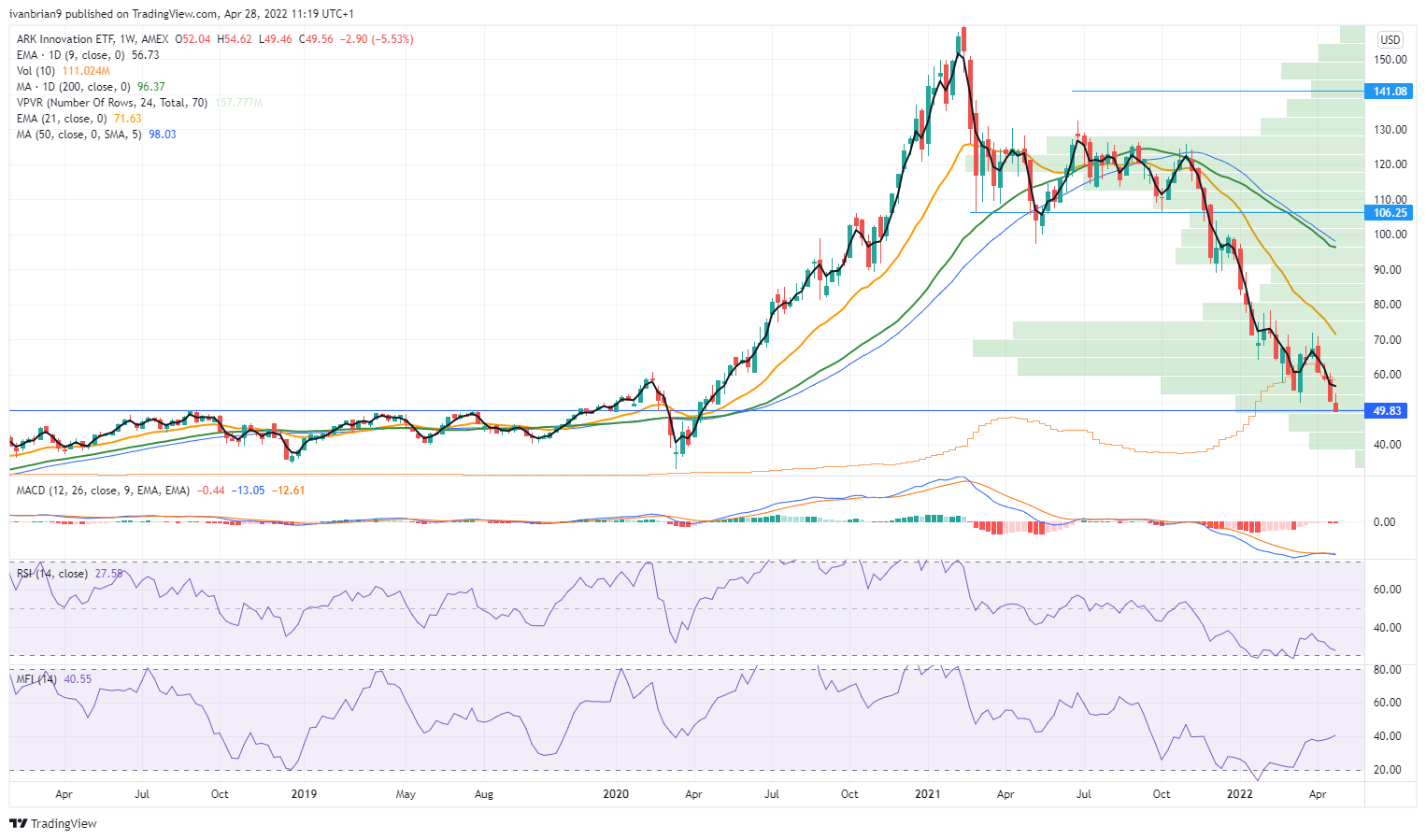

ARKK Innovation ETF Stock News: Rebounds from two-year lows but remains below $50 mark

- ARKK ETF is down 48% year to date in 2022.

- It gets worse as ARKK is down nearly 70% from February 2021.

- The innovation ETF had a large retail following during the pandemic.

