- US equity indices plunge more than 3% on Friday.

- China responds with 34% tariff on US goods.

- Wall Street warns that tariff war will ignite inflation, hurt GDP.

- US NFP for March shows major hiring gains, but February sees a substantial downward revision.

US investors are waking up to another maelstrom in the stock market. Indices are selling off on their second day following US President Donald Trump’s initiation of far-reaching tariffs on nearly every other foreign nation. China issued its own 34% tariff on US goods on Friday.

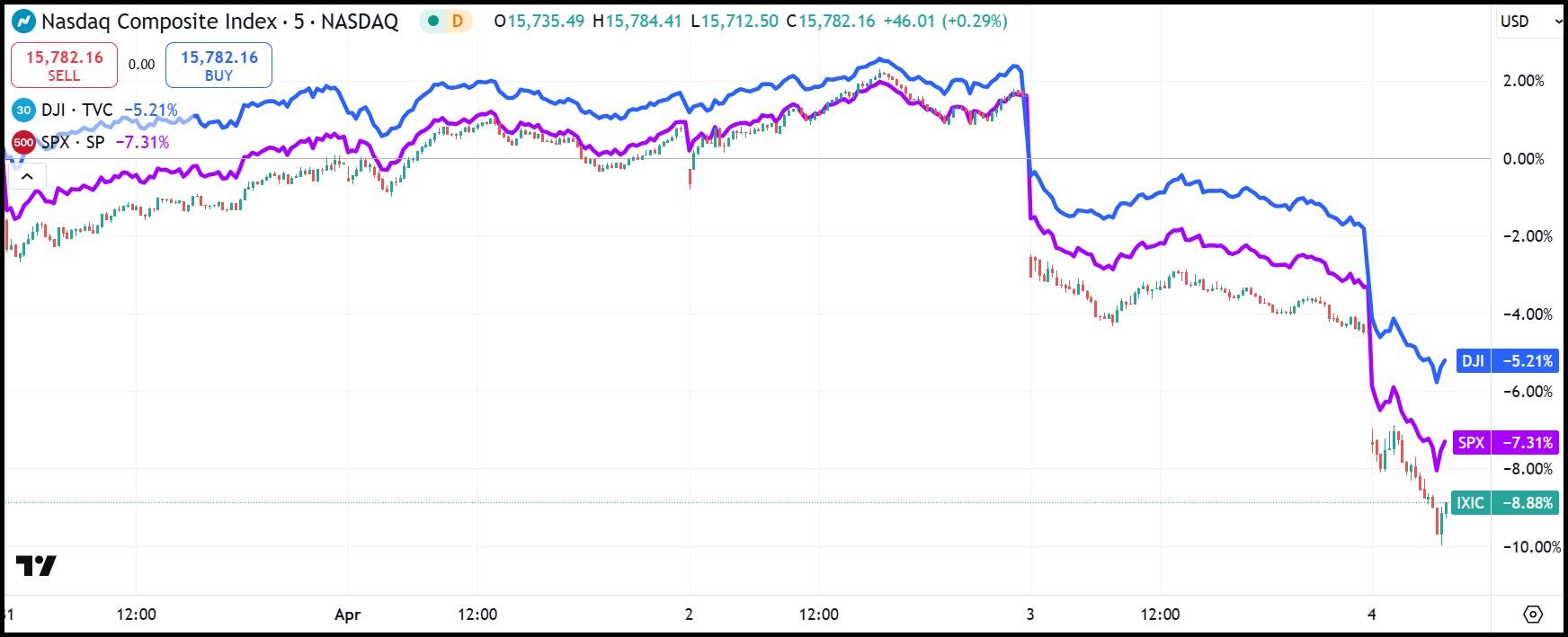

The Dow Jones Industrial Average (DJIA), NASDAQ Composite and S&P 500 have already registered more than 3% plunges by mid-morning on Friday, and much of Wall Street now expects an extended downswing as investors flee US equities in search of US Treasuries and other safe havens. US government bonds with 12-month, 2-year and 5-year tenures all saw their yields drop more than 3% on Friday morning. Bond yields fall as bond prices rise.

