATOS had improved its financial position by $81 million in 2020. Shares are up 2% on Thursday at the time of writing, trading at $3.55.

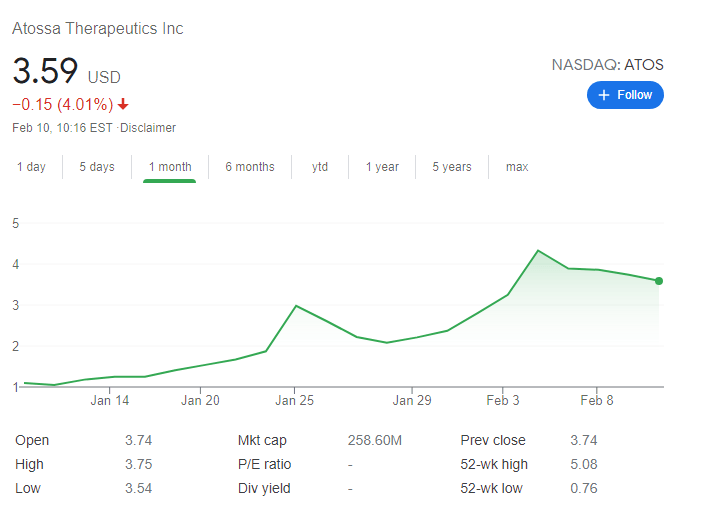

Update: Atossa Therapeutics Inc (NASDAQ: ATOS) share have been extending their falls on Wednesday, dropping below $3.60. The stock is sold off for the fourth consecutive day but it remains well above the lows in January – and also above the peak recorded last month – $3.00. Traders seem to be gradually reducing their positions after the rally, but doing it in a measured manner, reflecting confidence in the firm's medical breakthroughs.

Update: Shares of NASDAQ: ATOS are trading some 0.80% higher in Wednesday's premarket session, signaling an end to a three-day losing streak. Buying interest for Atossa Therapeutics Inc remains robust after the pharma firm reported substantial progress in its clinical trials for breast cancer in early February. It is also essential to note that despite the retreat from the highs, ATOS's closing price on Tuesday, $3.74, is considerably above a stock price of $1 seen early in 2021.

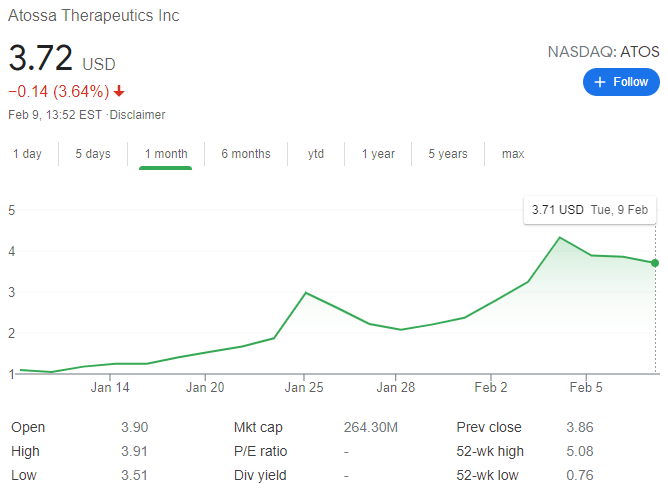

Update: Atossa Therapeutics Inc (NASDAQ: ATOS) shares started the second day of the week on the back foot after losing 0.77% on Monday. Following a drop to a fresh session low of $3.5, the stock recovered modestly and was last seen trading at $3.72, down 3.6% on the day. However, the recent decline seems to be a product of profit-taking as ATOS is still up nearly 70% in February. Moreover, investors remain hopeful about the biopharmaceutical company's ability to introduce effective treatments against breast cancer and COVID-19. Meanwhile, broader markets continue to trade mixed with the Dow Jones Industrial Average rising 0.05% and the Nasdaq Composite falling 0.12%.

NASDAQ: ATOS has been extending its decline on Tuesday, the third consecutive day of falls – and despite an early increase in premarket trading. Atossa Therapeutics's shares are changing hands at around $3.64 at the time of writing, a drop of over 5%. Despite the drop, the pharma firm is trading well above last week's lows just over $2 – and far above penny-stock territory recorded early in the year. Will investors buy the dip? Bargain seekers may jump on the bandwagon, remembering that ATOS has promising products.

Atossa Therapeutics Inc (NASDAQ:ATOS) is set to kick off Tuesday's trade with an upswing of over 2% to near $4, according to premarket trading figures. The Seattle-based pharmaceutical continues benefiting from its breakthrough in Phase 2 clinical trials reported early in February. Shares have had their time to consolidate, edging lower by 0.77% on Monday. Atossa's dual ventures in both breast cancer and COVID-19 look promising.

NASDAQ:ATOS has finally given its investors the news they wanted to hear and the stock reacted appropriately on Thursday, spiking by nearly 50%. On Friday, a predictable pullback that usually accompanies strong gains occurred as investors opted to trim back some of their realized profits. Atossa’s stock fell by 10.16% to close the week and ended the trading session at $3.89 and a daily trading volume that doubled its average volume of 18.5 million shares.

The catalyst for the surge in price was Atossa Therapeutics’ announcement that it had prematurely ended its Australian Phase 2 clinical trials with what it called ‘substantially positive results’. With the early finish to the studies, Atossa is hoping to fast forward the development of its treatment, Endoxifen. The reports showed that the patients exhibited an average reduction of 74% in tumor activity which brought it to levels that are indicative of long-term survival amongst breast cancer patients. Another promising sign from the studies was that patients did not exhibit significant side effects from Endoxifen, which is almost always a promising sign for FDA fast-track approvals.

ATOS stock predictions

The next step for Atossa is to gain FDA approval for Endoxifen. If or perhaps when this is granted, expect there to be a high demand for the drug as breast cancer topped the list in 2020 as the most frequently diagnosed form of cancer with over 279,000 cases and 42,000 deaths in the United States alone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD battles 1.3200 after UK jobs data

GBP/USD is defending minor bids near the 1.3200 mark in the early European session on Tuesday. The latest data from the UK showed that Unemployment Rate steadied at 4% in the quarter to February while Average Earnings disappointed, weighing negatively on the Pound Sterling.

EUR/USD stays defensive near 1.1350 as US Dollar looks to stabilize

EUR/USD remains on the back foot for the second consecutive session, trading near 1.1350 in the European trading hours on Tuesday. The pair weakens as the US Dollar attempts to regain stability amid the US-China trade war and growing concerns over US recession. German/ EU data are awaited.

Gold price holds above $3,200; bullish bias remains amid trade uncertainty

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair. Trump's temporary tariff reprieve improves global risk sentiment and might cap the commodity.

XRP resilient amid looming ETF deadlines

Ripple (XRP) flaunted a bullish outlook, trading at $2.1505 at the time of writing on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move, eyeing $3.0000 psychological level.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.