- Arrival might be the next big WallStreetBets stock.

- ARVL shares surge 20% in Wednesday's premarket.

- ARVL has popped 6% in Tuesday's regular session.

A new day, a shiny new toy for the WallStreetBets retail traders to turn their attention to. Every morning must be like Christmas for this stock-trading forum on Reddit. What new stock are we going to have fun with today? Arrival (ARVL) seems to be the new kid on the block with an initial starter move of 6% on Tuesday just to kick things off for the main course. Clearly things are starting to get interesting now that the premarket percentage change has had to be changed several times for this article.

We have been here before. Back in December, ARVL stock surged from $10 to $33 in a matter of days and remained elevated until March. The retail frenzy in January 2021 skipped Arrival shares, perhaps because they had been the early leader, even upstaging GameStop. ARVL shares slid back to $12.60 by mid-April and built a solid base. However, it was not until yesterday that things began to get interesting again for the stock.

Arrival is involved in the production of electric vehicles for the commercial sector and manufactures vans and buses. Recently, ARVL announced United Parcel Service (UPS) has given a commitment to purchase up to 10,000 electric vehicles from Arrival plus an option for a further 10,000. The Arrival electric van is due to begin road trials in summer 2021 with an electric bus planned for later in the year. Arrival is also working with Uber Technologies (UBER) to develop an electric vehicle specifically aimed at ride-hailing, according to a report by Reuters in May. There is plenty of news flow for this one.

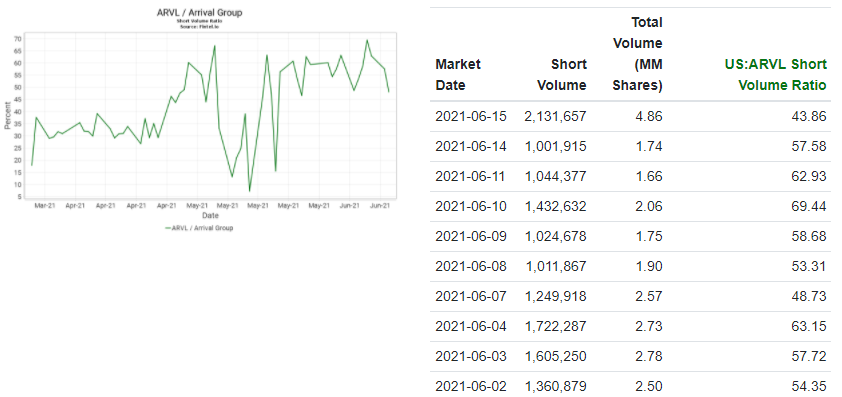

ARVL shares appear to have been driven higher by a post on WallStreetBets, but Barclays began covering the stock on June 3 with an Overweight rating and a $25 price target. A user on WallStreetBets on Tuesday identified ARVL shares as having a high short interest, but the latest Refinitiv data shows a short interest of only 1.6%. This data goes to the end of May. MarketWatch reports a short interest of just under 7%. Short volume is not the same as short interest, it should be noted, as both are being mentioned on social media. The short volume in ARVL recently can be seen in the below data from Fintel.io.

ARVL stock forecast

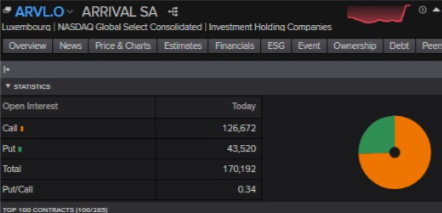

A feature of the retail or WallStreetBets revolution has been the use of options as a way to trade stocks. This is clever, as buying options means you know your maximum loss on every trade. Arrival (ARVL) stock is no different as the latest data from Refinitv shows the massive call versus put open interest differential.

The ARVL stock chart below shows the nice uptrend in place since mid-April with a classic series of higher lows and highs. The consolidation phase in May was eventually broken out of before being retested over the early stages of June with a retracement. However, the retracement found support from the consolidation region highlighted. This area also serves as the point of control for ARVL shares in 2021 year to date. $18.64 is the price at which the most buying and selling volume has taken place and acts as an equilibrium. This is always likely to give strong support. Tuesday's price moved bounced sharply and now in Wednesday's premarket the shares have exploded out of the upchannel. Volume, as can be seen on the right of the chart, drops off sharply above $20, leading to a potential acceleration of the move currently happening in the premarket. Above the data appears to be inconsistent or missing, so no further analysis can be made. The next consolidation area and resistance comes at the $26-30 region where ARVL stock price stabilized in January and February before dropping to the April lows.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.