The market scoffed at a better-than-expected US jobs report as well. US Nonfarm Payrolls (NFP) for March printed at 228K, 69% above the 135K consensus figure. However, February experienced an unusually large downward revision — from 151K to 117K.

As per usual, Trump left the market guessing by seeming to adopt two starkly different outlooks. First, Trump posted on his Truth Social platform, “To the many investors coming into the United States and investing massive amounts of money, my policies will never change.”

Screenshot of President Trump's Truth Social account - 4/4/2025

Trump trade advisor Peter Navarro echoed this sentiment when he said that the reciprocal tariffs announced on Wednesday were “not a negotiation” tactic.

But Trump told reporters aboard Air Force One on Thursday that he was open to negotiations with foreign nations if the agreement strongly benefited the US. Trump said he would consider it “if somebody said that we’re going to give you something that’s so phenomenal, as long as they’re giving us something that’s good.”

Wall Street reacts to Trump tariff policy

Trump’s tariff policy places a 10% foundational tariff on nearly all other nations, but many of the US’ largest trading partners received much higher tariffs. The European Union was hit with a 20% tariff; Japan, 24%; South Korea, 25%; Vietnam, 46%; India, 26%; Bangladesh, 37%; Taiwan, 32%; Indonesia, 32%; and Malaysia, 34%.

The normally optimistic Wedbush Securities called the tariff rates a “convoluted set of numbers/calculations that appear to be [dividing] each nation's trade surplus by their total imports with the US.”

“The concept of taking the US back to the 1980s 'manufacturing days' with these tariffs is a bad science experiment that in the process will cause an economic Armageddon in our view and crush the tech trade, AI Revolution theme, and overall industry in the process,” the analyst team, led by Dan Ives, wrote in a client note.

UBS said the tariffs amounted to a $700 billion tax on US consumers and projected US prices to rise between 1.7% and 2.2% directly due to the policy. However, the analysts at UBS were clear that second-round effects — such as a US recession or higher unemployment — were of greater importance.

UBS analysts suggest that the tariffs could trim US GDP forecasts by as much as 2%. Additionally, their calculations predict that keeping the present tariff structure in place would send long-term inflation to 5%.

PIMCO co-founder Bill Gross told investors explicitly not to “catch a falling knife”. Gross said that buying the dip on equities is a bad idea since the market is unlikely to contain the fallout for some time.

“This is an epic economic and market event similar to 1971, and the end of the Gold standard, except with immediate negative consequences,” Gross told Bloomberg.

Asked if he thought whether Trump would cave in and retract at least some tariffs, Gross said Trump “can’t back down anytime soon. He’s too macho for that.”

5-day chart of the NASDAQ (5-minute candlesticks), S&P 500 (purple), and Dow Jones Industrial Average (blue)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

US headline CPI came in at 2.4% YoY in March – LIVE

The latest figures from the Bureau of Labor Statistics (BLS) show that the headline Consumer Price Index (CPI) increased by 2.4% YoY last month—coming in below economists’ forecasts. Meanwhile, core CPI, which excludes the more unpredictable food and energy categories, climbed 2.8% over the last twelve months.

EUR/USD maintains its strong gains above 1.1100 post-US CPI

Heavy losses in the US Dollar prompt EUR/USD to flirt with the area of yearly peaks above the 1.1100 region following the release of US inflation readings in March.

Gold is trading on a positive footing near $3,130 after US inflation

Prices of Gold trade with marked gains following March’s US inflation prints, hovering around the $3,130 zone against the backdrop of a strong bearish bias in the Greenback and mixed US yields across the curve.

GBP/USD extends its advance to weekly highs on US CPI data

GBP/USD clinches its third consecutive daily advance, breaking above 1.2900 the figure and hitting fresh four-day highs in the wake of US inflation figures gauged by the CPI, and the weaker Greenback.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.