Update: ARKK extended its downward spiral into the third straight day on Thursday, losing about 1.40%. ARKK Innovation ETF witnessed a late rebound and settled at $48.87, having hit the lowest level since May 2020 at $45.90. The continued slide in Cathy Wood’s fund came on the back of a slump in value in most of its top holdings, including Tesla, Teladoc and Zoom. Further, investors’ wariness about ARKK Innovation ETF, as a cheaper and more diverse fund exists - the ALPS Disruptive Technologies ETF. ALPS has had a better performance so far in 2022.

Cathy Wood's name became synonymous during the pandemic for running one of the most successful funds in the stock market. One of the most successful in terms of performance and in terms of attracting huge flows of cash from bored stay-at-home American investors and traders. ARKK invested in a number of pandemic darlings, stocks that benefitted hugely during the lockdown.

Cathy Wood was seen on numerous media outlets extolling the virtues of the transformative and innovative technology underpinning many of her fund's investee companies, but the last 12 months have seen a dramatic change in fortune for the performance of ARKK. The ETF has plunged in value as many of its top holdings have slumped. The era of free Fed money has come to an end and the speculative excess is being weened out. This unfortunately has caught retail traders in the headlights with many losing huge sums or life savings.

ARK Innovation ETF (ARKK) news: TDOC extends high-growth dismal performance

The latest hit to sentiment for this name came from earnings from former pandemic favorite Teladoc (TDOC). TDOC stock has collapsed 37% since reporting earnings after the close on Wednesday. TDOC is one of the top holdings in ARKK.

ARKK Top 10 holdings, source: ark-funds.com

Teladoc is a near 7% holding in ARKK. Simple math implies 37% of that should equate to another leg down of about 3% for ARKK on Thursday. Simple math admittedly and it is a bit more complex than that but from an illustrative point of view, it gives a fair indication of the challenges facing ARKK. Other holdings have also seen serious stock price declines.

Tesla (TSLA) dumped after the SEC filing showing how much and the details of Elon Musk's collateral for his Twitter (TWTR) acquisition. Zoom (ZM) is down 70% from a year ago and 80% from its pandemic highs. ROKU is down 76% in the last year, and Coinbase (COIN) is down nearly 60% in the past year.

You get the picture and I'll stop now in case any longs are reading this through the tears. Investing is a tough business, otherwise, everyone would do it. It's your money so guard it carefully is the message here.

We also note that ARKK continues to buy many of these names, buy-the-dip they all said until they didn't! Many of these stocks are tech and growth names and so are highly correlated with one another. In essence, they are the same and so all rise and fall together. There is no diversification and no alpha.

ARKK Innovation ETF (ARKK) forecast: Not the time to be speculative

Time to exit if you haven't already. This is high-growth, high-risk investing. The time for that was when cash is flowing from the Fed printers and monetary policy is at the easiest in centuries. That once-in-a-generation time has now passed, I cannot put it more clearly than that.

There may be a few rallies ahead and I currently see one unfolding in the SPY but that will be catalyzed by quality companies with strong balance sheets, think Microsoft, Apple, Coke, etc. This fund has way too much speculative high-growth stocks. Economics 101 would teach you that growth needs low-interest rates and cheap credit. Not something we are moving toward, we are in fact moving in the opposite direction.

Support at $50 really needs to hold, otherwise it is on to test the pandemic lows.

ARK Innovation ETF (ARKK) chart, weekly

*The author is long Facebook and short Tesla.

Previous updates

Update: ARKK continues its slide on Thursday reaching a new cycle low at $45.89 as investors stayed with the offer despite a broader advance on Wall Street. The Dow Jones Industrial Average rose 1.9% to 33,916.39, the S&P 500 was up 2.5% to 4,287.50 and the Nasdaq Composite was 3.1% higher at 12,871.53. Nevertheless, the technical outlook remains grim as per the longer-term charts.

The Monthly chart could see the price at $33.00 before meaningful demand moves in. This is the 02 March low of 2020 and from where the year-long rally to the all-time highs got underway. On the other hand, the weekly picture has the price meets a structure level as per 2019 highs which could lead to a correction back to test the prior lows of 2022 at $55.09.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.