- ARKK ETF is down nearly 50% year to date.

- ARKK Innovation has turned Cathy Wood into an investing star.

- The innovation ETF has been a shooting star as 2022 hits ARKK.

ARKK ETF continues to be pressured as the imminent Fed decision awaits. Investors in the fund are staring at losses nearing 50% for the year but so far the rush for the exit has not materialized. This can lead to a self-fulfilling move if investors do look for their cashback. That will necessitate selling to raise cash to return to shareholders putting more pressure on ARKK stock.

Read more stock market research

ARKK ETF stock news: Bear-market rally coming?

We feel there may be a slight recovery or a bear-market rally imminent. We base this using several positioning and sentiment indicators. However, this rally may be short-lived. Firstly, we have an incredibly bearish sentiment from a plethora of sentiment indicators.

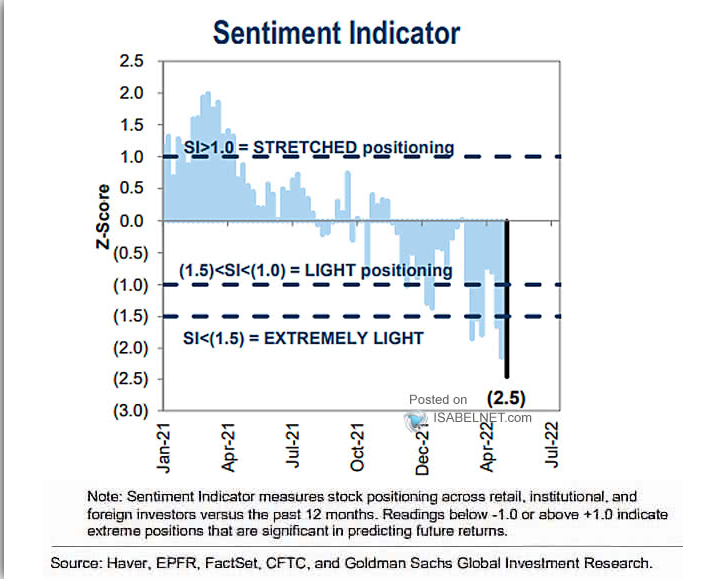

The CNN fear and greed index are showing huge levels of stress. The American Association of Individual Investors (AAII) is at noted bearish levels and so is Goldman Sachs's proprietary sentiment indicator. The put-call ratio has also moved to recent highs with everyone racing to buy puts as panic ensued.

Also of note is quite a bit of cash sitting on the sidelines until after Jerome Powell and the Fed hike rates today. Once that uncertainty is out of the way it could unleash an inflow to equities from both hedge funds and institutional investors, both of whom are underweight equities. Retail investors remain long.

Source: Goldman Sachs (via Isabelnet)

Source: CNN.com

Teladoc (TDOC stock) was the latest stock to hit ARKK as it reported terrible earnings last week and the stock cratered. Despite this, Cathy Wood has been buying the dip in TDOC stock saying it can be “one of the biggest stories in healthcare (...) a category killer during the next five to ten years (...) We see Teladoc in the same league as an Amazon.” Also of note is the buy-the-dip strategy among ARKK investors, the fund drew in more than $800M this year despite it collapsing by nearly 50%.

ARKK stock forecast: Big resistance too far away

A massive move lower has taken ARKK back to pre-pandemic levels. $49.83 was the key level and below here ARKK remains bearish. $72 remains the key resistance for bulls to regain control and that is likely too far away. A recovery as mentioned is likely but that rally will not advance far enough to break $72.

ARKK weekly chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold clings to gains around $3,430

Gold fell from its previous record high of $3,500 per troy ounce, as overbought indications and a comeback in the US dollar appear to have led purchasers to take a break. Meanwhile, all eyes are on the Trump-Powell frenzy and impending Fed officials' statements.

EUR/USD trims losses, retargets 1.1500 and beyond

EUR/USD now bounces off daily troughs near 1.1460 and refocuses back on the 1.1500 barrier amid some humble knee-jerk in the US Dollar. In the meantime, markets remain cautious in light of President Trump’s criticism of Fed Chair Jerome Powell and its potential implications for the US markets.

GBP/USD treads water below 1.3400

GBP/USD is trading in a narrow zone below the 1.3400 level as the Greenback's solid comeback gains traction on Tuesday. However, continuing concerns about a US economic downturn and misgivings about the Fed's independence are anticipated to limit Cable's downside risk.

3% of Bitcoin supply in control of firms with BTC on balance sheets: The good, bad and ugly

Bitcoin disappointed traders with lackluster performance in 2025, hitting the $100,000 milestone and consolidating under the milestone thereafter. Bitcoin rallied past $88,000 early on Monday, the dominant token eyes the $90,000 level.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.